On Wednesday, Snowflake (SNOW) went public in one of the most highly anticipated IPOs ever.

Snowflake is a cloud data platform that helps companies efficiently organize and analyze huge databases. The company’s revenue is growing at a rapid 133% year-over-year rate.

Snowflake’s IPO priced at $120 for a valuation of $33 billion. That alone made Snowflake the most valuable software company ever at the time of their IPO, according to Fortune.

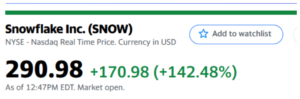

There are two primary problems here for those of us who are “retail investors.” First, only well-connected investors got in at the initial $120 price. Demand for this deal was so high that shares opened to the public at $245 and were trading at $290 at 12:47PM EDT on Wednesday.

So unless they happened to have a connection at a major investment bank or Snowflake, most investors probably didn’t get in at the $120 IPO price. Warren Buffett’s Berkshire Hathaway — and other well-connected firms — invested at that price. But the rest of us didn’t have that option.

The second problem is that on its first day of trading, Snowflake was already valued at more than a $60 billion market capitalization! As a comparison, Twitter currently trades at a market capitalization of $32 billion. It’s true that Snowflake is growing much faster than Twitter. But it also only has a fraction of the revenue which Twitter does and is currently losing a lot more money.

The issue is that this week is the first time most investors will get a chance to buy Snowflake shares. And it’s already worth more than $60 billion. Snowflake is an impressive and disruptive company, true. But at that high of a valuation, there’s only so much upside left (and quite a bit of risk). The biggest gains were already made by Snowflake’s early private investors. The public never got a chance to buy when it was still small.

One more thing. In February of this year, Snowflake raised $479 million at a $12.4 billion valuation from private investors. What could have possibly changed between February and today that made the company 5x more valuable? I believe the spike can only be explained by the bubbly financial environment we’re in today.

Private markets are where tech growth happens

Snowflake isn’t the only hot tech company to IPO at a crazy valuation. Today it’s rare to see any hot tech company IPO at a valuation of less than a few billion dollars. Just take Uber’s IPO at an $84 billion market cap and how Facebook was worth $104 billion when it went public as a couple of examples. Those are monstrously large IPO valuations. And Snowflake is right up there with them.

Nowadays when a really hot tech company goes public, it’s often already a big and mature business. And the majority of investors’ gains were made in private markets.

This is one of the main reasons I continue to invest in private startups. It’s one of the only ways to get access to very fast-growing companies today. Of course, there’s also more risk involved in private markets. But that’s balanced out by the higher upside potential. Startup investing also requires a lot more patience than trading stocks — but in my experience that’s a benefit and not a bug.