Online Startup Investing:

A Year in Review

By Adam Sharp, Founder, First Stage Investor

2016 was the year that startup investing entered the mainstream.

For the first time in 80-plus years, U.S. investors can now invest in private, early-stage companies.

There is no other investment class that can touch the returns that are possible here. It’s also the most interesting, rewarding and fun way to invest. And that’s important, because most people tend to be better at things they enjoy.

Andy and I have been preparing for this since 2012. And we’ve been extremely pleased with this new industry’s progress so far.

The deals are high quality and the fees are low. Importantly, startups and small businesses are raising money in a way that’s healthier for their businesses than the alternatives.

Before equity crowdfunding (ECF), most small companies had to resort to using credit cards or short-term loans at 40%-plus APRs. Those interest rates are crippling to a startup business.

There is no good alternative to equity crowdfunding. Public markets don’t work this early, while venture capital covers only a tiny part of the country (San Francisco, New York and a few other cities for the most part).

This is the future of early-stage capital formation. And as early adopters, we have the opportunity to gain a deep understanding of this lucrative new market… before the wider public catches on.

Every investment you make, track or turn down will add to your startup investing knowledge and increase your chances of hitting a home run.

Now, let’s take a look at the state of equity crowdfunding and what evolved in 2016…

Regulation A+ (Mini-IPOs)

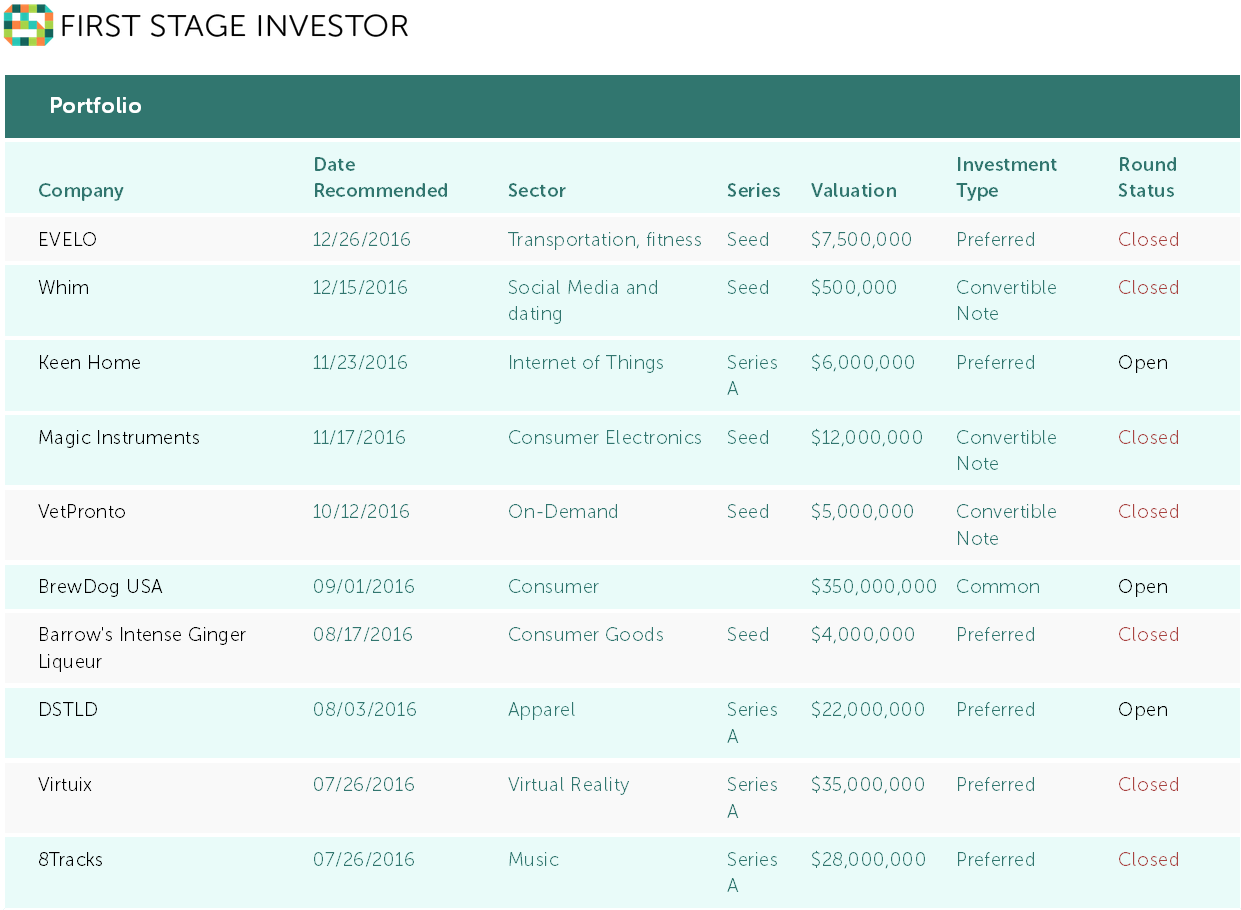

As a reminder, Regulation A+ deals (also called “mini-IPOs”) are the larger tier of equity crowdfunding deals. Under “Reg A+,” startups can raise up to $50 million per year.

As of the end of 2016, more than $172 million has been raised through this type of offering.

Not bad for a market that’s barely a year old.

We’ve recommended a number of high-quality Reg A+ deals so far, including…

- Virtuix

- DSTLD

- Keen Home

- BrewDog

- 8tracks.

We expect 2017 to be even better for Reg A+ deals. Now that the first batch of companies has blazed the trail, many more will follow.

Regulation Crowdfunding (aka Title III)

Reg CF is the smaller tier of crowdfunding investment deals. Young companies using it can raise up to $1 million per year, with minimal costs and preparation required. (We hope to see this limit increase to $5 million this year.)

Companies using Reg CF in our portfolio include…

- VetPronto

- Barrow’s Intense Ginger Liqueur

- EVELO

- Magic Instruments.

Overall, since Reg CF’s launch in March of 2016, more than $18 million has been raised by 70-plus startups. With minimum investments starting at $20 on some ECF portals, this is impressive. And it really couldn’t be much more convenient for investors. Now almost anyone can build up a portfolio of 10-plus startup investments.

What do startup founders think about Reg CF? To get an idea of the fundraising experience from their perspective, I asked a few to share their thoughts.

Eve Peters, founder of Whim (a company we recommended in December), wrote, “It was a fantastic experience. The administrative overhead to get set up in the beginning was significant (accounting catch-up, Form C requirements, legal, etc.), but well worth it. I was pleasantly surprised by the amount of public support from strangers.”

Eve also says Whim gained a significant number of new users from the company’s campaign.

Joe Waltman, founder of VetPronto, said, “All in all, we had a great experience. We were expecting to raise $50K to $100K and ended up with about $370K.”

Joe continued, “We definitely picked up a number of customers from the exposure. We also got some (rather flattering) inbound M&A interest from a very large player in the pet space.”

Joe also told me that new investors have already been adding value. Several have referred veterinarians to VetPronto. (More info about how you can help is in the Portfolio Review section below.)

The reason we like Reg CF so much is simple. When you invest in a company worth a few million dollars, the returns can be tremendous. And as with Reg A+, now that companies have successfully raised money using this new tool, we expect to see more volume in 2017.

Looking to 2017 and Beyond

Now that more than a hundred companies have raised money using equity crowdfunding, we expect 2017 to be a fantastic year for online startup investors.

More volume, more choices and more high-quality investment opportunities.

At some point during the year, it’s likely that we’ll get the opportunity to invest in one (or more) of the investment portals themselves. We’ll notify you immediately if and when this happens. Because who doesn’t love a good pick-and-shovel play in a fast-growing market?

Another development to watch for is the launch of “secondary” markets. Wefunder and other portals we’ve spoken with are planning to launch these platforms by late summer. They will enable investors to buy and sell secondhand shares in startups.

It will be interesting to see how this market develops. Shares will be thinly traded at first. That means the “spread” between the buy and ask price will likely be large. We’re not recommending members take any action when secondary markets arrive, for now. The whole point of startup investing is to buy and hold until an exit opportunity arises (IPO or acquisition). We would recommend selling only in an unusual circumstance, and we’ll let you know if that occurs.

Of course, we’ll also be looking for ways to add more value to your membership in First Stage Investor. We greatly appreciate your vote of support, and we’ll continue to work hard to find the very best investments for you.

Equity Crowdfunding Playbook

Part 3: The Best Round to Make an Investment

By Andy Gordon, Founder, First Stage Investor

Editor’s Note: This is Part 3 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed Part 1, click here. You can read the second installment here.

In startup investing, there’s early and then there’s very early. As a startup graduates from stage to stage, its shares get more expensive as its risks become smaller. So what’s the best – i.e., most profitable – stage to invest? Today we examine the differences between stages to answer that question.

Define “Early”

Let’s be clear: All startup investments are early.

Anytime you invest in the private shares of a company that hasn’t gone public, you’re getting in earlier than 99% of the company’s past, present and future investors.

By any reasonable definition, that’s early.

But there’s also very early.

The difference can be measured in several ways.

A company raising seed money is usually spanking new.

Its age is measured in months, not years.

Compare that to private companies that have been around for five to 10 years.

Spotify did its first recorded raise – a Series A – back in 2008. Uber raised its seed money in 2009. Airbnb raised its seed money a few months before Uber – in January 2009 – the same month Slack did.

These companies still represent early investing opportunities. But they’re no longer early-stage companies. Those stages are years behind them. They’re now in much later stages of fundraising – Series E, F and G.

These companies are called late-stage companies.

The Differences Between Early-Stage and Late-Stage Companies

The differences between early-stage and late-stage startups can also be measured in other ways – growth expectations, what is known (and not known) about the startups and the amount of risk they present.

In general, the more stages a startup has passed through, the higher the expectations and the more that’s known about the company.

And if expectations are being met? And if what is known about the company turns out to be positive?

Then risk declines.

Now, everybody knows that lowering risk is a good thing.

But let’s face it, nobody invests in startups to avoid risk.

We invest because of their outsized profit potential.

What makes early-stage startups so enticing is the opportunity to hit home runs.

But not the four-baggers – at best – you hit with public stocks.

Startups are capable of hitting tape-measure home runs – 10-baggers that can bring you 10X profits or more.

In fact, 10X should be your minimum expectation.

Why Price Matters

Here’s the thing…

It’s hard to make 10X profits with late-stage startups.

With more metrics and information and a longer track record of growth, the risk is lower. And your price to enter is higher.

In fact, it’s much higher than what you’d pay as an early-stage investor.

So, like a lot of things, it comes down to price…

Are the low prices you pay for early-stage startup shares worth it? Is the reward large enough? Does the risk overwhelm the high potential upside?

Let’s take real-world examples from our portfolio to answer these questions – Whim and Magic Instruments.

Both are seed-round companies. At the time they raised, Whim’s valuation was $5 million and Magic Instruments’ was $12 million.

For Whim to make investors 10X, its valuation would have to go up to $50 million before being bought out. In the startup world, that’s not a high bar. For Magic Instruments, its magic number is $120 million – much harder to get to than Whim’s.

Another way of looking at it…

Startups often carry valuations of at least $50 million in a Series B round. It can happen even earlier, in a Series A round. Whim has to go through just one to two more fundraising rounds to reach a valuation that would give seed investors a profit of 10X.

Valuations of $120 million are more typical in Series C and D. Magic Instruments would have to go through three to four rounds of meeting higher and higher revenue expectations before hitting a valuation that would give seed investors a 10X gain.

You can see the risk. Can it grow revenue? Will it be able to raise money in each new successive round?

To be clear, we have no problem with Magic Instruments’ valuation. It has great sales growth and a product that appeals to a big customer base.

But how about when (and if) Whim or Magic Instruments reaches $200 million in valuation?

Would we be willing to invest then?

As late-stage companies, they’d be in a very different place. To reach that valuation, they’d have to have begun scaling and to have great revenue growth. (I define scaling as rapidly growing revenue while incrementally increasing the cost of sales.)

The risk is much lower at that point. But so is the upside.

They would have to reach a valuation of $2 billion for investors to get 10X.

Possible? Sure, but not probable. The fact is, late-stage investors don’t aim for 10X gains. They aim for 50% to 250% gains. Makes sense, as those kinds of gains are unrealistic for most public companies.

As you can see, we’re playing with three variables here: upside, risk and price – and the different ways they stack up against one other in each round.

And the Answer Is…

The round that does the best?

Fortunately, one massive study points to a clear answer.

It was done by private equity fund-of-funds Horsley Bridge Partners (HBP). This large far-flung investment company was founded in 1983. It’s based in San Francisco with offices in London and Beijing.

It used a database of 5,500 deals.

HBP found that the best return/risk package comes at the early stages of a startup’s journey.

The reason comes down to risk.

There’s just not much more risk in the very early stages than there is in the very late stages (as measured by the percentage of total companies at these stages that end up failing and giving investors zero – or less than zero – gains).

For seed and early-stage startups, the risk of these companies failing was 62%.

Sounds about right.

For mid- to late-stage companies, it was 52%. That’s higher than I would have thought and only 10 percentage points lower than that of earlier-stage startups.

And the other finding sounds about right too…

Early-stage investors are 60% more likely to achieve 10X gains than those investing in the later and more expensive rounds.

In other words, early investors assume slightly higher risk to achieve much higher upside.

Or, in HBP’s own words: “The downside protection afforded by investing later is fairly small, while the upside potential is significantly dampened.”

What About Crowdfunding?

A caveat is in order here.

This is a study of startup investing that was done before crowdfunding came into being. The investors in play are all professionals… and have various levels of expertise and widely divergent levels of success.

It’s much different from today’s crowdfunding’s world. So these findings don’t automatically apply to the world of crowdfunding.

But it’s certainly better than if the study had found that early-stage investors assume much higher risk to achieve only a slightly higher upside.

In that case, I’d have to prove the opposite was true for crowdfunding.

Crowdfunding is new. There’s a dearth of studies. It’s just the way it is.

But I suspect the VC and crowdfunding worlds have many things in common.

The data points to the early stages as having the best combination of upside and risk for VC investors. The same combination of low share prices and high upside should mean the same results for crowdfunders.

I suspect it does. But we’ll have to wait for the proof.

In the meantime, the earliest stages have emerged as the sweet spot where investors can get the most bang for their buck.

Chart of the Month

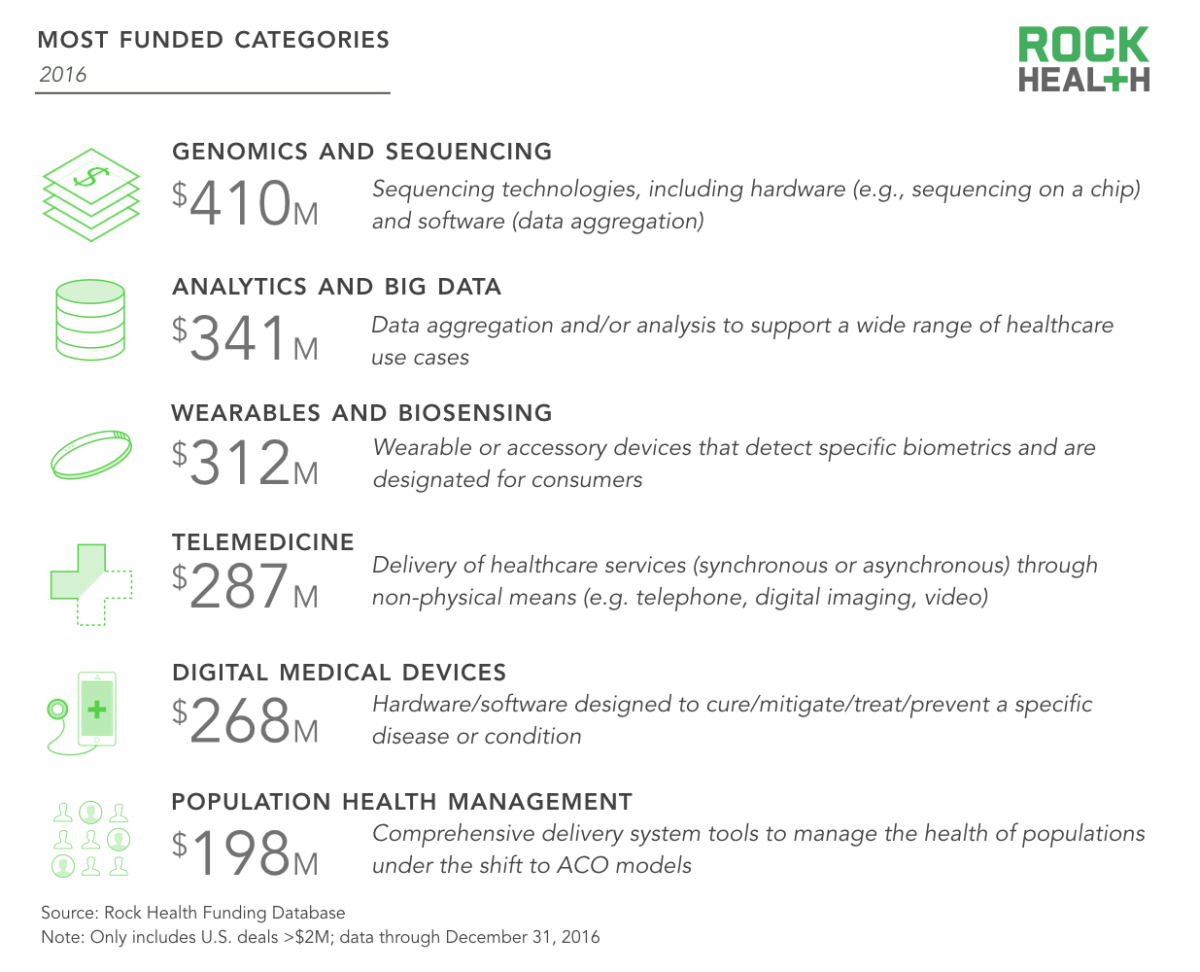

Where Did All the Funding Go in Healthcare?

Our chart this month highlights the healthcare sector’s most funded categories of 2016, according to Rock Health Funding Database.

Genomics and sequencing took the top spot. The human genome is just beginning to be tapped for medical breakthroughs. Everybody agrees its impact on healthcare will be huge.

It’s early but not too early for several companies in this area to have attracted major funding in 2016. Leading the way? Human Longevity ($220 million), followed by Color Genomics ($45 million), Seven Bridges Genomics ($45 million), Pathway Genomics ($40 million) and Emulate ($28 million).

Not far behind genomics and sequencing came analytics and big data. It attracted $341 million of investments made via 22 deals – more than double its 2015 numbers.

Wearables and biosensing came down to Earth last year, earning third place but down 32% from 2015.

One of my favorite categories is telemedicine. The technology is ready to transform how we access healthcare services. It was the fourth-biggest destination of investment dollars, attracting $287 million.

February Portfolio Review

VetPronto

Our favorite on-demand pet care company had revenue of $62,921 in December. That was down slightly from November due to the holidays.

VetPronto is expanding to Portland (among other cities) and has picked up favorable press coverage in local media:

- “A New App Will Soon Bring Veterinary House Calls to Portland”

- “‘Uber For Veterinarians’ Coming To Portland”

- “Latest ‘like Uber’ business is for animals.”

VetPronto is currently focused on expanding in the following cities:

- Atlanta

- Baltimore

- Chicago

- New Orleans

- New York

- San Francisco

- Los Angeles

- San Jose

- Tampa Bay

- Washington, D.C.

If you know any veterinarians in those areas who may be interested in joining forces with VetPronto, please email care@vetpronto.com.

Whim

Our recent recommendation Whim picked up nice coverage in an article by The Washington Post titled “Tinder is so last year.” Here’s an excerpt:

[Founder of CyberDatingExpert.com Julie] Spira says she believes that 2017 will see more of a push for people to meet in real life. She predicts a rise in apps like Whim, which skips the pre-date conversation and immediately matches people for meetups.

Keen Home

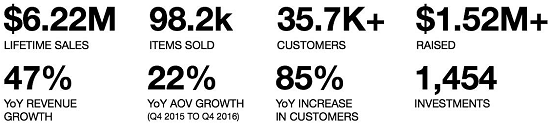

Keen Home describes 2016 as “a year of major milestones.” We’ve noted some of these already, including shipping 30,000 units, appearing on Shark Tank for an update and announcing its Smart Filter.

It also ended the year with a bang. On Black Friday, it introduced a new product bundle featuring eight Smart Vents and two Smart Bridges. It closed out 2016 with a “Total Control Bundle,” which included six Smart Vents, one Smart Bridge and a Nest Learning Thermostat.

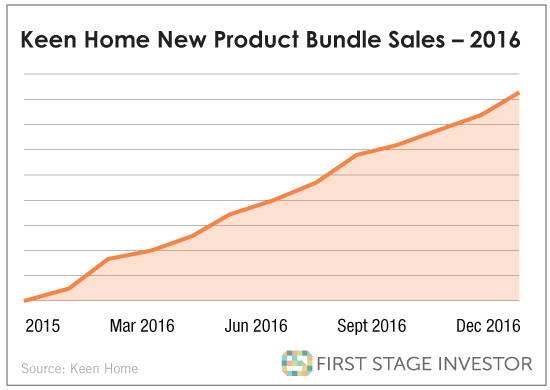

Both bundles sold well, helping to boost revenue by nearly 30% in the year’s last quarter (compared to Q3). The chart below shows a steep and steady trajectory.

It was anything but smooth sailing, though.

Here’s Keen’s story – in its own words – of how panic from running out of stock mid-year turned into an unexpected revenue windfall.

Back in June 2016, we had just shipped the last of our initial 30,000 unit production run and had opened a fresh batch of pre-orders in anticipation of our next run…

While an incredible milestone, selling out and needing to go back into pre-order isn’t always a good thing, especially if a company isn’t able to restock quickly.

A lot of companies freeze sales entirely at this point so they can spool up new inventory ahead of a fresh marketing push to avoid creating a backlog of orders. We did this at first, but within a week we were receiving so much inbound interest for our Smart Vent System that we decided to open pre-orders again.

Our team made the decision to pare back marketing and PR expenditures to conserve cash in anticipation of lower sales numbers than we had during Q1 and Q2 of 2016 when we were actively shipping new units.

To our surprise, Q3 and Q4 ’16 revenue numbers were on par with the previous two quarters, despite us being back in pre-order and spending 30% less on marketing compared to the previous period! We sold 18% more units during the second half of 2016 compared to the first half and average order value increased by 30%.

On tap for 2017?

The launch of more products and features, such as integration with ecobee (Honeywell’s Lyric platform) and the Keen Home Air Care subscription for Smart Filters (Keen’s first recurring revenue product).

DSTLD

Our online jean and apparel company, DSTLD, grew its revenues by a healthy 47% last year while adding more than 35,000 customers. It was a productive year for the up-and-coming retailer.

By the way, DSTLD is closing its round at the end of February. So far, it’s raised more than $1.5 million. That includes hundreds of investments from First Stage Investor readers!

More 2016 numbers…

Virtuix

Virtuix says that more than 20 top-tier virtual reality game studios are using its Omni SDK (software development kit) to make their games compatible with the Omni.

No update on Virtuix is complete without news on China. Exciting things are going on there…

Virtuix’s partner in Asia, Hero Entertainment, owns the Hero Pro League (HPL). It’s China’s largest mobile e-sports league. Last month’s HPL event featured the first-ever Omni eSports tournament. See the video below for a view of the action accompanied by then-live commentary.

https://www.youtube.com/watch?v=7FRUYLUPg8c

Virtuix says that this is just the beginning. Hero, it says, has big plans for the Omni and China’s thriving VR e-sports.

The company has begun selecting distributors and resellers to distribute its product in Europe, Canada and other foreign markets. If you know of a credible distribution business with a commercial customer base that might be interested in adding the Omni to its portfolio, please let Virtuix know at info@virtuix.com.