Deal Details

Startup: World Tree

Instrument type: Purchase agreement

Round size: Up to $1 million

Share price: $1

Minimum investment: $1,000

Investment portal: Wefunder

Deadline to invest: April 3, 11:59 p.m. ET

Low-risk investments that provide interest payments of more than 5% are pretty rare. I should know. I specialized in finding them some 10 years ago. I found a lot I didn’t like and only a handful I was willing to invest in.

As for interest income above 10%? I found only a couple worthwhile investment opportunities there.

I was careful and proficient at what I did. And there wasn’t a whole lot to choose from.

That’s why World Tree – the remarkable startup I’m showing you today – has challenged my notions of what is possible in generating income streams. It will probably force you to re-examine yours too.

Of course, there is still some risk with World Tree. It’s not like investing in a 10-year U.S. government bond (which, by the way, isn’t as safe as you’ve been led to believe). But I was quite impressed with how low the risk is, especially for the unbelievably high gain you should get.

I certainly didn’t believe it… at least not at first. So I was extra careful in vetting this opportunity – triple-checking the facts and searching high and low for any possible risk.

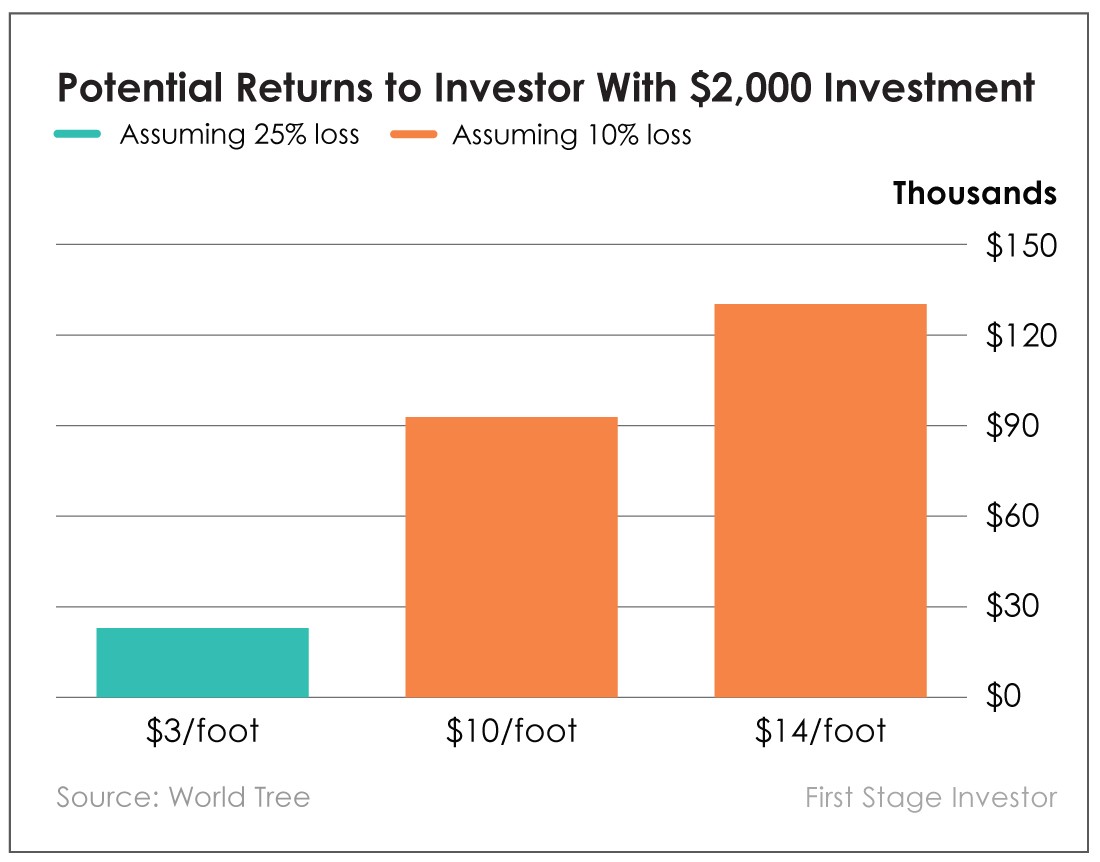

This is what happens when a company offers the equivalent of 30% annual compound interest for a 10-year period… as a worst-case scenario. Just imagine a $2,000 investment that will generate $23,153 in returns by year 10. It’s one of three scenarios the company says could happen. The other two would give even greater returns!

The investment opportunity itself is easy to understand. It starts with an extraordinary tree called the Empress Splendor.

Buy a Tree, Cut It Down, Make Money and Save the World

The Empress Splendor is the fastest-growing hardwood tree in the world. It can grow up to 20 feet in its first year. But there’s so much more to this tree.

An acre of Empress Splendors absorbs 103 tons of carbon dioxide a year (11 times more than any other tree). It also replenishes the soil and is noninvasive. One of the softer hardwoods, the Empress Splendor is as light as balsa, as strong as pine and is water resistant. It is also extremely buoyant and rot-resistant, and it acts as a good insulator.

Its unique properties give it a ready market. It can be used to make furniture, musical instruments, veneers, surfboards and sailboats, just to name a few.

Fast growth. Carbon-eating monster. Varied applications. All necessary ingredients for World Tree founder and CEO Wendy Burton to hatch a brilliant plan in which YOU play an important and extremely profitable role.

She wants to plant these trees all over North, Central and South America. Her team has already planted 1,000 trees. The goal is to plant 3.5 million more over the next five years.

For that to happen, World Tree needs farmers and money. So Wendy came up with a profit-sharing scheme to attract both.

Investors can finance planting a full acre with a $2,000 check (the minimum investment is $1,000). As an investor, you get 25% of the profits. Farmers get 50% (and get to keep the tree after 10 years for free). And World Tree gets 25%.

Everybody makes out incredibly well. Here’s the math. One 10-year-old acre generates 30,870 board feet. The revenue generated per board foot (after costs) ranges from $3 to $14. At $3 per board foot, that’s $92,610 in revenue. Your 25% share comes to $23,153. World Tree gets the same, per acre. And the farmers get double that amount.

Investors make an 11.6X return, if all goes according to plan. So what could go wrong?

Can the Empress Weather These Risks?

First, let’s examine the obvious risks inherent in any agriculture-related enterprise: weather and disease.

World Tree works with 100 farmers spread across the U.S., Canada, Costa Rica and Guatemala. It’s highly unlikely that an extreme weather event such as a drought would affect the entire Western Hemisphere. In this era of increasing extreme weather patterns, it’s possible that some growth could be affected.

Thanks to the Coriolis effect, Costa Rica is virtually immune to hurricanes. Hurricane Otto hit the country as a tropical storm in 2016. Before Otto, Costa Rica’s most recent hurricane was 1851. Hurricanes in Guatemala are rare as well. The last major storm was Hurricane Stan in 2005. Guatemala also has earthquakes. The biggest one in recent history was 1976, with a 7.5 magnitude.

As for disease, there is no known disease that affects the trees. There’s always a chance something infectious could crop up, but an exhaustive literature search turned up only caterpillars as an insect that could slow the trees’ growth.

World Tree also helps its farmers. A World Tree team visits farmers at planting time to train them on how to prepare the land and plant for the best results. It also provides feedback and advice throughout the years to keep everything on track.

As far as weather and disease go, the risks are minimal but can’t be ruled out entirely.

For this reason, the 30,870 board feet per acre I quoted above assumes a 25% tree loss. World Tree has several nurseries to address any such loss. Most losses occur when these trees are two years or younger and are at their most vulnerable. The company will replace them with trees kept in the nurseries for up to two years of growth.

I believe the 25% loss built into the company’s calculations is excessive. This is especially true when it’s combined with the $3 per board foot price (meaning price or revenue after costs for the purposes of this recommendation only). Current prices begin at $7 per board foot. The last price at which World Tree sold the lumber was $10.66 per board foot (to Fender Musical Instruments Corp.).

If we choose NOT to be ultraconservative and put the loss of trees at a more realistic 10% and raise the price to $10 per board foot (best-case price is $14, according to World Tree), we get more realistic results: 37,044 board feet times $10 is $370,440. Your 25% share comes to $92,610… on a $2,000 investment.

That’s a 46X gain. I consider $23,153 the approximate minimum return and $92,610 the approximate maximum return. That said, if your gains were to go above $100,000, I wouldn’t be surprised.

Timber Prices Expected to Rise

The biggest risk to the high end of this range isn’t weather or disease, but the market for lumber. What will lumber demand look like 10 years from now? The World Bank estimates that timber prices in 2030 will be roughly 10% to 25% greater than 2018 prices. The World Bank also predicts that demand for timber will quadruple by 2050. World Tree says it has a “waiting list” of buyers for its lumber.

Predicting commodity prices in general 10 years out is somewhat speculative. A global economic slowdown could depress prices. Oversupply could dampen prices too. These are circumstances that could drive the price of Empress Splendor timber down from the $10 to $14 per board foot range toward the $3 per board foot price. But again, that’s still an 11.6X return.

A Perfect Alignment

What makes this high return possible in a worst-case price scenario is the tree’s fast growth and the avoidance of upfront land and labor costs. These are typically the most expensive parts of timber investing. But this time, you as an investor do NOT have to front them.

This smart setup is the brainchild of Wendy, an unabashed Empress Splendor admirer who has been working with the tree for more than two decades. She heads a group of foresters with more than 30 years of experience growing trees for timber. The team is as solid as they come.

Each year, World Tree takes in a new pool (or season) of investors who receive year-specific units. For the purposes of this raise, it is issuing World Tree COP (carbon offset program) 2018 Units. (Previous investors are linked to their season of trees.)

Your shares (as a 2018 Unit holder) entitle you to share, on a pro rata basis, 25% of net profits of the trees planted in 2018 only. Please note that you are not getting equity in the company, as such. Your shares will be paid out in year 10, 2028, when the trees will be harvested. Again, that’s also when World Tree and the farmers will be paid too. The interests of all three parties are perfectly aligned. World Tree has a vested interest in making sure its farmers are successful.

How to Invest

World Tree is raising up to $1 million in this round of funding on Wefunder. You’ll need to sign up for an account there if you haven’t yet.

Once you’re signed in to Wefunder, head over to the World Tree page. Now enter the amount you want to invest and click the green “Invest” button on the right-hand side of the screen. The minimum on this deal is $1,000.

Risks

All early-stage investments are risky. While this one has substantial traction and a very reasonable valuation, you can still lose your investment. As always, don’t invest money you can’t afford to lose. You should expect to hold on to this investment for 10 years.

Good investing,

Andy Gordon

Co-Founder, First Stage Investor