Four Steps to Become a Successful Private Investor Today

By Adam Sharp, Co-Founder, First Stage Investor

Dear Member,

Welcome! And thank you for joining First Stage Investor.

As promised, I have three recommendations in this issue that I can’t wait to tell you about. But before I do, I want to take the time to help familiarize you with this brand.

My goal over the next few months is to show you an excellent return on your purchase. To help you find the best equity crowdfunding investments. And avoid common mistakes.

This is a job that my Co-Founder Andrew Gordon and I are well prepared for.

For the past three years, we have been running a service for wealthy individuals called Startup Investor.

On our recommendation, Startup Investor members have purchased shares in some of the fastest-growing private companies in the world.

Later-stage private companies (that you might have heard of) like…

- Instacart

- Spotify

- Dropbox

- The Honest Company

- Bonobos.

And early-stage startups (that you most likely have not heard of) such as…

- Connect.com

- Geekatoo

- Care at Hand

- Dealflicks

… and many more.

Now that anyone can invest in private companies (via equity crowdfunding), we’ll be delivering the same caliber of research to members of First Stage Investor.

Over the last three years, Andy and I have developed excellent relationships with industry leaders. We know the major players and will use this insider access to deliver the best deals directly to you.

Since this is our first issue, we’re going to cover a few of the most important aspects of equity crowdfunding (and early-stage investing in general).

The investment recommendations we’ll be sending you are private companies. Many of them will be very early-stage startups.

No other investment on Earth can touch the possible returns here. However, it requires a different strategy than typical stocks do.

Here are the key steps you need to take in order to be a successful first-stage investor.

No. 1 Diversify: Invest in at Least 10 Companies

When investing in companies worth $1 million to $20 million, the potential rewards are tremendous. But there’s also risk when you invest this early.

So no matter how promising a company looks, don’t put too much in any one deal.

Let’s say you have set aside $5,000 for startup investments. (I strongly recommend no more than 5% to 10% of your overall portfolio.)

I would spread that across at least 10 deals (and preferably 20). With minimums starting at $100 and even lower in some cases, this is very doable.

The more companies you invest in, the higher your chances of hitting a 100Xer.

I personally have more than 70 early-stage investments, and I plan to do another 30 over the next two years. So far, I have one startup that has increased in value by 50X and a handful that are in the neighborhood of 10X.

Bottom line: A big and diverse portfolio is critical to successful early-stage investing. My colleague and co-founder Andy Gordon stresses the importance of this later in this issue.

No. 2 Understand Startup Valuations and Fundraising Rounds

A company’s “valuation” is how much it’s valued at in a particular round of funding.

For example, a typical seed-stage startup may have a “pre-money” valuation of $4 million. If it raises $1 million, the “post-money” valuation would be $5 million.

So in order to raise $1 million, the founders had to give up 20% of their company.

In many deals, you’ll also see a price per share listed. Whether it’s $1 or $100 per share doesn’t matter. Share price is essentially meaningless. What matters is the valuation. It determines how much of a company you’re buying.

How is the valuation determined?

Sometimes a startup simply says, “We’re raising money at a $10 million valuation.” If it asks too high of a price, it may have to rewrite the contract and lower it.

But often there is a “lead” investor who negotiates the terms (valuation and other important details). Usually the lead is an experienced angel investor or institutional investor. Angels are well-off individuals who invest part time. Institutional investors invest other people’s money and do this full time. They run funds from around $30 million all the way up to the multibillions.

During that same round of funding the angel or institutional investor is leading, everybody else invests on the same terms.

Keep in mind that rounds don’t last forever. Fundraising is time-consuming, so founders like to get it over with ASAP. If you miss your opportunity, it’s unlikely you’ll get another.

It’s also important to understand that in the private investing world, companies don’t trade on the Nasdaq or NYSE. There is very limited liquidity. It’s difficult to sell or buy secondhand shares (meaning private shares on the secondary market).

No. 3 Get to Know AngelList (Angel.co)

AngelList combines elements of sites like LinkedIn and E-Trade. But it focuses exclusively on private companies (mostly early-stage startups).

I use AngelList for researching investments, industries and co-investors.

The site, founded by veteran entrepreneurs and angel investors Babak Nivi and Naval Ravikant, has become an indispensable tool for early-stage investors.

One of my favorite uses for AngelList is evaluating co-investors. In other words, researching the other investors in a deal you’re looking into.

Say you’re considering an investment in a fictional startup we’ll call NewCo.

NewCo is raising $1 million. The deal’s “lead investor” is a fictional venture capital firm called Ludicrous Ventures.

(The lead could also be an angel – or individual – investor. The process for investigating either is the same.)

The lead investor is important for a few reasons. First, they negotiate the terms of the deal. Second, the fact that they’re leading this round shows conviction. They believe in this deal. So our goal here is to figure out whether that conviction means anything.

The first step is to look into Ludicrous Ventures’ track record. The easiest way I know to do that is with AngelList. So we head to the AngelList homepage, search for “Ludicrous Ventures” and click to its profile page.

You can learn a lot about an investor’s history from their AngelList page. Their portfolio is displayed, along with other background information.

Let’s say Ludicrous lists 50 investments on its profile. Look for familiar names.

If you see names like Uber or Snapchat or Dropbox, that’s a very promising sign. By the way, you’re looking for recent investment history – investments made less than eight to 10 years ago – not ancient history.

If you don’t recognize any of their investments, that’s not necessarily a bad thing. It simply requires more digging. Start clicking on their investments and looking at the profile pages of their portfolio companies.

One easy way to judge the success of a startup is its funding history. A typical “unicorn” (a startup that increases to more than $1 billion in value) fundraising history will look something like this:

- 2011: Seed round, $750K

- 2012: Series A, $6 million

- 2013: Series B, $30 million

- 2014: Series C, $60 million.

A funding history like this usually indicates quality and traction. If a co-investor has multiple investments that fit a similar pattern, it’s a great sign.

There are countless other ways to use AngelList. And the best way to learn is to register an account. Then start following anything that looks interesting. News related to anybody you follow will pop up right on your homepage feed.

No. 4 Going the Extra Mile to Add Value to Your Portfolio

This is completely optional, but one of the neatest things about early-stage investing is that it’s possible to take specific, concrete action to help your own portfolio.

It’s doubly rewarding, as you’re helping the founders and yourself as an investor.

If you add significant value, word will spread and your investment network will expand. You could be offered “advisory” shares for your efforts. But that’s up to the company and should never be expected.

With investors adding incremental value, you can imagine how beneficial this will be for the companies.

Conclusion

Of course, following will not guarantee your success in first stage investing. Remember, equity crowdfunding is an entirely new space for most investors. Opportunities like these have never been available to the average investor…

For this reason, we think it’s essential to count on experts with both the experience and the insider know-how in this area. Specifically, to know what to look for in a company in the earliest stages of the game – to ultimately determine if a startup has the potential to be the next Google, Facebook or Uber…

That’s what we’re here to do.

Again, welcome to First Stage Investor. If you’re looking for the possibility of getting in on the next great startup story, you’ve come to the right place.

Two Key Things to Look for When Investing in a Startup

By Adam Sharp, Co-Founder, First Stage Investor

As a member of First Stage Investor, you’ll be getting one or two highly vetted recommendations per month – and always the best opportunities we can find.

But I imagine you will want to understand exactly what we look for in a company in order to maybe even do more investing on your own. So here are two key things we look for in promising startups.

Cash Efficient, Lean

First, early-stage startups should be lean.

If a startup is raising a $1 million seed round, that should be enough to get it through eight to 12 months or more.

A million dollars doesn’t allow for a big headcount, which is okay. At this stage, it’s much more about the quality of people than the quantity.

Always look at how much money the company has raised so far and see how efficient it’s been. What has it accomplished?

If a startup hasn’t raised money yet but has gained significant traction, that’s one of the most positive signals you can get.

Teams that can do a lot with a little tend to continue doing just that. This is referred to as “bootstrapping.”

Finding bootstrapped startups that have come a long way and are now raising money for the first time is rare. When it happens – no matter the industry – I always take a close look at these opportunities.

Another important question is this: Does it have significant debts/accounts payable? It will be tempting for some companies to use equity crowdfunding to pay off debts. That’s fine, but unless the money can also solve the underlying cash flow problems, it’s a negative signal.

It’s not uncommon at early stages to see founders who aren’t taking a salary at all. Not every founder is in a position to do this, naturally. But when you see it, it’s another positive signal.

Fast-Growing Industries

Second, almost nothing is better for a young company than being in a fast-growing industry. It makes everything easier, from sales to hiring.

This is why I often talk about things that may seem a little odd, like the legalization of marijuana.

That industry grew 232% from 2014 to 2015. No other billion-dollar industry is growing anywhere close to that fast.

Of course, cannabis is a bit of an outlier. Shifts like this come along maybe once a generation. Most industries don’t have such a strong growth catalyst (in this case, the legalization of an already huge black market industry).

But it’s certainly worthwhile to skew investments toward areas that are fast-growing with strong catalysts.

Another obvious example is artificial intelligence (AI) and machine learning (ML). We are finally at a stage where both the hardware and software needed to make impactful products are widely available.

This sets the stage for more explosive growth over the next two decades, at least.

This is evident when you consider TensorFlow, a powerful ML library Google recently released. It’s now open source and completely free to use.

The release of tools like this gives everyone capabilities that five years ago, only a handful of companies in the world had. This catalyst will help the next generation of great AI/ML companies blossom.

Yet, you have to watch out for startups that get into a fast-growing industry simply because it’s hot right now. To avoid these, look into the founder’s history. Have they been in this space for a while, or are they simply jumping on the trendy bandwagon?

Bottom line: Look for investments in industries with strong growth catalysts.

The Most Important Rule of All

By Andy Gordon, Co-Founder, First Stage Investor

I’d like to introduce you to the most important rule in startup investing.

It’s simple enough…

The more companies you put in your portfolio, the more you maximize your chances of hitting a “life-changer.”

The reason?

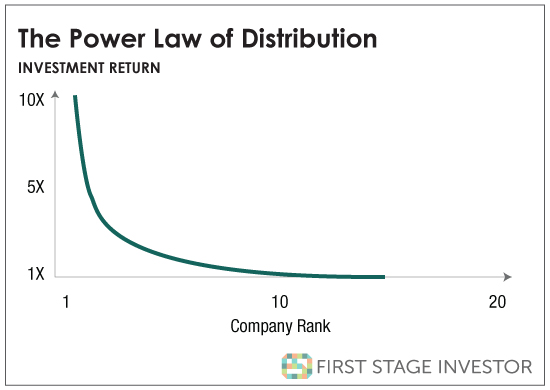

Most startup returns fall between 0% and 100%. Here’s how they look mapped out in a graph…

Now, there’s nothing wrong with 100% gains. It probably means an extra vacation to someplace exotic.

But it’s no life-changer.

When you invest in startups, you enter the realm of big-game hunting.

You’re looking for startups to give you 50 times to 100 times your stake.

These kinds of returns are not uncommon when you invest in companies in their early stages of fundraising.

The consensus before equity crowdfunding became legal was that 10 to 15 startups per year ended up giving you outsized returns.

Now that more companies can raise more money by tapping into a rich new vein of investment capital – namely you, the everyday investor – well, those numbers have just one way to go.

And that’s up.

Right now, The Wall Street Journal lists 149 startups in the “Billion-Dollar Startup Club.” Their valuations start at a billion bucks and go up from there.

Ideally, you should have at least one of these companies in your portfolio… or the equivalent of one – for example, two startups with valuations of $500 million to $600 million.

You don’t do it by investing in one or two or three companies.

Again, the rule is the more, the better.

Ten is better than five. Fifteen is better than 10. Twenty is better than 15, and so on.

It just depends on how many startup investments you can afford.

We recommend having at least 10 to 15 startups in your portfolio. With minimums as low as $100 (and sometimes lower), affordability shouldn’t be a problem.

Okay, so this is how the “power law” works in practice…

Say you make one investment of $100 and it goes up to $10,000.

You’d be looking at a $9,900 profit. Nice.

But instead, let’s say you put $100 into 10 different investments.

You’re much more likely to hit a big winner.

Ten times more likely, in fact.

And you’ve still made $9,000!

Okay, same math but let’s start out with a $1,000 investment instead of a $100 investment. It goes up to $100,000.

Your profit is $99,000. A nice profit indeed.

But if you made 10 $1,000 investments? Your chances of getting a big winner go up 10 times.

And your winnings still amount to $90,000.

This is how the power law works in action.

This law is not a secret. It’s well-known and commonly used by all the billionaire venture capital investors I know of.

They put dozens of startups into their portfolios. They prepare for dozens of disappointing returns – including many that are flat-out busts.

They don’t mind. In fact, it’s exactly what they expect.

They still get incredibly rich from the small minority of companies that turn into big winners.

There’s no reason it can’t work for you in exactly the same way it works for them.

Just remember the cardinal rule: the more startups in your portfolio, the better.

Where to Invest: The Equity Crowdfunding “Portals”

By Adam Sharp, Co-Founder, First Stage Investor

Equity crowdfunding portals are a new type of business that came into existence thanks to the JOBS Act of 2012. They are regulated by the SEC and FINRA.

Like brokerages, you need to go through these sites in order to make an investment.

Unlike stock exchanges, equity crowdfunding portals showcase investments that are not “liquid.” These are early-stage deals. With this in mind, expect to hold on to these investments for several years – and don’t invest money you’ll need soon.

With all of the equity crowdfunding portals out there, fees and customer service vary widely. Today I’m going to share everything I know about the portals.

Let’s get started.

Wefunder

Wefunder has taken the early lead in equity crowdfunding. It launched 20 high-quality deals in the first week that legislation opened the gates for equity crowdfunding.

That’s more than everybody else combined. It’s very early, and many more portals will be coming online soon. But Wefunder has hit the ground running.

Mike Norman and Nick Tommarello are Wefunder’s co-founders and now serve as the company’s president and CEO, respectively.

I’ve known Mike and Nick for a few years. In fact, my fellow co-founder Andy and I visited their San Francisco office last time we were out there. They run a well-oiled machine and have done deals of a similar nature for about three years already (for accredited investors).

They are well-connected in Silicon Valley. The first deal on their platform was a startup called Zenefits. Its worth went from $9 million in 2013 to around $3.5 billion today. That’s nearly 400X growth in just three years.

These guys also were instrumental in getting the JOBS Act (which made all of this possible) passed and signed into law.

Right now, Wefunder is the best place for investors to start looking at deals. It’s got a large number of quality offerings and the lowest fees around (5% total). All the information is clear and easy to understand, with the deal terms shown prominently.

It’s early, but Wefunder has positioned itself well.

You can read more about the portal here on Wefunder.com and check out its live deals here.

SeedInvest

New York-based SeedInvest has also been doing these types of deals for a while – but, until recently, only for accredited investors.

Andy and I have gotten to know the team at SeedInvest over the last two years. They’ve built an impressive platform and do a great job screening startups. We’ve recommended a few companies from SeedInvest to members of Startup Investor.

SeedInvest is currently listing seven live startup deals. It also has a number of Regulation A+ listings. Reg A+ deals are larger deals (up to $50 million) available to anybody.

Republic

Republic is a spinoff of AngelList, a leading accredited investor portal. AngelList has some truly impressive deals, some of which are startups opting to “top off” a round of funding via the crowd on Republic.

For consumer startups, offering a small part of a round to non-accredited investors is going to be a great option. It means more investors, champions, helpers, enthusiastic supporters and money. It also gives friends and family a way to invest.

AngelList should feed Republic a steady drip of quality deals as it builds its own brand. Republic is positioned to have some of the best deal flow out there.

Its founder is Kendrick Nguyen, former general counsel at AngelList. I’ve spoken on the phone with Kendrick a few times and have always come away impressed. This is one to watch.

A Word of Caution

Note that portals cannot reject companies that wish to raise money on their platforms. As long as a company has all its paperwork in order, an equity crowdfunding portal is required by law to list the company.

In other words, investors cannot rely on these portals alone to assess which investments are most promising.

This is where your subscription to First Stage Investor comes in… Along with the specific recommendations we’ll make, this is also where you will learn to read between the lines to better understand what kinds of startups to invest in.

Welcome aboard. We’re happy to have you here and are excited to be your facilitator for some of the biggest potential gains anywhere on the planet right now.

The Picks

By Andy Gordon, Co-Founder, First Stage Investor

As Adam mentioned earlier, First Stage Investor will add one or two companies to the portfolio each month. But since this is the first issue, we’re making three recommendations for you this time. Here they are…

Virtuix

(Urgent note: This deal closes as soon as July 31, 2016. If you’re reading this after August 1, you’re probably too late, but don’t worry. We’ll have plenty more high-quality deals to come.)

This company is solidifying its leadership position in the fast-growing virtual reality (VR) space. It just landed two powerful investors from China, both multibillion-dollar companies that will help Virtuix gain traction in the largest consumer market in the world.

Minimum investment: $998.

Click here to read all about why Adam and I are so excited to be making this recommendation to First Stage Investor subscribers.

8tracks

8tracks is a music streaming site with more than 6 million active users. It creates 10,000 new playlists every month through “crowd curation,” a brilliant twist to what other larger music streaming companies do. 8tracks has raised venture capital funding from some of the best firms in the world and is now turning to its large user base (and others) for this round of funding. A perfect use case for equity crowdfunding.

For more information on why we’re recommending 8tracks, click here.

Minimum investment: $99.

Brewdog

(Note: This deal will be live soon.)

Brewdog is a U.K.-based craft brewer that has taken off like a rocket ship. It’s launching its U.S.-based affiliate, and you have a chance to get in on the ground floor. Read our write-up here.

DSTLD

Based in L.A., the high-end denim manufacturing capital of the world, this online retailer specializes in making quality denim jeans at great prices. Revenue is now averaging $5 million a year and is about to embark on a very steep climb, according to company founders. Investors include Paige Craig, one of the most respected venture capital investors out there today. Not even two years old, the company has already sold its product to more than 21,000 customers. And half come back within the year to buy more. And because nearly everyone wears jeans, its market is massive.

Minimum investment is $500. Click here to read all the reasons why we’re so excited about this company’s upside.