My first and last surgery was a couple of years ago. I’m glad I didn’t know then what I know now. My surgeon told me the risks were low and a favorable outcome was high. He didn’t mention that he’d be using instruments that would burn or at least char my flesh. He also didn’t say, “Oh, by the way, a fire might break out.”

If he did, I’m not sure I would have believed him. I mean, this is something I saw on “The Nick,” a terrific HBO series that explores the crazy and experimental nature of surgical practices at the turn of the 20th century in New York City. One episode showed a rudimentary vacuum cleaner — repurposed from rug cleaning to vacuuming up blood — short-circuiting during a surgery. In short order, the surgeon’s beard caught fire, then the patient caught fire. A bucket of water was quickly thrown on the patient. He was immediately electrocuted.

I have no doubt stuff like that happened 110 years ago. I had no idea it could still happen today.

Your Surgeon’s Dirty Little Secret

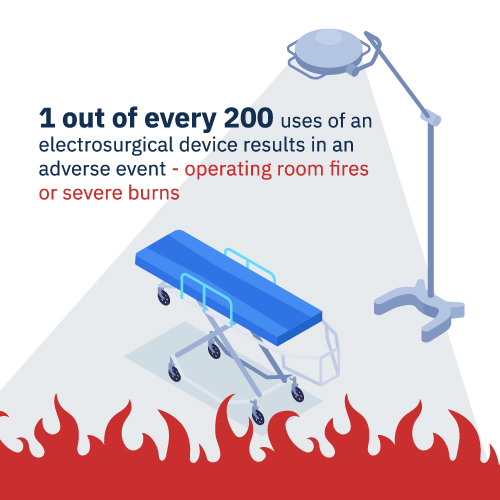

But it does. Alarmingly, one out of every 200 uses of an electrosurgical device results in an adverse event — such as operating room fires or severe burns — due to electric currents being used to cut or cauterize human tissue.

There are two ways of looking at this. One way is that this is no big deal. If your immediate family and friends are under 40 (and assuming each goes under the knife at least once), there’s less than a 20% chance that something like this will happen to one of them. A lot of people can live with those odds.

But there’s another way of looking at it: This is a huge global problem. There are 410 million annual surgical procedures worldwide. And the vast majority of completed surgeries — 89%, to be precise — employ electrosurgical devices. That amounts to 365 million surgeries. Plug in one out of every 200 surgeries and you get 1.8 million patients every year getting exposed to the kind of danger you thought only firemen had to worry about.

A Safer and More Precise Solution

Let’s not beat around the bush here. In this day and age — with medical technology advancing on hundreds of fronts — this should absolutely not be a problem. And thanks to a startup called Novuson Surgical (and advances in transducer technology), it doesn’t have to be.

Novuson uses high intensity focused ultrasound (in medical jargon, it’s called “therapeutic ultrasound”) instead of electrical currents for vessel and organ sealing and dividing in addition to bleeding control (“hemostasis” is the medical term). Novuson’s award-winning technology is lightyears safer and more precise (in cutting and sealing) than current technology. Hospitals and insurance companies will love it because it leads to better outcomes, reduces the need for “re-operative” surgeries and should cut down on lawsuits.

Novuson’s surgical device

Surgeons should like it too. They won’t be catching on fire — and neither will their patients. Novuson’s devices will be used in the same way and for similar procedures as current devices. Surgeons, however, will have to make one key adjustment. Today, they usually look for smoke, burning and charring to indicate when a treatment is complete. Novuson’s technology avoids those harmful effects. Surgeons will need to adjust to the clean, smoke-free performance of Novuson’s technology. Not a big ask, in my opinion!

The market opportunity is huge and there for the taking. The global market is dominated by two companies. Novuson has rendered their technology — which causes smoke, charring, and thermal damage to tissue — outdated and unacceptably dangerous. The problem is vast. These two companies supply 98% of the global market. And until now, there was no alternative. Novuson is aiming to fill that gigantic hole.

Novuson’s two competitors have sort of tried to improve their technology (but not really). One has developed a smoke evacuator (and it’s the company’s second biggest revenue generator!). It’s unbelievable that that’s the best they can do. It’s like building a leaky boat and giving customers pumps to use when the boat fills up with water.

These companies really need to try harder. Failing that, their only alternative would be acquiring Novuson’s technology. While it won’t come cheap, that scenario is far more likely than the first. As a matter of fact, the company that makes hundreds of millions of dollars a year from its ancient cutting devices and smoke evacuators is very interested in Novuson’s technology.

Novuson founder and CEO Stuart Mitchell says he’s talked to the company. “They’ve expressed interest in making us an offer a little bit down the road,” he adds.

A Pathway to Unicorn Status

Would Stuart bite?

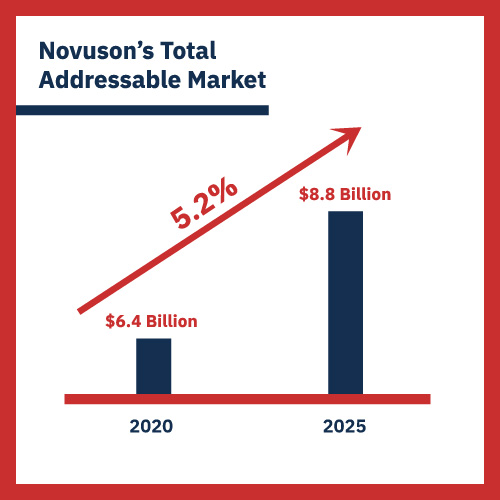

His response: “And turn our back on an $8.8 billion market when we believe we can capture a large piece of it?”

“Let me put it this way,” Stuart says. “The price would have to reflect the enormous market opportunity we’d be giving up. I don’t know what that exact number would be, but it would have to be a very hefty number. FDA approval is right around the corner for two of our four products. We’re the future. Those other two companies represent the past. Even the CDC has recommended that surgeons should not use their devices!”

If Novuson captures just 2% of that $8.8 billion market — $176 million a year in sales — it’s likely to become a unicorn. It just goes up from there. This is what Stuart is referring to when he talks about the “enormous market opportunity.” There’s no other company — legacy or startup — that is going down this path. Competition poses no risk.

Rather, the risk comes from technology, regulations and sales. The company has patents and prototypes, but prototypes don’t always seamlessly segue into mass production. Stuart assures me the products aren’t hard to make and there are dozens of contract manufacturers capable of making them. Nonetheless, Novuson is still in the pre-production stage. And validation studies still need to be done. There’s a modicum of tech risk here.

The same goes for regulatory risk. There are safety and efficacy requirements to meet. But the tech should pass with flying colors. Funding FDA approvals for its two products — a submission later this year and a second one next year — will cost Novuson about $300,000. That should not be a big problem.

That leaves sales and marketing. As much as Novuson’s technology is needed (and preferred), the products won’t sell themselves. Stuart is targeting the more than 3,500 independently owned ambulatory surgical centers, where he has an extensive network and doesn’t face the red tape accompanying hospital procurement. That said, ramp-up won’t happen overnight. But he’s aiming for $12 million in sales by 2025 and $62 million the following year.

Three More Drivers of Growth

Any revenue projections that are more than a couple of years into the future should be taken with a grain of salt. That said, we need to consider these three semi-hidden growth drivers.

- Stuart’s figures do not include distribution agreements, which Novuson will rely on to expand its global sales. Domestically, he’ll use distributors to market to hospitals. That’s not included either.

- Novuson’s pending deals with China will generate a separate but sizable revenue stream that includes R&D collaboration and licensing agreements. Stuart is in discussions with two Chinese companies. Both would also welcome a chance to invest several million dollars in Novuson. Oddly, it makes this current raise redundant. Novuson is doing it to basically finance its two 510(k) FDA submissions. Chinese money is about to take care of that. As investors looking for exceptional deals, we’re lucky this raise is available to us. If the Chinese deal came together a moment sooner, we’d be out of luck.

- Among Novuson’s numerous positive signals, we cannot lose sight of the fact that it has a razorblade business model. Novuson’s tech will come in the form of an energy console with six handsets that will need to be replaced every month. Instead of one-off transactions, Novuson will steadily build its monthly revenue stream. And the technology is good enough that hospitals will want to keep buying it. As an investor, I’m a big believer that the best and fastest-growing income is recurring income.

With more money about to flow into the company’s coffers, Stuart will have the means to bring the company home. With more than 20 years of experience in biomedical technology development and business, Stuart has the skill set to make it happen. As it reaches the cusp of generating serious revenue, Novuson will need his high level of execution.

Everything I know of his past leadership and everything I learned from a couple of long chats with him indicates that he can help realize the company’s vast potential.

Deal Details

Startup: Novuson Surgical Inc.

Security type: Common stock

Offering Maximum: $1.07 million

Valuation: $24.8 million

Price per share: $0.64

Minimum investment: $256.00

Where to invest: StartEngine

Deadline: June 29, 2022

How to Invest

Novuson is raising up to $1.07 million on StartEngine. If you don’t already have a StartEngine account, you can sign up for one here. Once you’re logged in to StartEngine, go to the Novuson deal page. Then click the green “Invest Now” button. Enter the amount you want to invest, starting as low as $256, and proceed through the required steps. Be sure your investment is confirmed, then you’re good to go.

Risks

This opportunity, like all early-stage investments, is risky. Early stage investments often fail. Novuson might need to raise another round of funding in a year or two, if not sooner. If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early stage companies.

The investment you’re making is NOT liquid. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe Novuson offers an attractive risk-reward ratio.