This month, U.S. equity crowdfunding platform StartEngine plans to open a “secondary market” where investors can buy and sell investments in startups that have already raised money using Regulation Crowdfunding and Regulation A+.

This new service is called StartEngine Secondary. Here’s an excerpt from StartEngine’s description of its new service:

Traditionally, startup investors had to wait 5-10 years in order to see a return on their investment. They often had to wait for a liquidity event, such as the startup being acquired by another business or the company going public via an IPO. 5-10 years is a long time to wait.

We hope to change that with StartEngine Secondary. With our platform, users can not only invest in companies on StartEngine, but also trade with other investors if they are available. Investors should be aware that the only bids for their shares may be less than what they originally paid.

Secondary markets for startup investments are a relatively recent development. Netcapital — another startup investment platform — already offers the ability to buy and sell secondary startup equity for crowdfunders. AngeList just debuted a new secondary market service for accredited investors.

The most active secondary market for startup equity is on the UK-based platform Seedrs. Seedrs’ equity crowdfunding platform has been operating since 2012, so they have a four year lead on American platforms that launched in 2016.

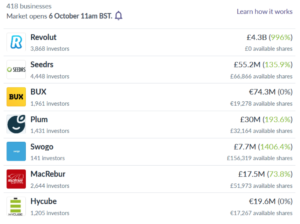

Take a look at a few of Seedrs’ current secondary offerings.

As you can see, Revolut investors are up around 996%. And Swogo is up a healthy 1,406.4%. Those are some impressive numbers. (Keep in mind that UK equity crowdfunding has been around twice as long, so it’s had more time to mature.)

It seems inevitable that in the near future, we’re all going to have the option to easily buy and sell our better-performing startup investments.

To Cash Out, Stay In or… Buy In?

Investors who are up around 1,000% will be tempted to sell their shares. It’s a remarkable return. However, I would advise investors not to be too hasty here.

Keep in mind that it’s only going to be easy to sell “shares” in the very best startups. There will be little demand for mediocre startups. If and when you get the option to sell, it will be for a startup with huge potential. And those just don’t come along all that often…

The whole point of investing in startups is to shoot for 25x-to-100x gains. These wins are what make the math work (they make up for inevitable losers and laggards). Great VCs don’t cash out early. They hold until the startup is acquired or goes public (IPO’s) — and sometimes even after.

So if you ever find yourself wanting to “cash out early” on a startup, consider only selling a portion of it. Try to hold onto at least half of it. Otherwise, you’re missing out on the huge upside of startup investing.

I think the most interesting part of these new secondary markets is the ability to buy shares in really good startups. I think there will be some excellent opportunities to buy into more mature, fast-growing companies. Yes, the shares will be more expensive than what the original investor paid. But this is actually a very positive sign in the startup world. You want to invest in companies with rapidly-growing valuations.

There will also be opportunities to snatch up great startups on the cheap. Investors who are willing to seriously research little-known startups are likely to find some gems. This will be a very inefficient market — and that means opportunity for investors like you and me.

In short, I am looking forward to secondary markets for buying — not selling.

The American public startup investing scene is just starting to come into its own. Deal quality, volume, and traction have all gotten so much better over recent years. It’s a great time to start building up a startup portfolio. And I recommend you hold onto it for the long-term.