Measuring general attitudes toward cryptocurrencies is easy. Everyone has an opinion – even if their opinion is “I don’t know.” What’s much more difficult – and therefore more interesting – is measuring the attitudes of actual crypto owners. That’s a much smaller universe – and harder to find.

That’s why the 2017 Bitcoin Omnibus Survey (also conducted in November and December of 2016) conducted in Canada is so interesting. The Bank of Canada polled bitcoin owners on their general cryptocurrency knowledge, what they use bitcoin for and, more importantly, why they own bitcoin.

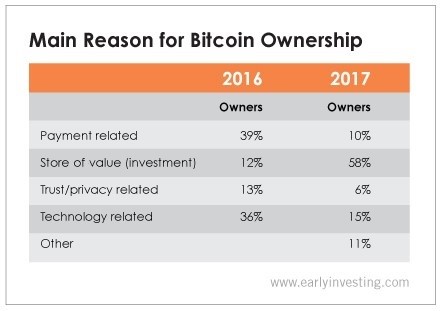

In 2016, payments was the most-cited reason for buying bitcoin, with nearly 40% of respondents saying so. In 2017, the majority shifted to buying bitcoin as a store of value (investment).

Interestingly, in 2017, the second-most common reason for ownership (after “it is an investment”) was “my friends own bitcoin.” This speaks to the organically viral nature of bitcoin that Adam has written about before – the more people who learn about crypto and adopt it for themselves, the more the word spreads and the user base grows. This certainly seems to be the case in Canada.

The Bank of Canada surveyed bitcoin owners from December 12 to December 15, 2017. Just two days later, on December 17, 2017, bitcoin’s price reached an all-time-high of $19,783. Given its rising price around that time, it makes sense that most investors viewed it as a store of value.

Of course, we generally agree that holding your crypto is the best approach. No matter how much the price fluctuates, it’s best to view your crypto as a long-term investment. Though there are owners who have tried to use bitcoin in day-to-day transactions, it still hasn’t quite made it to the mainstream yet. So the Canadian bitcoin owners who treated their bitcoin as an investment – and hopefully still do – seem to have the right idea.