SpeechTrans

Knocking down the language barrier

Remember the original Star Trek, the one with Captain Kirk and Spock? Okay, you would have to be as old as I am. Whenever a Klingon or another planetary species appeared on his communication screen, Kirk would instruct Ensign Sato to turn on the “Universal Translator.”

The stuff of science fiction, right?

Well, not anymore.

The world is getting smaller. Travel is global. Business is global. The Internet is global. So are movies and TV shows now.

But one big barrier remains: language.

In the late 1880s, a Polish Jewish doctor tried to eliminate the language barrier by inventing a language he called Esperanto. He hoped it would be adopted by nations all over the world.

This “constructed” language failed to catch on, although it had thousands of adherents. For the period between the two great world wars of the 20th Century, it was called “the most outlandishly successful invented language ever.”

Languages come and go, sometimes taking centuries and sometimes millennia. But we’ll always be a world speaking in many tongues.

So if you can’t change that, the next best thing would be making language translation easy, cheap, mobile and accurate.

How far off do you think that day is?

Actually, it’s here right now, thanks to the remarkable technology of one small company.

It’s not a household name to you. But it is to HP, Microsoft, Nuance and Intel. These giant companies have all partnered up with this small one.

Slowly but surely, this startup – which goes by the name of SpeechTrans – is getting the recognition it so richly deserves by America’s high-tech corporate titans.

For example, just a few days ago, on Dec. 9, 2013, SpeechTrans was singled out by Sanket Akerkar, a Microsoft VP. He praised SpeechTrans for having the latest speech recognition and translation technologies. And he mentioned one of SpeechTrans’ neatest products, Surfi, a Microsoft Windows 8 version of Apple’s Siri.

Speak any question and Surfi can display it and speak an answer directly back to you.

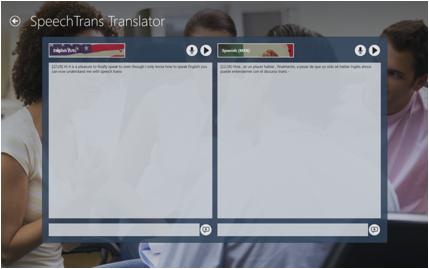

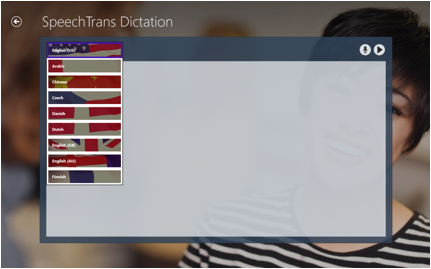

Rather than describe to you how it works, here are some screenshots showing SpeechTrans Windows 8 Applications in action.

SpeechTrans is also a top 25 app as a “Microsoft Managed Partner” on Windows 8.

The latest giant tech company to hook up with SpeechTrans? None other than Intel. In early July 2013, it began working with SpeechTrans and recently gave SpeechTrans $50,000 to help market the New SpeechTrans Pro pre-loaded on the Intel-powered Android x86 Tablets and Ultrabooks.

SpeechTrans already is working closely with HP. Its software is embedded in all of its new computers, as part of HP’s “MyRoom” video conferencing.

Who else is getting on the SpeechTrans bandwagon? How about iTunes. SpeechTrans has been featured on Apple’s iTunes homepage in 48 countries.

And Android. It’s been downloaded 50,000 times for free and 500 times for $5 per download. Who else?

The Army Medical Command is using SpeechTrans to communicate in over 40 languages.

In fact, government agencies from all over the world have begun using SpeechTrans’ translation services.

The startup has targeted legal IT professionals for its transcription services. Here is what one professional says…

“No one wants to spend the extra time to train dictation software. SpeechTrans technology uses cloud technologies with over 4 million speech samples for each language; that’s 4 million different people per language, 4 million different pitches and voices to improve initial accuracy. And it keeps improving over time.”

And now SpeechTrans has made its transcription services available to the legal as well as the medical community through SpeechWeb, its latest cloud-based product. For $50 a month, doctors, lawyers and their administrators can virtualize their desktop and enable speech recognition in the Cloud. That helps decrease downtime and increase productivity.

Did we try out SpeechTrans translation app ourselves? Of course we did.

It was fast and accurate. My Russian, as poor as it is, was converted into English quickly and accurately. We did the same thing with Spanish. SpeechTrans works with most European languages at an 85% accuracy rate. With Asian languages, its accuracy rate – at 70% to 75% – is better than other newly minted translation services.

As SpeechTrans spreads its wings, it seems that the market is expanding right alongside it. Widely respected research firm Gartner expects the $34.5 billion a year translation industry in 2012 to exceed $150 billion by 2020.

Nice growth. But can SpeechTrans take full advantage?

SpeechTrans employs a special and quick-adapting learning technology. That’s one big advantage.

Another is SpeechTrans’ powerful partners. This matters a great deal. Why?

Startups are limited in resources. They lack marketing acumen, brand recognition and plain ol’ experience. It was SpeechTrans’ partners that first caught my attention. This is what I wrote about three months ago in my notes on SpeechTrans.

“Instant credibility and marketing muscle with HP, Microsoft and Intel on board.”

I added a second note: “Will roll out over 200 million new potential customers through their Middle East telecommunication company partners in 2014.”

Both notes speak to the company’s strong “traction,” a concept that angel investors and VC investors take very seriously. It refers to marketing progress. So much about startups is about potential. But this measure is all about the here and now. And that’s why investors pay extra attention to it.

Traction, however, does not necessarily equate to revenue. SpeechTrans rightly considers itself a pre-revenue company with some money coming in from here and there (about $650,000 in the past three years).

By the end of 2016, its projected annual cash flow is projected at more than $15 million. SpeechTrans insists its numbers are realistic. The company tries to be conservative in its projections, but at such an early stage, such projections should be considered guesstimates and be taken with a grain of salt.

Given the extremely rapid growth projected by SpeechTrans, a shortfall in revenue against projections would not prove fatal to the company. Its monthly cash burn is extremely low. It will go up in 2014 but will remain at modest levels.

In other words, SpeechTrans has given itself a big cushion to play with in the next two years. Unless it utterly fails to generate revenue along the lines projected, this next year is setting up to be a breakthrough year for the company. Its execution has been great so far. It will have to continue at a high level. Part of the risk you’re taking is not knowing for sure. It’s part of the territory with startups. Nothing is “for sure.”

And that’s also why the monetary reward can be so great.

The market isn’t without competitors. There’s Google Translate and Jibbigo. They cover the mobile space. And Lexifone and NTT DoCoMo. They offer over-the-phone automated machine language translation.

None measure up to SpeechTrans’ high standards. I can’t critique all these companies in this report. But let me do one of them: Jibbigo.

It’s not cloud-based, like SpeechTrans. Its accuracy falls in the 60% to 70% range. And it only has 40,000 words under its belt (SpeechTrans has 400,000 words).

Oh, yes, it also doesn’t work on the older iPhones.

So, no, it’s not a worthy competitor. But that didn’t stop Facebook from acquiring it in August of 2013 for an undisclosed sum.

I believe SpeechTrans is the class act among the new translation companies.

Will that change? Who knows? Maybe. Startups have such a long way to go; nothing is guaranteed. But I like SpeechTrans’ chances, for all the reasons I’ve discussed in the past few minutes.

Fortunately, I’m not the only one. I mean it. I don’t want to be on an island in the startup space. If you’re the only one who likes a company, its chances of getting the funding it needs aren’t that great.

It’s nice to know that back in 2011 SpeechTrans raised $320,000 from an investing company called Jumpstart. That was a seed round.

This time around it’s raising $1 million in a “Series A” round. And the New York chapter of Harvard Business School Angels said if SpeechTrans gets to $750,000, they will chip in the last $250,000.

Notably, these guys will be offering their considerable expertise as well as their money.

And I know for a fact that SpeechTrans’ Co-Founder and CEO, John Frei, is looking forward to having them on board. That’s the way John is, very open to new ideas and advice. John comes from New Jersey, far away from the hubbub of Silicon Valley. He’s an experienced and successful businessman, having grown a company from scratch to over 25 employees. I’ve talked to John many times. He has articulated to me his short-term and long-term objectives and how he plans on meeting them in a very straightforward way.

John is joined by Yan Auerbach, a tech guy who has also worked for a VC firm, in fact the oldest one in the world, Bessemer Venture Partners. His skills and experience complement Frei’s very nicely. Together they make a strong and competent team.

I suggest you talk to John or Yan yourself, if you’d like. See for yourself. This is your money after all.

If you do, you might want to ask them about their exit strategy. SpeechTrans could go on and prosper. More likely, it would be bought out. Prime candidates would include SpeechTrans’ current partners – HP and Microsoft. Nokia, Facebook or intelligent systems company Nuance are other possibilities.

So This Is What You Should Do…

And if you do decide to invest, your minimum would be $5,000 and you’d be buying a convertible note. Your interest on the note would be 8%. For this “Series A” round, the company is capped at $10 million and they’re offering investors a 20% discount.

Okay, what exactly does all this mean?

To make the math as simple as possible, let’s say you put $10,000 into the company. When SpeechTrans does its next round, in all probability it’ll give investors the opportunity to buy shares. And that means it will have to put a value on the company, so investors know how big a stake they’re buying.

At a $5 million valuation, $10,000 buys you a 0.2% stake in the company. At a $10 million valuation, it buys you a 0.1% stake. At a $20 million valuation, it buys you a 0.05% stake.

But, remember, for purposes of your convertible note, the company is capped at $10 million. So, even if the company gets a valuation of $20 million next round, for you, it’s as if the company is valuated at $10 million. And if SpeechTrans gets a $5 million valuation next round, the $10 million cap doesn’t enter into the picture.

Now there’s one more thing to consider: the 20% discount. With 20% off the next round’s share price, your $10,000 will buy $12,500 worth of shares.

The terms are all in SpeechTrans’ term sheet, which you’d get by clicking the investment-pipeline link. The link will take you through step-by-step everything you need to do to make an investment. You can also check out SpeechTrans on RockThePost.com.

Important note to subscribers: Investing in startups is inherently risky. We recommend setting aside a small portion of your portfolio for such private investments. Then spread it out across 10-20 companies over the course of a year. This strategy minimizes risk. We also recommend contacting a professional advisor if you have questions, as we cannot provide personalized investment advice.