Restrictive crypto rules can come from inside the U.S. We’ve certainly seen this with the Securities and Exchange Commission and the New York attorney general’s office.

But the next wave of tough new rules will be coming from outside the U.S. And they’re going to create big problems for crypto users.

An international agency called the Financial Action Task Force (FATF), whose members include 36 countries (plus two regional bodies) and some of the biggest economies in the world, is expected to publish new operating procedures for crypto exchanges later this month. The new regulations include the “travel rule,” which would require exchanges to pass customer information to each other when transferring funds. The rule is nothing new for banks. But it’s a huge problem for crypto.

The travel rule is designed for a financial system that relies on intermediaries to confirm both sides of a transaction before any money is transferred. It goes beyond basic “know your customer” (KYC) rules that most regulated crypto exchanges are forced to follow. Basic KYC rules require exchanges to verify and keep records of their own users’ identities, the idea being that the better exchanges/banks know their customers, the better they’re able to combat terrorism financing, money laundering and other fraudulent activities. But with travel rules, exchanges must also identify both the “sending” and “receiving” parties of a transaction.

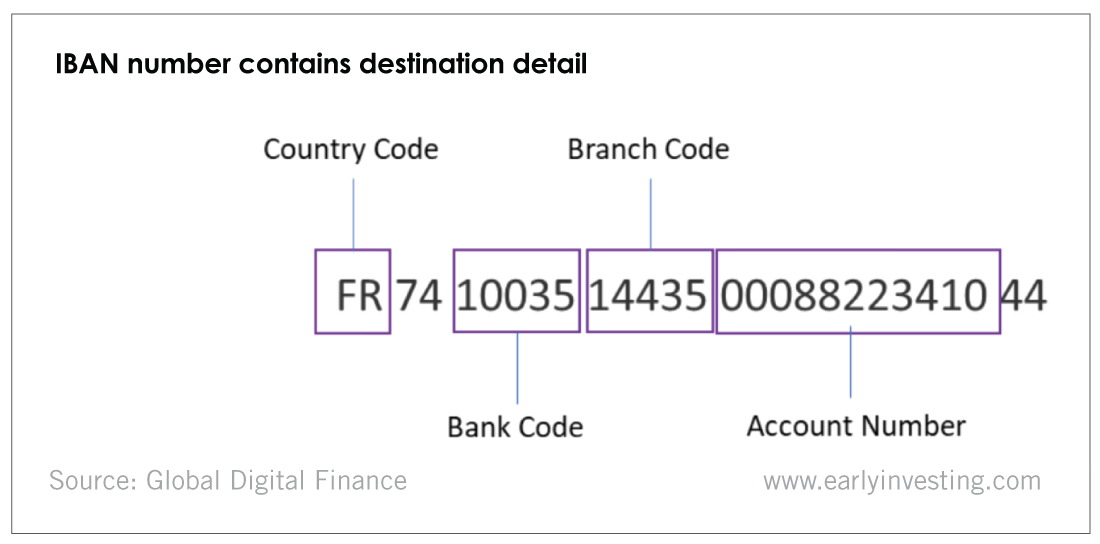

The way our current financial system is set up, banks have little problem doing this. A wire transfer, by design, requires bank, branch and account numbers for the recipient.

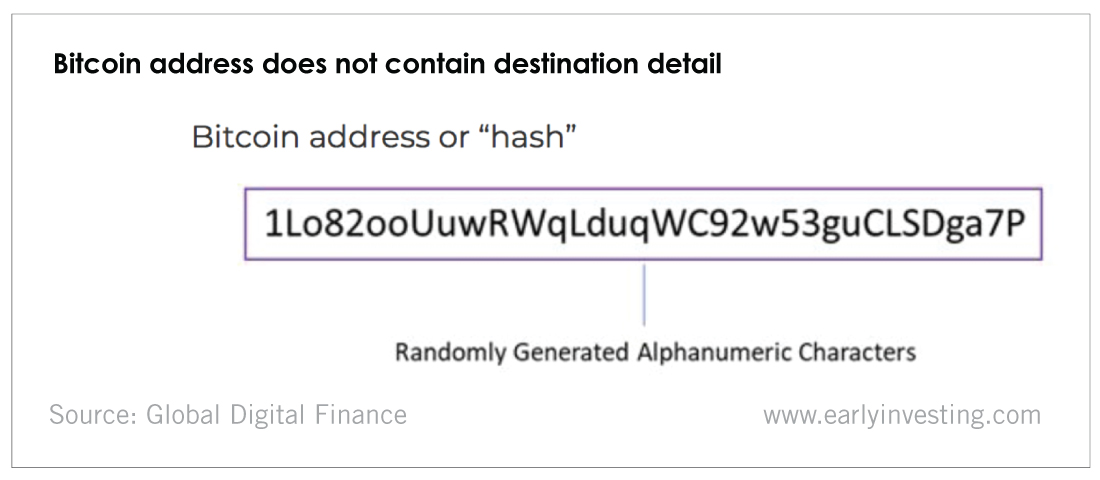

But a crypto transaction requires only an address.

By design, an exchange sending crypto on behalf of a customer doesn’t know who or what owns the destination address. The destination could be a person, exchange or business. According to Joseph Weinberg, co-founder of blockchain startups Shyft Network and Paycase Financial, it could also be a “machine, smart contract and any other infinite set of potential endpoints.”

At best, this requirement would be a hassle for crypto customers. At worst, it could be a major setback for the entire industry.

A compliance officer at a U.S. exchange says implementation is feasible… but is more of a “paper-chasing exercise” that won’t further law enforcement goals. “We’ll end up bothering good customers and asking them for information we can’t verify,” he said.

Weinberg said, “It could drive the entire [crypto] ecosystem back into the dark ages.”

This problem strikes at the beating heart of why cryptocurrencies were created in the first place. Bitcoin’s market cap has grown to $144 billion because it increases transparency (the whole blockchain is open to anybody to view) while enhancing privacy and identity protection. Its trustless technology is rightly considered revolutionary for its ability to cut out the middleman. It doesn’t need (or want) banks or exchanges to manually generate and monitor a paper trail. Nor does it want outside entities representing the old banking order to be able to access such information.

Unfortunately, the travel rule will make its way to the U.S. The U.S. Treasury’s Under Secretary for Terrorism and Financial Intelligence said the standard is on track for publication next month, and gave every indication that the U.S. will be adopting it, as will the vast majority of the developed countries.

I’m all for good rules and a sensible strategy for fighting terrorism. But the travel rule is neither. About 200 to 300 people attended FATF’s consultative meeting in Vienna in early May to voice their concerns. But I’m amazed this is happening with so little protest.

The battle lines have never been drawn this sharply before. I resent that I’m being forced to choose between fighting terrorism and defending cryptocurrency… between using regulated exchanges and using nonregulated platforms.

The last thing the government should want is to drive cryptocurrency underground. But that is where we may be headed.

Good investing,

Andy Gordon

Co-Founder, Early Investing