We’re just a few days away from the start of a new year. So I’m reflecting on all the things that have happened in 2022… and all the things that may happen in 2023.

2022 was a rough year for the stock, startup and crypto markets. Inflation has been brutal, which has dampened investor spirits. Many institutional and retail investors have pulled back, leaving many startups struggling for funding. Crypto plunged into a bear market and still hasn’t reached the bottom.

2023 is likely to be another challenging year. It may take several more months for the Federal Reserve to bring inflation down and for the crypto bear market to end. But I’m an optimist. And I believe 2023 will bring us some good news too.

To that end, let’s dive into three things I hope investors see in 2023.

Lower Inflation

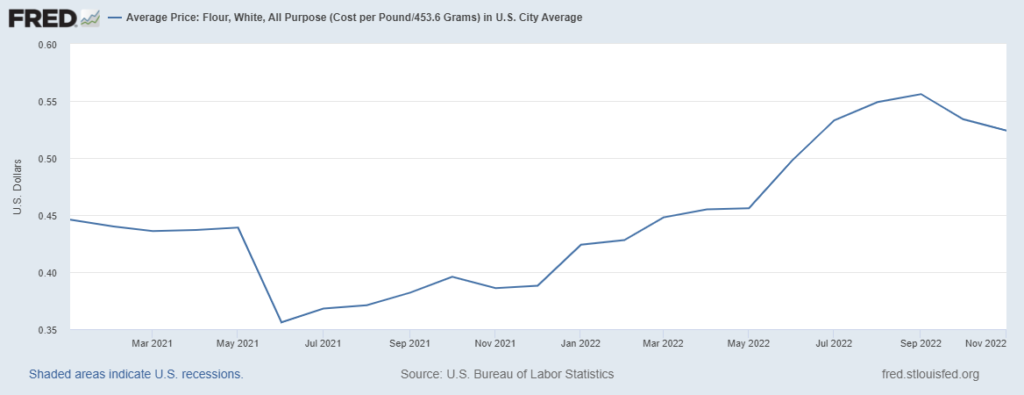

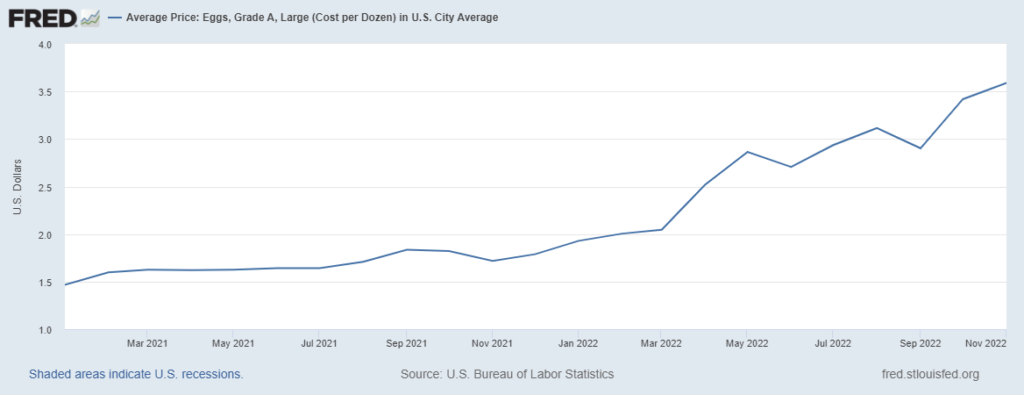

First, I hope the Fed gets inflation under control. Just basic necessities like food and rent have become painfully expensive. The price of flour is up more than 17% since January 2021. The price of eggs has more than doubled since January 2021 (though some of that is due to a bird flu outbreak). The charts below illustrate just how severe the increased costs have been. And that’s just for two items! It’s like this for almost everything we pay for. Everyone I know is struggling with rising costs.

As inflation has risen, the Fed has tried to combat it by raising interest rates. The higher interest rates have in turn contributed to stock market volatility and recession fears. Investors are spooked. They’re selling their stocks as part of a flight from risk. We’ve seen the same thing happen in the crypto market.

If the Fed can get inflation under control, investor sentiment will improve. They’ll feel more confident about the direction of the economy and will begin investing in stocks, startups and crypto. The markets will spring back. And more startups will have the funding they need to innovate and succeed.

Which leads me to my next point…

More Healthcare Solutions

I’d like to see innovative startups in a number of different industries. But if I had to pick one, I’d say the American healthcare system is in the most desperate need of disruption.

To be clear, I don’t think startups can completely fix our broken healthcare system. That’s on the government. But I do think startups can do a lot to improve the current system. Take insurance, for example. Just recently, Andy Gordon, Vin Narayanan and I were discussing how devastating it is to be locked out of your own company’s health insurance system. (You’ll hear more about this in our Early Investing Podcast next Wednesday.) And it happens to people all the time because navigating insurance coverage is a nightmare.

As they are now, insurance companies are designed to leech as much money as possible out of people and severely limit the amount of medical care they actually cover.

It’s a terribly broken system. And the government isn’t likely to change it anytime soon — so we need a way to improve the system we’re stuck with.

That’s why I want to see startups that make it easy to understand healthcare coverage. Startups that advocate for patients. Startups that have integrated systems so that healthcare providers and insurance companies actually talk to each other without forcing patients to go on a wild goose chase to track down their own medical records.

COVID-19 has spurred a lot of medical innovation out of necessity over the past two years. I hope 2023 will bring us even more.

More Equitable Funding

My final wish for 2023 is that we’ll see more underrepresented founders get the support they need. And I don’t just mean female founders. I want to see female founders, founders of color, female founders of color, queer founders, queer founders of color, and disabled founders get a larger piece of the funding pie.

We already know that these underrepresented founders tend to receive less venture capital funding than their white male counterparts. The percentage of money going to female founders in particular has ebbed and flowed over the last few years, but by and large, venture capital firms are overwhelmingly investing in white male founders or white male majority teams.

We also know that crowdfunders don’t seem to hold the same biases. So I see no reason why that trend can’t continue into 2023. KingsCrowd has highlighted a number of startups run by underrepresented founders — some of which were rated very favorably as investment opportunities. And KingsCrowd’s search filters make it easy for investors to search for companies run by underrepresented founders. So if you share my desire to find and research more startups run by these kinds of founders, there are easy ways to do it!

Innovation comes from all kinds of people from all parts of the world. Let’s hope that the new year will bring us more of that.