Cryptocurrencies today are a rare opportunity.

More and more people are beginning to recognize the benefits and value of cryptocurrencies, particularly bitcoin.

Bitcoin is the most popular cryptocurrency. It has the biggest brand name. And it’s extremely secure. The bitcoin network has never been hacked. It should make up the bulk of your crypto portfolio. But it’s not the only cryptocurrency worth investing in.

Even as bitcoin leads the market, other coins have emerged. Each has its own specialty.

Bitcoin, for example, is emerging as “digital gold” – a way to store and grow money. Bitcoin can be changed into cash or other assets all over the world. It’s the “reserve currency” of the crypto world.

Litecoin is “digital silver” and has the advantage of lower fees and faster transactions.

Monero is a privacy-focused coin with terrific traction.

Ethereum is a platform for building decentralized applications and executing smart contracts on a public ledger (more on this in the Ether section below).

It has become clear that there will be multiple winners in the cryptocurrency space. We’re aiming to find the next big ones.

Two Coins With 1,000X Potential (And One Bonus Pick!)

From an investment perspective, we have a fantastic opportunity in front of us. We’re still in the early adopter phase, as only a few million people own any crypto at all.

Bitcoin has already made thousands of people wealthy. It has an excellent brand, strong security and a huge head start in terms of adoption.

But in this report, we’re going to cover three cryptocurrencies that should be in your portfolio. Each is stronger than bitcoin in some areas (and weaker in others). Each has excellent traction and meets my 10 “must-have” conditions for success.

But before we start looking at our new crypto recommendations, I’m going to go over some portfolio guidelines.

I recommend investing no more than 3% of your overall investment portfolio. Of course, you can start with as little as $50 or $100. And you don’t have to buy a full bitcoin or Litecoin. Fractions are fine.

Bitcoin will make up 70% of First Stage Investor’s crypto recommendation portfolio. Everything bitcoin-related is covered in my report titled “How to Profit from the Next Bitcoin Bull Market.” I recommend reading that first, as you’ll need a Coinbase account to get started.

The three other coins covered in this report will make up the remaining 30% of our portfolio…

- Litecoin (LTC) – 10%

- Monero (XMR) – 10%

- Ethereum (ETH) – 10%

These coins are still small compared with bitcoin. Here are the market capitalizations (total value of all coins) as of August 22, 2019…

- Bitcoin: $180.5 billion

- Ethereum: $20.3 billion

- Litecoin: $4.6 billion

- Monero: $1.4 billion

Now let’s get into the recommendations…

Crypto Recommendation #1: Monero

Percent of Portfolio: 10%

Crypto ticker: XMR

Market cap: $1.4 billion

Total supply: 17,168,290 (no “hard” max)

Category: Privacy Coin

Launched: 2014

Monero is one of the oldest and most battle-tested cryptocurrencies. It launched in 2014. Unlike most “altcoins,” it didn’t have an ICO. And it did not reward developers with a free heap of coins.

In many ways, Monero functions like bitcoin. But there’s one key difference. From the start, Monero’s focus has been on creating a fully functional, yet private cryptocurrency. I believe Monero is the strongest privacy coin on the market. And privacy coins are critically important to crypto’s future.

Many people think of bitcoin as private, but this simply isn’t true. All transactions on bitcoin’s blockchain are public. And they can be traced. For example, if you give someone your wallet address (so they can pay you), that person can easily see how much bitcoin you have in the wallet. And if they want to, they can see who you send bitcoin (from that wallet) to.

In many cases, a bitcoin user’s real identity can be revealed using forensic accounting methods.

Monero is different. It uses advanced technologies such as ring signatures, ring confidential transactions and stealth addresses to make transactions confidential and private.

Privacy coins like Monero have a number of advantages (and at least one disadvantage) over public cryptocurrencies such as bitcoin.

Monero’s built-in privacy is one of its biggest advantages. The privacy technology makes it a truly “fungible” cryptocurrency. Fungibility means that one unit is indistinguishable from another. Cash and gold are generally considered fungible, for example.

This is in contrast to bitcoin, where every coin has a publicly viewable history. So a bitcoin owner could, hypothetically, find themselves in an awkward situation if it turns out the bitcoin they bought was previously stolen or used for illegal transactions.

I have heard from a reliable industry source that bitcoin’s lack of fungibility is one of the key stumbling blocks for regulators being asked to approve bitcoin ETFs. What would happen if stolen or “dirty” coins ended up in a publicly-traded ETF? Nobody knows. But from what I hear, regulators are worried about the possibility.

Monero’s privacy features avoid such potential complications.

Privacy is especially important in the financial world. For example, you don’t want every person you do business with knowing how much money you have on hand. If you use bitcoin, tech-savvy people can simply look at your wallet and see how big your bankroll is. Imagine if your landlord knew you had dozens of bitcoin in your wallet. They might think about raising your rent. But with Monero, they couldn’t find that information out.

And think about how useful Monero could be in countries like Venezuela, Iran, or North Korea. Bitcoin is popular in all these places. But due to its public nature, savvy government investigators can track these transactions and take action against bitcoin users. Any place where there is an authoritarian government, private cryptocurrencies could be a lifesaver. And let’s face it, no government likes competition from cryptocurrencies.

In terms of disadvantages, the primary one I see is that government regulators don’t like that Monero is untraceable. It’s possible that if Monero adoption becomes widespread, governments could try to ban it or hamper its growth. However, Monero is strongly decentralized, and it will be very hard to shut down, as I’ll explain later.

Real World Usage

The good news is that Monero is one of the very few cryptocurrencies with real, worldwide user adoption. There are hundreds of merchants and service providers that accept Monero online. The downside is that some of this usage is for illegal purposes.

Because of its anonymity, Monero is a popular option for users purchasing items they don’t want anyone to know about, such as “adult entertainment,” drugs (legal and illegal), and VPNs (virtual private networks, which are used by both corporations and privacy-conscious individuals).

Here it is important to remember that many of bitcoin’s early use cases were also illegal. The most popular ways to spend bitcoin early on were gambling through unregulated services like “Satoshi Dice” and purchasing drugs on “The Silk Road,” an anonymous drug marketplace on the dark web.

It is only natural that new forms of currency would first take root on the fringes of commerce. So the fact that Monero has some unsavory uses shouldn’t scare us off. Cash is the No. 1 anonymous criminal currency and is used for plenty of illicit reasons. Yet nobody thinks there’s anything wrong with using cash.

Monero’s development also traces the same path the internet followed. In the early days of the internet, porn and unlicensed gambling sites helped fuel the growth and adoption of both the net and e-commerce.

I believe the world needs a private form of money. Monero is currently the lead contender and is well-positioned to continue its adoption path.

Strong Leadership, Very Active Development

Monero is fortunate that it has a popular and dynamic lead developer and maintainer in Riccardo Spagni. Riccardo has been with Monero since its launch and is the public face of the project.

I strongly recommend learning more about Spagni before making a decision on whether to buy Monero. He is a well-spoken advocate for the coin. As an introduction, I suggest listening to this podcast featuring Spagni. In it, he answers common criticisms and explains why he believes the world needs Monero.

For a more technical discussion about Monero’s privacy features, check out Jimmy Song’s interview with Spagni on Youtube. Jimmy Song is one of the most well-respected bitcoin developers and advocates. Song is dismissive of 99% of altcoins, but he takes Monero – and Spagni – quite seriously.

And that’s quite a feat. Song is a serious “bitcoin maximalist” (meaning he favors bitcoin over all other cryptocurrencies). Spagni is clearly a well-respected figure in the cryptocurrency community.

And it is because of Spagni’s leadership that Monero has made such incredible technical progress over the years.

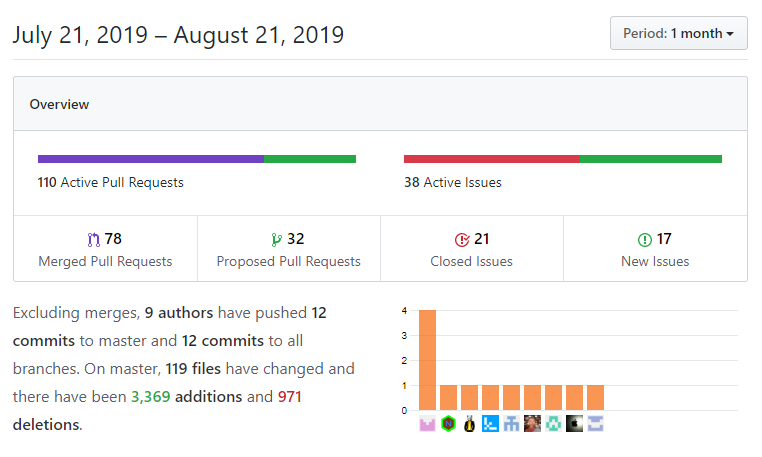

Monero has one of the most active developer communities in cryptocurrency. More than 500 unique developers have contributed to the project.

Monero’s developers regularly roll out major improvements to the project, and they do so in a very professional manner. Unlike many cryptocurrencies, big changes to Monero are often audited by third parties for security.

You can see that this project is quite actively maintained by looking at Monero’s Github page. (Github lets developers store and share versions of their code.) Below is a snapshot of Monero’s Github activity over the last month.

Strong Decentralization

One of the key features of Monero is its strong decentralization. Monero accomplishes this by making Monero mining available to everyone, not just big corporations who can afford specialized computers and data centers.

Monero mining functions in much the same way bitcoin mining does. Miners process transactions and secure the network, earning rewards for their efforts.

However, with bitcoin and most other major cryptocurrencies, the bulk of mining is done by large corporations using specialized computer chips called ASICs (application-specific integrated circuit). ASICs are designed specifically to mine only one cryptocurrency and are far more efficient than non-ASIC mining machines.

The drawback to cryptocurrencies dominated by ASIC mining is that it increases centralization. When just a few large companies have a majority share of the mining market, it is far easier for a government or other bad actor to interfere with the network.

Monero is considered an “ASIC-resistant” cryptocurrency. This means that anyone with almost any computer can mine Monero. ASICs have been built to mine Monero. But Monero deals with this by changing its algorithm regularly, making the specialized ASICs worthless. So the network is more widely distributed and more decentralized. It’s harder to shut down and harder for bad actors to interfere with.

Monero developers are working on new, longer-term solutions to prevent ASIC mining. This is a smart tactic, and it should help ensure strong continued decentralization.

Monero Coin Supply

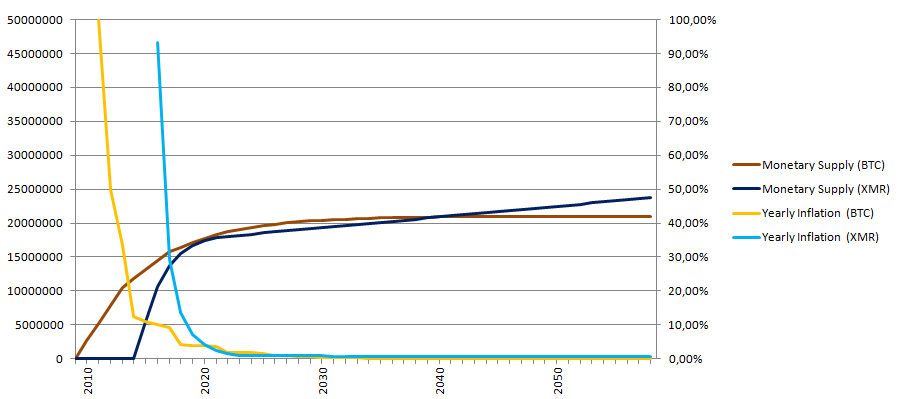

There are currently just over 17 million XMR in existence (very similar to bitcoin). But unlike bitcoin, Monero does not have a “hard cap” on the coin supply.

Monero’s “inflation rate” (the percentage of new coins added per year) is already low, and by 2022 it will be just 0.9% per year. After that it will slowly drift toward zero.

As you can see from the chart below, Monero’s coin supply and inflation metrics actually look quite similar to bitcoin.

To put these numbers into perspective, the amount of gold mined every year is around 1.7% of total global supply. And with an inflation rate set to be substantially lower than this in the near future, I think Monero’s coin supply is well-thought out and shouldn’t adversely affect price.

Monero’s “uncapped” coin is actually quite reasonable. Miners need an incentive to keep processing transactions and securing the network. Having a constant trickle of coins to reward these individuals is important. I believe that population growth, increased adoption, and lost coins should more than offset the trickle of new XMR coming onto the market over time.

Where To Buy Monero (XMR)

For U.S. members, I recommend buying Monero on Kraken.com. If you do not yet have a Kraken account, you can open one here.

Kraken allows users to purchase bitcoin with U.S. dollars, but you can’t directly purchase Monero with USD. You’ll need to either transfer bitcoin into your Kraken account or purchase some directly from them.

Once you’ve got some bitcoin in your Kraken Wallet, head to the “Trade” tab and select the XMR/BTC trading pair. Select the number of coins you want to purchase and complete the order.

For more info, here’s a handy how-to guide.

International members have more exchange options, including Binance, which has higher XMR trading volume. Go here for a full list of exchanges that trade Monero.

Wallets and Storage

Once you’ve purchased your XMR, you should move it to a wallet under your direct control if you’re comfortable doing so.

I recommend using a hardware wallet such as the Trezor or Ledger to store your XMR. There are a number of detailed guides on the web with the specifics of how to do so. These two are a good starting point:

https://support.ledger.com/hc/en-us/articles/360006352934-Monero-XMR-

https://wiki.trezor.io/Monero_(XMR)

Additional Resources

- List of Exchanges That Trade Monero

- Riccardo Spagni on Twitter (@FluffyPony)

- GetMonero.org – full of information and resources

- Monero FAQs

- Monero Discussions on Reddit

Crypto Recommendation #2: Litecoin

Percent of Portfolio: 10%

Crypto ticker: LTC

Market cap: $4.6 billion

Total (max) supply: 84 million

Category: Store and Transfer of Value

Launched: 2011

Litecoin was created by MIT grad Charlie Lee in 2011. Charlie is a heavyweight in the crypto world. After creating Litecoin, he went on to work in an executive role at Coinbase.com (the largest U.S. cryptocurrency exchange).

In early 2017, Charlie left Coinbase to focus on Litecoin full time.

Litecoin is a lot like bitcoin… but faster. It has a chance to go to $1 million but from a much lower starting point.

It’s also cheaper to send. So merchants who transact in crypto (there are a lot of them) love using Litecoin. It has good liquidity on exchanges, so it serves as an excellent currency.

Litecoin is based on bitcoin’s open source code. But Litecoin implemented some major improvements, and as a result, it scales better than the original. Litecoin can handle far more transactions per second than bitcoin can.

Litecoin is battle-tested since 2011, a feat very few coins can claim. It has demonstrated excellent security and has momentum on its side.

How to Buy Litecoin

You can buy Litecoin on Coinbase.com. Simply navigate to the “Buy/Sell” tab, choose “Litecoin,” and choose your payment method.

Disclosure: I own Litecoin and have since 2013. I have no plans to sell any and will notify members a week in advance if I do.

Bonus Crypto Recommendation: Ethereum

Percent of Portfolio: 10%

Crypto ticker: ETH

Market cap: $20.3 billion

Total (max) supply: No hard cap on supply; coins are issued by the Ethereum Foundation to secure and develop the network. Current circulating supply: 107.4 million

Category: Smart Contracts and Decentralized Applications

Launched: 2015

Ethereum is a smart contract platform – a network of connected computers with a shared ledger. It has built-in currency called ether, which is what you’ll be buying. And even though Ethereum was hit hard by the 2018 bear market, it’s still the dominant platform for smart contracts and decentralized applications. This company is a grand slam for tech. And that makes it worth investing in.

Founded by 23-year-old Vitalik Buterin in 2015, Ethereum took off like a rocket.

The most popular use of Ethereum today is initial coin offerings (ICOs). An ICO is when a new cryptocurrency offers its coins for sale to the public. It’s also called a token or coin sale.

When you buy new coins in an ICO, this usually happens on the Ethereum network. You buy the new coins using ether.

So to participate in ICOs, you usually have to buy ether on cryptocurrency exchanges (like Bittrex). This creates constant demand for ether from ICO participants. However, the funds raised in an ICO will eventually be sold to pay for software development and other overhead expenses. Overall, it’s a net positive for the price.

Smart contracts are used to process coin and token purchases from ICOs. You send Ether from your wallet to a specific address, and the contract records your purchase on the blockchain and automatically sends you the new tokens. These smart contracts have all sorts of advanced features like escrow, anti-spam measures, transparency and other additional new innovations.

ICOs saw explosive activity last year. Crypto startups raised nearly $3 billion using ICOs in 2017. And new coins and tokens are still launching every day.

Ethereum essentially allows developers to build applications that run on top of it. Running these applications costs tiny amounts of Ether. This incentivizes developers to write efficient code and helps eliminate spam and malicious traffic.

It’s a powerful platform with practically limitless applications.

Ethereum has the potential to disrupt financial systems, internet architecture and more.

There are hundreds of active young projects that utilize the Ethereum network and more starting all the time.

Two examples include… (Note: We are not recommending these coins/tokens)

- Golem (a distributed supercomputer): Golem aims to build the world’s largest distributed supercomputer using individuals’ spare computing power.

- Augur: A decentralized prediction market with its own currency.

Corporate members of the Enterprise Ethereum Alliance include many of the largest companies in the world…

- Visa

- Toyota

- Accenture

- BP

- Intel

- CME Group

- Cisco

- J.P. Morgan

All these companies are exploring ways to utilize the Ethereum blockchain and network. We are still in the very early stages with Ethereum, but these companies (and millions of people) believe the potential is significant.

Ether is also becoming a widely accepted currency and value store. This is natural with any asset that is valuable, rare, securable and easily transferrable.

It is widely used within the industry as currency. Developers are paid in ether, so they have a vested interest in making the system as strong as possible.

Ethereum is quite volatile, so you may want to buy over time. There will be dips.

Coinbase makes it easy to average into a position. Right from the order screen, you can click on the box for “Repeat This Buy.” Then select if you want to schedule your buys daily, weekly or monthly.

So for example, you could buy $100 worth of Ether every month for a year. Then you don’t risk buying your entire position at a near-term top.

How to Get Your Share of Ethereum

You can buy ether using U.S. dollars through Coinbase or a number of other crypto exchanges using bitcoin.

Simply go to Coinbase.com (or another exchange), log in to your account, go to the “Buy/Sell” tab, and select “Ethereum,” then complete the purchase. Note: You will need to confirm your buy before it goes through.

Disclosure: I own Ethereum and have since 2016. I have no current plans to sell it and will notify members a week in advance if I do.

Keeping Your Coins Safe

Let’s go over security measures.

Even if you have only a little today, it could be a lot in the future. It’s worth taking the small amount of time to properly secure your accounts.

If you keep your coins on an exchange like Coinbase or Bittrex, eventually you will want to move them off the exchange. When your coins are on an exchange, you don’t have the private keys (the brokerage does). And your private key is what ultimately determines ownership.

The best option for many people is a hardware wallet. This is a small device that connects to computers via USB.

The nice thing about a hardware wallet is that your coins won’t be connected to the internet. They’ll be in cold storage. You’ll need to keep a copy of your private keys somewhere else. Somewhere very safe. Your private keys are everything. Print them out, or make sure you write them down correctly, and have someone else double-check them. Then check them again.

The two options I’m familiar with are Ledger Nano and Trezor. I hear good things about both but haven’t tried one myself.

Some people will prefer storing coins on a wallet on your computer. This is simply a program you install yourself. (There are Mac, PC and Linux clients.)

Keeping your cryptocurrency safe requires effective password security.

Choose very long, unique passwords. Ideally they should be at least 20 characters. You’ll need unique passwords for all your accounts. One password for your email, another for your crypto.

Your password should be 100% random. Do not use your birthday, anniversary, graduation year, etc. People can guess those things by poking around online.

This is what a really good password looks like: 3251080qnchfy!!ahtqwetfdgvca^^*

Understanding Potential Investment Risks… as Always

You should realize going in that these are high-risk, high-reward investments. You could lose a lot of your investment if something bad happens. That’s unlikely in my opinion, but we do have to accept it’s possible. So don’t risk too big of a chunk of your portfolio.

Bottom line: Don’t invest anything you can’t lose. The primary risk to cryptocurrencies today is government regulation or overreaction, particularly in the smart contract space. Crypto is disruptive technology that could cut the middle man out of a lot of financial industries. There will be resistance from the status quo. We don’t know how this situation is going to play out.

That said, the potential profits are simply too great to ignore. Everyone should have at least a tiny part of their portfolio in cryptocurrencies.