Note: This is a guest post from our friends over at MillionAcres. They’re focused on finding the best real estate investment opportunities for accredited investors like you and me. And as they show here, real estate investing, much like angel investing, can be far more lucrative than investing in stocks. — Adam Sharp

Life only has a few real certainties. Death. Taxes. And some people would be tempted to add stocks to that mix. After all, aren’t stocks the single best wealth generator known to man?

Generations of investors have believed the answer to that question is a resounding “yes.” Championed by investing legends like Warren Buffett and Peter Lynch, as well as widely published academics like Robert Shiller and Jeremy Siegel, equities have become the asset class of choice for the individual investor.

Here’s the thing though. The public stock market hasn’t been the best performing asset during our lifetime. As members of Pre-IPO Profits, you already know that. That’s why you’re interested in early stage and angel investing.

But there’s another asset vastly outperforming the stock market. It’s real estate.

Real estate has probably produced as many millionaires and billionaires as the stock market over the years. But until recently, most investors couldn’t unlock real estate’s profit making potential.

Today, real estate investing is easier and more accessible than ever. With the right approach, investors can find opportunities that deliver spectacular returns and outperform the stock market.

Real Numbers

Real estate is the third-largest asset class behind stocks and bonds. According to estimates from Zillow, the value of all residential real estate in the United States is a staggering $32 trillion. That’s larger than the combined market capitalization of the S&P 500. More than $400 billion of commercial real estate (CRE) — that’s apartment buildings, offices, hotels, shopping malls, and industrial buildings like factories and warehouses — changes hands in the U.S. every year. And if you add up all the rents paid by U.S. tenants on either residential or commercial leases, it comes to almost $700 billion per year, according to the U.S. Census Bureau.

Real estate is big business. It can also be extremely lucrative. You may not be familiar with names like Donald Bren, Stephen Ross, Richard LeFrak, and Sam Zell. But they are some of America’s richest individuals. And they made the bulk of their fortunes from real estate. As industrial baron Andrew Carnegie once said more than a century ago, “Ninety percent of all millionaires become so through owning real estate.”

And of course, many of us non-billionaire Americans have enjoyed the tax advantages and leveraged returns of a home or rental property, too.

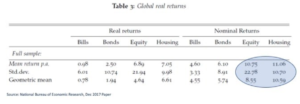

Let’s examine a contrarian view from a non-contrarian source. The National Bureau of Economic Research (NBER), which isn’t in the business of selling books or financial securities, released the results of a major study in December 2017. Under the somewhat audacious title of The Rate of Return on Everything, 1870-2015, NBER’s report examined the long-term returns of various asset classes in 16 advanced economies, including the United States.

The results were startling — well, at least for investing nerds like me. Using new and more comprehensive data sets on house prices and rents, NBER concluded “that residential real estate, not equity, has been the best long-run investment over the course of modern history.”

Here is a snippet from one of the key tables in the report:

Whether you’re looking at real (inflation-adjusted) or nominal returns, housing, at least in NBER’s eyes, has been the superior investment. And real estate has been less than half as volatile as equities when measured by the standard deviation of its returns.

That’s a key point. Because the stock market — especially individual stocks — can be extremely volatile, most brokerages won’t lend an investor more than two times (2-to-1) the value of their account. And on the margin loans brokers do make, the rates they charge tend to be extremely high and variable. That makes it too costly (and justifiably so) for investors to take excess risks on stocks.

When it comes to real estate, however, banks and mortgage lenders are usually happy to lend at 4-to-1, 5-to-1, and in some cases, even 10-to-1 or more, against an investor’s equity (or down payment). And home loans tend to come with fixed interest rates that are (at least in recent times) incredibly low.

Because of its relative stability, real estate offers investors something stocks can’t — the ability to make highly levered bets on an asset that offer returns that are similar or even superior to those of the stock market. Even a 2% or 3% gain in the value of a house can mean a double-digit return on a homeowner’s equity. (In real estate circles this is commonly referred to as an investor’s cash-on-cash return.) And that’s before accounting for the fact that mortgage interest is tax deductible and taxes on capital gains are exempt for most homeowners when selling a primary residence.

Let’s Get Commercial

Real estate isn’t limited to your primary home or that rental property you’ve been eying down the street. In the commercial world, real estate takes all different forms and sizes — from a mom-and-pop retail shop in Peoria, Illinois to a multi-billion-dollar office building in Manhattan. In between you’ll find apartment buildings, shopping malls, hotels, warehouses, self-storage facilities, hospitals, senior care centers, you name it. And like residential real estate, investment returns in the commercial world are still mostly a function of price and rental income.

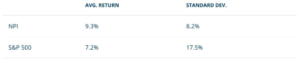

The National Council of Real Estate Investment Fiduciaries (NCREIF) has been measuring the returns of the U.S. commercial real estate market for more than four decades. The NCREIF Property Index (NPI) tracks 7,500 office, apartment, retail, industrial, and hotel properties worth more than $500 billion, making it a robust and diverse database of commercial real estate properties (and their associated property values and rents) from around the country.

How has the NPI performed against the S&P 500?

Source: National Council of Real Estate Investment Fiduciaries

According to NCREIF, over the last 20 years and across two full business cycles, including one historic recession, commercial real estate has outgained stocks by a full percentage point annually with less than half the volatility. In fact, the NPI has only experienced three down years since it began tracking CRE returns in 1978; the worst year being 2009, when the index fell 16.9%. The S&P 500 has had far worse years, including a 37% loss in 2008.

Divergent Paths

In case superior returns with less volatility isn’t a good enough argument for you to consider adding real estate to your investing plans, here’s something else to think about. Investors often look to alternative investments such as bonds and gold because they tend to be less correlated with stocks. When stocks go down, these investments tend to go in the other direction. For many investors, especially those who are risk averse or approaching retirement, these investments can help smooth out returns and preserve capital.

But who needs low-returning bonds and commodities when you can find the same diversification benefits with real estate, but with far better returns?

When two securities are perfectly correlated — meaning they move exactly in tandem with each other — they will have a correlation coefficient of 1. Conversely, when two assets move in exact opposite directions, they will have a coefficient of -1. Two securities with no association to one another will have a coefficient of 0.

If you measure the 40 years of NPI returns against the returns of the S&P 500, you’ll end up with a correlation coefficient of just 0.12, suggesting a positive, albeit very weak relationship between the two asset classes. Put another way, movements in the stock market have almost no bearing on the returns of commercial real estate, making CRE an excellent way to diversify one’s portfolio.

(Real estate investment trusts, or REITs, which I’ll discuss more in the next section, also offer diversification benefits. But since they are constructed and trade like general equities, their correlation with the overall stock market tends to be higher, between 0.4 and 0.7 depending on the time period. That’s according to Ralph Block, author of the excellent REIT primer, Investing in REITs.)

“All real estate is local” is probably a phrase you’ve heard before, and it goes a long way in explaining why it can be a powerful diversifier (and value-add) for an investor’s portfolio. Especially with commercial real estate, investors can identify lucrative opportunities far afield from their own backyard — in the vast technology ecosystems of San Francisco and Silicon Valley, the luxury office markets of Chicago and New York, or multifamily opportunities in places with strong demographic trends like Denver, Nashville, or Portland, Oregon.

Geography isn’t always the most important factor; the type of property can be just as important. A small hotel in Memphis can offer the same rewards as a sprawling biotechnology campus outside Boston. A Class B apartment building in Washington, D.C. could be a better bet than a gleaming new Class A luxury building a few blocks away.

When you’re a CRE investor, your opportunity set is as limitless as the stock market.

Getting Started

OK, let’s say you’re convinced and are ready to make real estate a real part of your investing. But let’s also assume the idea of being a landlord is about as enticing to you as a root canal. Dealing with leaky toilets or messy tenants who are always late with their rental payments just isn’t how you want to spend your Saturdays. Fortunately, you’ve got options!

Ironically, you can start with the stock market. There is a slew of publicly traded companies that have real estate as their primary business. Consider a company like Vail Resorts (NYSE: MTN) and its oh-so-appropriate ticker symbol. Vail of course is best known for its namesake ski resort in Colorado, but it also owns or has the rights to the land (and, importantly, the mountains) for an expanding portfolio of top ski destinations in North America, including Vail and Breckenridge in Colorado, Park City in Utah and Stowe Mountain in Vermont. Lodging, hospitality services, and real estate transactions are important sources of revenue for the company. Skiing is what Vail is known for, but real estate is its competitive advantage.

Another example is the Howard Hughes Corp. (NYSE: HHC). Hughes isn’t in the aviation business as you might expect, but rather in the real estate development business. The company owns thousands of acres of yet-to-be-developed land, as well as dozens of operating properties including retail, office, multifamily, and resort properties in places as diverse as New York City, Las Vegas, and Honolulu.

Or take a company like Jones Lang LaSalle (NYSE: JLL). It’s not necessarily in the business of owning real estate, but it’s one of the country’s largest real estate managers, with expertise in leasing, property management, tenant services, and commercial mortgage lending.

The REIT Way

If you’re looking for securities that are even more tied to the fortunes of real estate, then you’ll want to turn your attention to real estate investment trusts (REITs). REITs were established in the 1960s as a way for individual investors to invest in real estate, without the capital or credentials often necessary to invest directly in the asset class. You can think of them as mutual funds that have real estate properties as their primary holdings.

REITs have several advantages. For one, they pay no corporate income tax as long as 90% of their taxable income is paid to shareholders in the form of dividends or capital gains distributions. That means REITs almost always come with above average dividend yields, which makes them appealing to income-seeking investors.

Like the stocks we discussed above, REITs also offer investors the opportunity to invest in real estate with the liquidity of the stock market (and without the costs and headaches of being a landlord). Investors get instant diversification because your typical REIT will own interests in dozens (if not hundreds) of properties spread across multiple locations. Finally, because commercial property tenants are typically under long-term (5-years or longer) leases that include rent-escalators, REITs generate steady, growing cash flow streams that are far more stable than the revenue and profits generated by your typical public company.

Investors today can choose from hundreds of publicly traded REITs of all different shapes and sizes. There are giant REITs like Equity Residential (NYSE: EQR), which owns hundreds of apartment buildings in dense urban centers like New York City and San Francisco. There are small REITs like Ryman Hospitality Properties (NYSE: RHP), which owns several one-of-a-kind resort and destination properties, including the famous Grand Ole Opry in Nashville. There are REITs that specialize in niche markets like CubeSmart (NYSE: CUBE), which is one of the largest operators of self-storage units in the country. Or consider a REIT like Stag Industrial (NYSE: STAG), which focuses almost exclusively on single-tenant industrial buildings serving tenants in the transportation, shipping, and logistics industries.

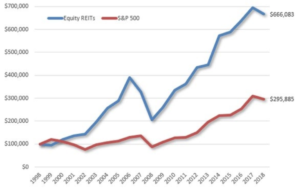

Best of all, REITs have been exceptional performers. According to data from the National Association of REITs (NAREIT), REITs have generated an annual return of 11.5% from 1972 through 2018. The S&P 500’s comparable annual return over that time frame — with far more volatility — is 10.2%. Over the last 20 years, the spread is even larger, with REITs returning 10% annually compared to the stock market at 5.6%. To see just what kind of difference that can make, check out what $100,000 invested in REITs 20 years ago would be worth at the end of 2018 compared to the same investment in stocks.

Source: National Association of REITs, author’s calculations

Going Mogul

The stock market and, especially, REITs, offer investors an almost boundless universe of liquid, low-cost and, in many cases, low-risk opportunities to gain exposure to real estate. But if you’re an investor who’s willing to take more risk for the chance at far higher returns, then it may be time to think about investing directly in commercial real estate.

How can I do that, you ask? Years ago, the answer depended to a certain extent on you having a rich family member or an expensive country club membership. Real estate opportunities tended to be kept within wealthy social circles and among the friends and family members of large commercial brokers, private equity firms, and moneyed institutions. And even when the rare CRE deal came available, it was often limited to deep-pocketed investors who were able to put $250,000 or more in a single deal.

But thanks to innovation and some recent legislative changes, private commercial real estate investing is more accessible than ever. The passage of the Jumpstart Our Business Startups (“JOBS”) Act in 2012 and its subsequent titles catalyzed the emergence of online marketplaces and crowdfunding platforms that enhanced the individual investor’s ability to invest directly in single-asset commercial real estate opportunities. Now, with just a few clicks of a button and for as little as $10,000, individual investors can gain exposure to institutional quality CRE opportunities from around the country.

Here is just a small sample of deals recently available to investors on CrowdStreet, one of our real estate crowdfunding partners:

— A new self-storage development near Denver offering investors a 19.9% targeted annual return.

— A redeveloping multifamily complex near Dallas offering a 17.8% return.

— A Marriott hotel undergoing renovations in Memphis offering a 16.5% return.

— An apartment building in New York City, just blocks from Central Park, offering a 17.7% return.

— A ski resort in Stowe, Vermont offering a 23.5% return.

Each of these deals offered investors the opportunity to more than double their investment in under five years. Even in the best of bull markets, stocks rarely generate these kinds of returns over multiyear periods.

Just as important, the democratization of the CRE market has enabled investors to be as diversified as they would be investing in REITs or general equities. Investors now have an abundance of opportunities across the four main CRE categories — office, industrial, retail, and multifamily — right at their fingertips. Using just the above sample, an investor could invest $100,000 ($25,000 each) in four of the five opportunities listed above and feel confident they’ve achieved a certain level of diversification across both property class and location.

How’s that for taking your portfolio to the next level?

Real Risks

Before you set sail to becoming a real estate mogul, it’s important to pay heed to the risks that come with private CRE investing. First and foremost, real estate is an illiquid asset. As anyone who owns a primary home or rental property knows, equity can be tied up for years waiting for a buyer to come along. A similar dynamic plays out in crowdfunded CRE opportunities. In most cases, an investor’s capital will be tied up for at least a few years (sometimes longer) depending on the nature of the asset and the strategy of its developer (or “sponsor” as they are often referred to in the crowdfunding world). Investor outcomes are also further outside the control of the investor. Distributions, capital returns, and profit shares — the components that make up those tantalizing returns I shared in the previous section — are often tied to the sale of the property, a refinancing of the project’s debt, or the signing of a long-term lease with a major tenant, which is often the case with a major office renovation. If the economy slows or if demographic trends in the property’s region worsen, investors may not only lose money on the deal, they may have to wait many years to get their capital back. This is a far cry from REITs or general equities, which can be bought and sold in seconds using a discount online broker.

Real estate is also more sensitive to interest rates than the overall stock market. At the property level, sponsors will almost always employ debt in the form of senior bank loans and other borrowings alongside investor equity to finance property acquisitions, construction costs, renovations, or operating costs. Changes in interest rates not only impact those costs, but also the overall value of the property at sale. After decades of falling, interest rates are trending higher around the world; investors should factor that in when assessing opportunities in the CRE world.

The Mogul Bottom Line

Hopefully this report convinced you that real estate deserves a significant spot on your investing horizon. Because contrary to the purported conventional wisdom, real estate does offer returns that are similar, if not superior in many cases, to the stock market, with much lower volatility. At the very least, it can be an excellent diversifying force for your overall portfolio. And these days, thanks to legislative changes, technology, and the rise of crowdfunding platforms like CrowdStreet, quality real estate opportunities are right at your fingertips.

Get ready to take your portfolio — and your future — to the next level.

MillionAcres is affiliated with the Motley Fool. The Motley Fool owns shares of and recommends Ryman Hospitality Properties, Stag Industrial, and The Howard Hughes. The Motley Fool recommends Vail Resorts.