Zoom In on This $163.5 Billion Opportunity Later This Month

By Andy Gordon, Founder, First Stage Investor

Editor’s Note: This is a preview of an expected investment opportunity in VirZOOM, a groundbreaking virtual reality startup company. As soon as the opportunity is live — perhaps as soon as a couple weeks — and our recommendation finalized, we’ll alert you on when and how to invest.

The startup I’m introducing you to today – VirZOOM – has one of the greatest upsides I’ve seen in an early-stage company.

That’s why we’re giving you a “sneak preview” of this virtual reality startup.

Right now, the VR sector is on the precipice of breaking out.

Like a surfer catching the perfect wave, VirZOOM is exactly where it needs to be to ride a wave of newly commercialized VR products and technology.

But I want to be absolutely clear about this: We’re not issuing a recommendation on this company… at least not yet.

We hope VirZOOM’s impending fundraise will go live on a portal as soon as late March. When (and if) it does, we’ll give you all the information you need to invest.

An Amazing First-of-Its-Kind Product

So what is this amazing product that VirZOOM has created?

It’s an ever-growing collection of new exercise games. When used with the company’s specialized exercise bike, the games provide a fun VR exercise experience.

And there’s also VirZOOM’s vSports – real physical competition in virtual reality that takes place in vSports Centers. Today’s centers can be VR arcades, eSports arenas or LAN (local area network) gaming centers that have VirZOOM bikes and VR gaming consoles.

The company first went to market with its exercise bike in June 2016.

At first glance, the bike’s nothing special.

In the real world, you’re pedaling a stationary bike. Ho hum.

Ah, but in the virtual world, you’re riding a horse… racecar… tank… or flying Pegasus.

You’re transported into a fantasy world of fun and adventure. And the faster you pedal in the real world, the faster you move in the virtual world.

The Wait Is Over

Virtual reality is not exactly a secret. Its technology has been making important inroads recently.

For example, the U.S. Army is using it to train soldiers on M1A1 tanks… the Air Force to simulate emergency evacuations in the Middle East… and NASA to prepare astronauts for space walks.

But there’s been no eruption… no “aha!” moment… no massive wave of adoption.

Last year was too early. Next year will be too late. But this year…

THE WAIT IS OVER.

In my opinion, this is the year that VR shakes off its shackles and takes off. The game changer is Google’s Daydream. Compared to the underwhelming Google Cardboard 3-D glasses, the Daydream headset offers surprising performance. More than 20 smartphone models will soon be compatible with Daydream. By the end of 2017, Daydream is expected to be used in at least 10 MILLION SMARTPHONES.

VirZOOM has positioned itself to be one of the biggest beneficiaries.

It’s only three to four months away from offering several exciting new VR games specifically designed for mobile phones. VirZOOM enjoys a huge head start on this front.

This is key. And it’s why a major Hollywood studio and an Asian entertainment conglomerate are deep in discussions with VirZOOM to license branded VR content from them.

VirZOOM, in combination with Daydream, is opening up a new world of exciting opportunities.

In 2016, about 116 million smartphone users in the U.S. downloaded and played mobile games.

Now, instead of spending $700 to $2,000 to buy a complex video game system, all a mobile VirZOOM consumer has to do is buy a $79 Google Daydream View for their smartphone and download VirZOOM content from the Google Play store. Then they simply connect their VirZOOM bike to their phone via Bluetooth, tap an icon to launch a VirZOOM game, put their phone into the VR holder, hop on the bike and start pedaling.

They can do this at home, at the health club or in the fitness room at their favorite hotel – wherever VirZOOM’s exercise equipment is available.

A Bicycle That Is About to Forever Change How We Exercise

The company’s technology should help millions of Americans (and tens of millions of Chinese) get in shape… and actually have fun while doing so!

Its breakthrough exercise bike combines the benefits of a good workout with the fun of VR gaming.

That solves a huge problem you’re probably all too familiar with.

Countless U.S. households buy exercise gear every January for their “New Year’s resolutions”…

Only to see it gathering cobwebs by March because it just feels too much like hard work.

This product turns indoor exercise into an exciting new adventure every day, where users can track performance, set goals and challenge friends to competitions.

The company has just signed a $1 million deal in China with the powerful Chinese state-owned company Datang Network Company Ltd.

Keeping fit just isn’t part of China’s culture. The country doesn’t have many fitness clubs.

But what it does have is thousands of arcades eager to offer exciting VR experiences.

Virtual reality and virtual gaming already have a massive following in China. And it’s only going to get bigger.

In addition to its $1 million contract with China, VirZOOM is finalizing talks with a major global toy company to introduce a kid’s version of its bike to the Chinese market.

The initial contract could be for up to 10,000 bikes. And there are several other China deals in the works.

Its marketing initiatives for China look extremely promising.

A $163.5 Billion Market Taking Shape

But how about the U.S.?

This is where VirZOOM can really make hay.

The market in the U.S. is set to explode.

Recent estimates show an initial target market – health club members who are also active VR users – of about $1 billion.

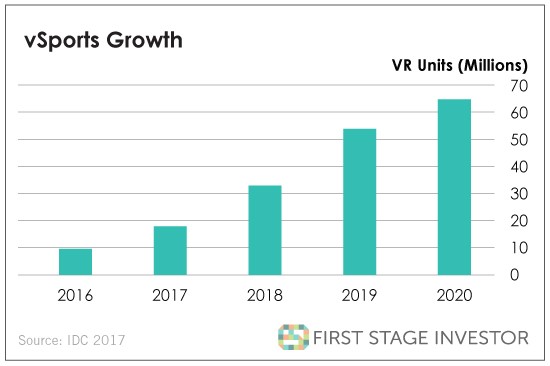

And as the total market expands to include both VR users who are NOT health club members and mobile gamers, the total market is expected to soar to an estimated $163.5 billion by 2020.

VirZOOM has already put into motion its plan to ride this massive wave of new VR users.

To showcase its products, the company has set up 23 vSports Centers across the U.S.

The best part? VirZOOM isn’t paying for them. The vSports Centers buy products from VirZOOM, and its partners foot the cost of expensive gaming PCs and VR gear.

VirZOOM plans to have 100 vSports Centers by the end of 2017.

Revenue is already showing signs of taking off. By the end of 2016, VirZOOM had sold 2,200 of its devices through its distributors and online retailers, including Amazon, Best Buy, Target and GameStop.com.

And that’s just the beginning.

VirZOOM plans on each of its 100 centers selling an average of 12 bikes a month by this fall. Very doable.

At the current $400 selling price, the company would be making $480,000 (100 x 12 x $400)…

Per month!

And that doesn’t include its my.virzoom subscriptions (a $10 monthly fee giving members access to multiplayer games and providing performance tracking) that will begin later this year… or its online sales… or its sales in China.

And to really scale sales?

VirZOOM plans on licensing its technology to OEM partners in the fitness equipment industry as soon as it can – hopefully by the end of this year. The partners – and not VirZOOM – will undertake the responsibility of manufacturing, marketing, distributing and supporting millions of VirZOOM exercise bikes for commercial and home markets.

People Love This Bike

Unfortunately, we weren’t able to travel up to Boston to try out the product ourselves. But the initial news coverage has been positive…

“VirZOOM is the only fully realized VR exercise product out there right now.” (The Verge)

“I never want to get off this bike.” (Today show)

“VirZOOM is the perfect VR headset accessory for game-loving fitness enthusiasts.” (Tech Times)

Additionally, here is a sampling of customer reviews…

“This is ultimately the best exercise bike I’ve used to date; I even quit cycling classes after two days of this.”

“At the gym, I can’t last long. On the VirZOOM, I sweat and ride till I can barely breathe.”

“The best exercise bike I’ve used. After 30 minutes of cardio I am sweating like crazy. This is an amazing experience… I’d give it 10 stars if I could.”

Ready for Prime Time

I’ve been tracking the progress of VR technology ever since Oculus Rift’s successful Kickstarter campaign caught my attention. That was back in September of 2012.

Since then, VR’s basic building blocks – processors, sensors, screens and accelerometers – have vastly improved.

High-end graphic technology has also gotten better and better. It’s certainly not done improving, but it’s good enough RIGHT NOW to give mobile VR game users a thoroughly convincing and immersive VR experience.

Growth and Leadership Come Up Aces

We gave VirZOOM high marks for its one-of-a-kind product and technology. And it gets kudos for entering a mushrooming market at the perfect time.

Its leadership team is also impressive.

Founder Eric Janszen is a seasoned leader who has more than 25 years’ experience in the technology space as both an entrepreneur and investor.

I’ve logged almost 10 hours of conversation with Eric. He’s given me great answers to dozens of questions.

VirZOOM’S co-founder, chief technology officer and product development guru is Eric Malafeew, the same person who was instrumental in bringing us Guitar Hero, Rock Band and other blockbusters.

I have no doubt in my mind that Eric and his MIT-trained co-founder are the right people to lead this company to great heights. Their marketing strategy is nothing short of brilliant – allowing for growth and scalability with minimum expense.

What’s Next?

VirZOOM’s fundraise could be going live as soon as late March.

We’ll send you an alert once it does. It’ll include the valuation, the minimum you may invest and all the other deal terms you need.

You don’t want to miss out on this early-stage investment opportunity. It’s in one of the most exciting and fastest-growing markets in the world.

And its upside is every bit as exciting as the market it’s in.

Current Open Positions

By Andy Gordon, Founder, First Stage Investor

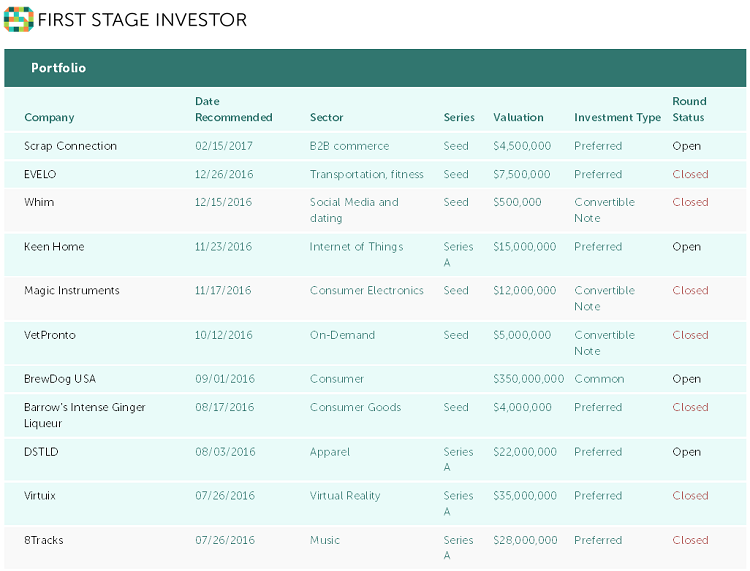

We have two other companies in the First Stage Investor portfolio whose round statuses remain open. Here’s a quick look at these other open positions.

Scrap Connection

Scrap metal is a $250-billion-a-year business. Scrap Connection wants to run at least 10% of that business through a proprietary platform it has set up to buy and sell scrap.

We think the platform can get the job done and will become an irresistible tool that scrap traders won’t be able to imagine going without. One of the reasons we recommended Scrap Connection is that it’s positioning its service as one that moves the needle… that puts the industry on an entirely new path.

Click here for our in-depth recommendation of Scrap Connection. Deal details are listed below.

- Minimum investment: $200

- Security type: Future preferred stock via SAFE (an agreement that grants the holder the right to equity at a later date, typically when the company raises another significant round of funding)

- Valuation: $4.5 million with a 15% discount

- Industry: Business-to-business commerce

- Raising up to: $300,000 (planned but not finalized)

Keen Home

Last month Keen Home announced, “We are officially open for investment.” Before then, a “reservation” – made through SeedInvest – got you a spot at the front of the line.

This announcement means your reservation can now turn into an actual investment.

There are more than 600 investors lined up to have official equity stakes in Keen Home. Their total investment comes to almost $1.4 million.

It’s a great start. Keen Home wants to raise up to $8 million over the next couple of months.

For those of you who didn’t make a reservation, go ahead and take a look at our original recommendation right here.

And if you decide to invest, you can do so right here. Deal details are listed below.

- Minimum investment: $999

- Security type: Preferred shares

- Valuation: $15 million

- Industry: Internet of Things

- Raising up to: $8 million

Equity Crowdfunding Playbook

Part 4: Maximizing the Cash-Out Potential of Your Startup Portfolio

By Andy Gordon, Founder, First Stage Investor

Editor’s Note: This is Part 4 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them below:

- Part 1: A Special Risk-Reward Equation

- Part 2: Key Players in Your Startup Ecosystem

- Part 3: The Best Round to Make an Investment

Forget how you build, track and cash out your portfolio of public stocks.

A portfolio of startups is different. Very little from your stock investment experience applies.

In this lesson, I’ll be outlining a new set of portfolio management rules and tools that specifically apply to startup investments.

Let’s get started.

Building Your Portfolio

In putting together a startup portfolio, you need to remember these three things.

Ease into it. Sure, you’re excited. But you also have much to learn.

There’s an understanding in Silicon Valley that new venture capital hires spend their first two years making wildly inconsistent investment choices.

Expectations begin rising in the third year. Finally, enough progress has been made along the learning curve for these recent hires to start earning their keep.

And these are professional investors. They do this full time.

For a part-time “investor”? Even more patience is required. You need to take your time. No reason for you to invest in a dozen companies during your first two months.

Remember, once you invest in these companies, they’re yours for years. If you change your mind about a company, you’re stuck. You can’t sell your shares.

(Of course, you’re welcome to replace your experience with ours. So, in following our recommendations, you can move faster because your investments would be based on many years of experience.)

Invest according to a budget. You should have some idea of how much money you’ll be investing into startups.

As a general rule, it shouldn’t be more than 5% to 10% of your investable savings. How would that work in practice?

Let’s say you’ve saved $100,000. You can put at least $10,000 of it into startups. And assuming you’ll be growing your savings over time, you can ultimately put in more.

You should invest in a bare minimum of 10 to 15 companies over that time. But I strongly suggest aiming for twice or even three times that.

The more, the better.

Let’s do some quick math here. I’m putting you on a five-year hypothetical plan. You have five years to build a full startup portfolio.

This means you have a budget of $2,000 a year. (The budget for the later years should be higher as you grow your savings, but let’s keep things simple and ignore that for now.)

The SEC allows everybody to invest at least $2,000 into startups each year. So you’re not going to get into trouble with the government.

Working backward, let’s say you’re aiming for a portfolio of 25 startups. Each year, you’ll need to average five startup investments. That comes to an average investment of $400 per startup.

That’s average. But what if you REALLY like a company?

This is where a budget comes into play.

If you invest $1,000 in this one startup, you have only $1,000 left to invest in the remaining four.

It’s not the end of the world. With $100 minimums available on many seed-round investments, it doesn’t have to be a budget-breaker.

But what if there’s another company that you’re really excited about?

Now you’re feeling a little hog-tied. Not a good feeling.

One way to avoid that is to keep most investments at the minimum. The really SPECIAL ones? You can double up and still remain under budget.

Much like what a spending budget does, an investment budget forces you to act with discipline, think ahead and not go too crazy.

But how about budgeting for beyond your first five years?

Remember, you will probably see some liquidity coming in the three to five years after you first start. And in years five through 10, your exits, along with your real profits, should pick up – boosting your savings and giving you the ability to reinvest in more startups.

Diversify your portfolio. Again, I’m not giving stock-picking advice here. But, as I said in Lesson 1, diversification is important.

Sector diversification is pretty much a given. Chances are, even if you love, say, the drone or virtual reality sectors above all others, there simply aren’t enough of these startups available for you to populate your portfolio with companies only in these sectors.

Other ways to diversify? You can diversify by portal (sources for finding startups), fundraising round (seed, Series A, Series B, etc.), geographical location (U.S. city or country) and audience (consumer versus enterprise).

Here’s another one: having a combination of single startups and funds of startups in your portfolio.

I keep all of them in mind.

But the one thing I don’t do is prioritize diversification over quality. I do not invest in an enterprise company if there’s a better consumer startup available. I don’t select a company from SeedInvest.com if there’s a better one on MicroVentures.com. And so on.

But if I think I’m short on enterprise companies in my portfolio, I make doubly sure I pay attention to all the enterprise startups that become available – perhaps even spending an extra few minutes on them when I first come across their offerings.

At the end of the day, you should obey this one commandment above all others: Invest in the best and forget the rest.

Tracking Your Portfolio

This is optional. You can just invest and walk away, if you want. I have no problem with that. Unlike with public stocks, you don’t have to know when to sell in order to capture gains or prevent losses.

With startups, your shares are illiquid. You’ll own them for three to 10 years.

This is honest-to-goodness long-term investing.

Follow the journey. Personally, I want to know how my startups are doing.

I’m curious. Heck, maybe I can help them in some way. I know people who know people. I want to be part of the journey, even if it’s not always smooth.

So, if you want to keep up with a company’s latest achievements, you could sign up for updates (usually on the company’s website).

Or you could use owler.com to track any company you want. Or you could set up Google Alerts.

And, of course, we’ll give you updates on our companies based on our communications with the founders.

Follow the valuation. Even though I can’t cash out, I want to know if my investment returns are trending in the right direction.

If a startup is growing revenue by 300% a year, it’s likely that valuation is going up, for example. But you don’t know for sure or by how much exactly until the startup decides to raise money anew.

That could be anywhere from 10 months to two or three years away.

It’s just the way the market operates. Homeowners and first-time homebuyers should be familiar with this situation.

Houses aren’t liquid. (Just try getting cash for your house tomorrow.) Nor is their value obvious. You need to get together with a realtor… figure out how demand is trending… and what the comparables are… throw in interest rate considerations… and the new mall being built a couple of miles away…

Then come up with a valuation (or price) that you hope gets it right. But still, even at this point, you can’t be sure. You may find out that your house is worth more or less once you put it on the market.

It’s the same with startups: Paper profits are nice, but you won’t know for sure how much they’re worth until a liquidity event occurs.

A useful calculation to make is internal rate of return, which measures the increase in value. So, if a startup’s valuation grew 5X (or 400%) in three years (not unusual for the ones that “hit”), your internal rate of return is 70%.

That’s a hypothetical example, of course. As a general rule, your return should be at least 1.5 times as much as what public stocks are returning (to be worth the risk).

Cashing Out Your Portfolio

At some point, you’ll hear either very good news or very bad news.

You’re either about to put real greenbacks into your pocket via a buyout of your company or via an IPO… or you’re about to get the bad news.

The company is calling it quits. Or it’s getting chopped up and sold.

The specific liquidity event determines how you cash out, how much you make and what your choices are. There are three basic kinds…

Buyout. Could be good or bad news. Read the terms of the acquisition. You’ll get a letter from the company informing you that it’s been acquired.

Buyouts can give you life-changing gains. Or they can give you modest profits. They can also happen at any point – very early, very late or sometime in between. Historically, returns from buyouts haven’t been as big as those from IPOs, though this is beginning to change.

If the acquiring company is buying the company for its technical employees, the return definitely won’t be great. If it’s a fire sale, you’ll make a small profit at best.

Best scenario is to get cash in return for your private shares. But sometimes the buyout will be for shares of the acquiring company. Other times, it’s a stock and cash deal.

IPO. This is great news for early-stage investors: You’ve probably made 10X to 100X. (See my post “Should You Invest in Snapchat?” as to why this is so.)

The government imposes a six-month lockout period on pre-IPO investors. You can’t cash out during this period.

That’s not such a bad thing. It’ll give you a chance to sit back, take a deep breath and figure out whether you want to keep or sell your shares – which are now converted into public shares, by the way.

In 2016, roughly half of IPOs went down in price in the months after their public listings. Half went up. Most years, new public companies do better, but some years, they do worse.

I think that capturing huge gains is never a bad move.

But for the more adventurous, keeping a third to half of these shares beyond IPO day to reap even larger possible gains could make sense. It’s a very personal decision. I can’t make it for you.

That said, whenever our holdings do IPO, we plan to give you the pros and cons of both keeping shares and cashing out.

When it comes down to it, that’s not a bad problem to have.

Bankruptcy. It happens to the portfolio holdings of the best (and wealthiest) investors. And it’ll happen to you.

Some startups just don’t make it. As they unwind their assets, you may get something back. It probably won’t be much. Take the money and move on.

Seven Great (and Free) Learning Resources for the Early-Stage Investor

By Adam Sharp, Founder, First Stage Investor

I do a lot of reading and research. Keeping up with the latest in tech and investing is not only part of the job, but integral when looking for the best startups.

So for those of you who are new to all this, I decided to put together a list of my go-to resources. The best part is, they’re free!

Here are my top destinations for learning about emerging technology and investing.

Industry Blogs

- AVC: Fred Wilson is the co-founder of legendary venture capital firm Union Square Ventures. Not only is he one of the top venture capitalists in the world, but he also runs AVC.com, a popular industry blog. It’s insight into the mind of one of the best investors on the planet. I read it daily.

- Reaction Wheel: Written by venture capitalist Jerry Neumann, Reaction Wheel publishes only a few posts per year. But Jerry makes up for the infrequency with high quality. I recommend reading “The Deployment Age” and “Heat Death: Venture Capital in the 1980s.”

- Mattermark: This blog is full of venture capital and early-stage news, data and charts. It also has a daily list of interesting new reads from venture capitalists and startup founders.

- Startup Boy: Naval Ravikant is the co-founder of AngelList and an early investor in Twitter, Uber, Postmates and many more success stories. A combination of contrarian philosophy and investing wisdom is what makes Naval one of my favorite bloggers. He’s also worth following on Twitter.

Venture Capital Sites

- Founder’s Fund (FF): Founded by PayPal billionaire Peter Thiel, FF is one of the best in the business. And its site is full of fascinating tech articles, podcasts and videos. I recommend reading “Machines That Learn: A Primer on Neural Nets and Deep Learning.” It’s a great introduction to machine learning, or AI.

- Union Square Ventures: USV.com has a large collection of articles written by some of the top minds in VC. They explain their current investment themes in great detail and write about their portfolio companies often.

- Andreessen Horowitz: This VC fund, also known as “a16z”, is one of the largest in the world. It manages billions and has funded some of the most successful companies in the world, such as Airbnb, Facebook and Twitter. The site is full of smart, tech-focused investing content, including podcasts, articles and videos. Dig in.

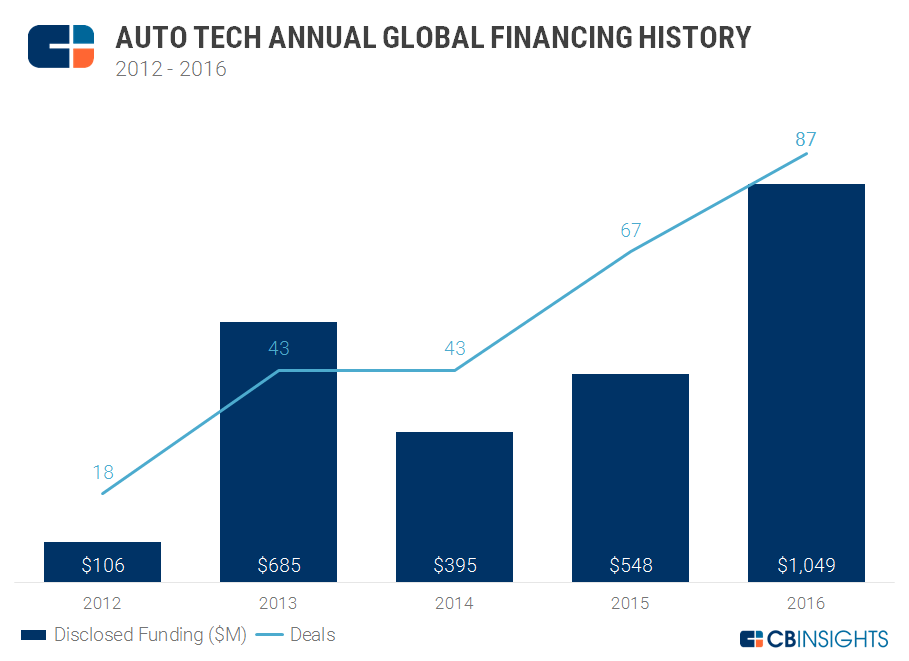

Chart of the Month

Cars Continue to Get Smarter

The auto industry is being disrupted from all sides.

And auto-related startups are a hot commodity – especially ones that use software to improve technology.

GM bought intrepid startup Cruise for just over $1 billion. Ford just bought artificial intelligence startup Arago AI for $1 billion.

Zoox, an electric robot-taxi developer, reached Unicorn status in 2016, as did solid-state LiDAR (Light Detection and Ranging) company Quanergy.

Investors poured 65% more money into auto tech companies last year than in the previous record year of 2013. They made 50% more deals.

Mobileye, the maker of driver-assistance vision systems, IPO’d in 2014 with a value of $5.3 billion.

It’s now worth more than $10 billion.

An outlier? Perhaps, but it still counts. Early investing is an outlier’s game, after all.

Investors don’t want to miss out on the next Mobileye.

FOMO (fear of missing out) can lead to frenzied investing and bad decisions.

In this case, the ground-shaking auto tech revolution will clearly produce more than one Mobileye, in terms of size and success.

I believe 2017 will see another round of heavy investing.

Editor’s Note: CB Insights defines auto tech as companies that use software to improve safety, convenience and efficiency in cars, specifically looking at assisted driving/autonomous software, driver safety tools, connected vehicle/driving data, fleet telematics, vehicle-to-vehicle communication and auto cybersecurity.

Quote of the Month

“Are you offering customers a ‘painkiller’ or a ‘vitamin’?”

– Managing Partner, Trifecta Capital

This is a classic question addressed to founders.

The preferred answer? “I’m a painkiller.”

“Vitamin” startups have a much tougher road. Here’s why:

- Painkillers are given to customers painfully aware of their need. Vitamins go to customers who need to be educated about their benefits.

- Painkillers are taken with a sense of urgency. Vitamins are taken with a sense of complacency.

- Painkillers are proactively bought. Vitamins are reactively bought.

- Painkillers get adopted faster, smoother, easier and more organically – more pull than push. Vitamin sales campaigns feel harder, slower, bumpier and more expensive – more push than pull.