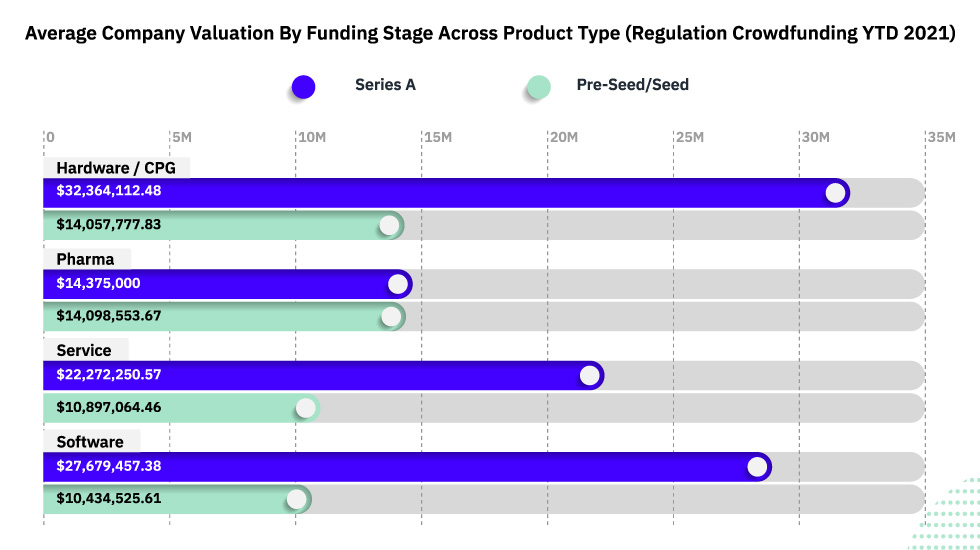

Editor’s note: Our friends at KingsCrowd produce a ton of data on startups. This week, they created a fascinating chart (see below) exploring the relationship between product type and funding stage. We’re sharing this chart with you because it provides useful insights that can help you assess a startup’s valuation. We hope you enjoy it.

To read their full analysis, visit the KingsCrowd website here.

In order to help evaluate risk, KingsCrowd categorizes every startup by its product type. The four categories we use are: hardware / CPG (consumer packaged goods), services, pharma (pharmaceuticals), and software.

This week, we decided to take this data one step further by drilling down into funding stages. This data includes all active and closed startup funding rounds that raised capital via the online private markets on or after January 1st, 2021. We chose to only examine Regulation Crowdfunding rounds. Additionally, we combined pre-seed and seed stage companies together.

To read the full analysis on this chart, check out the article on KingsCrowd here.