Note: Determining startup valuations is more of an art than a science. Lately, we’ve written about how startup valuations are reaching eye-popping highs. But how do online startup valuations and offline startup valuations compare? That’s the question that our friends at KingsCrowd address in a recent Chart of the Week.

A startup’s valuation is an indicator of its progress as well as an estimation of its future growth. There are various ways of determining a company’s valuation. In the traditional venture capital (VC) world, VC investors determine what valuation they invest at for a company. However, in the online private markets, founders have control over their startup’s valuation. This difference is one of the major separators of the online and offline private markets. However, in both cases, startups valuations have grown by 10% or more over the last decade. So how do valuations in the online private markets rank against the top deals in the offline market?

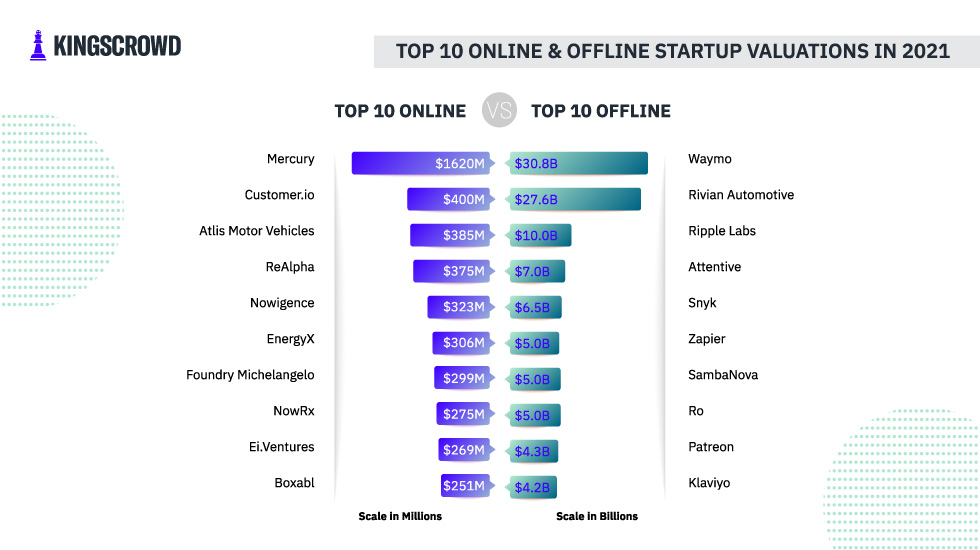

In this Chart of the Week, we compare the 10 highest offline valuations and the 10 highest online valuations of 2021, ranking each from highest to lowest. It is important to note that valuations for the offline market are post-money, while the online market displays pre-money valuations. This difference comes about because details of offline raises are communicated after the round closes — making it post-money. With online equity crowdfunding, a startup’s valuation is set at the beginning of a funding round — thus being pre-money.