The five most exciting future markets are, in no particular order, robotics, medtech, fintech, energy and space/aerospace. But only one of them is harboring a big ugly secret.

And that’s the space market.

Imagine the FDA allowing companies to avoid listing harmful side effects on their drug labels… the Department of Transportation greenlighting autonomous vehicles with software that can’t identify engine problems… or the Federal Aviation Administration (FAA) not enforcing the use of black boxes on airplanes.

Welcome to the incredibly flawed and dangerous space industry of today. And it’s all the more dangerous because it’s primed for rapid growth as payloads become cheaper and faster. The government dominated this space for the past 60 years. Now it’s the private sector’s turn. And in this global and entrepreneurial “new space” market, private companies are creating efficiencies that NASA could only dream of.

Tens of thousands of spacecraft have been launched into space. But no rockets in the past or present fly with a black box.They do have data acquisition systems (DAQs). But these DAQs fall well short of what black boxes do.

DAQs gather data generated by the vehicle’s many sensors. But they could stop transmitting well before an event that causes an accident or explosion.

It’s a dangerous situation. And as long as it continues, it threatens the space industry’s promising future.

Right now, legacy space companies are building their own DAQs. It’s expensive, and they all build to different specifications. And these DAQs have limited ability to capture last-second data and survive crashes.

It’s worse for smaller companies. They can’t use the legacy black boxes that planes use. Airplanes typically have two black boxes located in the back of the plane (though the location varies by craft) — this is meant to increase the black boxes’ chances of surviving a crash. But this practice doesn’t work for spacecraft. Falling from much greater heights significantly reduces these boxes’ chances of surviving an impact on earth. And if they do, they’re very hard to find. These smaller companies end up cobbling together a DAQ from off-the-shelf equipment and parts.

The current situation is a slapdash mess. But it’s a mess largely hidden from the public. For them, this is, well… a big black box.

The government, though, is painfully aware of what’s going on. And it’s also aware that the longer this problem goes unaddressed, the more likely it will bite the government in the backside. An accident will happen. Lives could be lost. Investigators wouldn’t have a clue as to cause or liability.

And insurance companies would be scrambling to figure out what happened without the information they need. [Geek Note: No finding of fault is needed for “earth to space” damages. It’s governed by international treaty. Liability is borne by the “launching state.” U.S. law requires launching companies to carry insurance that indemnifies the U.S. government for damages in such cases. For “space to space” damages (like one satellite crashing into another), fault does matter.]

The government is tempting fate here. And it knows it. Which is why the Federal Aviation Administration, the Office of Commercial Space Transportation, the Space Force, the Air Force and others have finally begun discussing new space regulations.

An instrumental part of those regulations would be requiring black boxes specifically designed for spacecraft. Right now, only one company is developing the requisite technology — a small high-tech company aptly called Immortal Data.

Immortal Data anticipates regulators will make black boxes mandatory for spacecraft in the near future, in line with existing practice in aviation, maritime, and road transport.

I love regulation plays. And this is one of the better ones I’ve seen. I couldn’t agree more with Immortal Data’s assessment that “regulating space practice in line with other environments is already U.S. policy; extending black box requirements would just be an implementation of that policy.”

It’s not only in the government’s interests to develop a regulatory regime that fits the needs of the new space market — it’s in the private sector’s interests too. Space underwriters have begun working with private space companies (and NASA/FAA) to create insurance products that address the risks they face when it comes to human flight. Many insurance companies will insist that their clients use black boxes. And the premium for those that do, says Immortal Data, will be much less.

Immortal Data is in a terrific position to take advantage of the changing spacescape. It’s made substantial progress on both technological and regulatory fronts. It’s developing black boxes that are smaller than computer mice, heavily fortified and extremely intelligent. They are, essentially, modified smartphone devices that monitor, capture, store and safeguard data and inter-module communications. Its signature “ShipsStore” product accumulates and stores sensor data in real time.

The “real time” is key. Just a couple of seconds of lag time could mean the difference between knowing and not knowing what happened just before an explosion or accident (and why it happened).

Now, remember when I said that only two legacy black boxes go into airplanes? Immortal Data is going to make it possible and affordable to use, say, 500 sensors and 100 ShipsStore units on a space flight.

In case of a catastrophic event, all you need is to recover one ShipsStore unit to reconstruct the data from all the sensors.

5 Reasons to Like Regulation Plays

So here’s why I like regulation plays and why I really like this one in particular…

- They’re predictable. Regulations are often more predictable than fickle market forces.

- The demand ramp is explosive. These companies often grow exponentially. Market-driven hyper-growth can’t come close.

- They’re must-haves. If we assume serious enforcement, regulation plays are must-haves by definition. Must-haves are a much more powerful driver of demand than nice-to-haves. And regulation-driven must-haves are stronger drivers than market-driven must-haves (where choice is limited but still present). Companies like United Launch Alliance, SpaceX and Virgin Galactic will have no choice but to turn to Immortal Data to comply with the new regulatory environment.

- Black holes in demand beget black holes in supply. While demand ramps up quickly once new regulations are issued, it can take a while for companies to provide the supply. Companies simply have a hard time preparing products when demand for them is literally zero under the old regulatory regime. As far as I know, Immortal Data is the only company taking this journey. As a result, it’s light years ahead of any other company developing black boxes for space.

- Product-regulation fit is more attainable than product-market fit. A big goal of most startups is to achieve product-market fit. If you want to sell your product, you need to make what the market wants. But figuring that out isn’t always easy.

Meeting the specifications of new regulations is much more cut and dry. Either you meet them or you don’t. They don’t change from year to year. Regulations, unlike demand, don’t go off in unexpected directions.

Product-regulation fit is easier as long as you’re plugged into the network of government players that shape the regulations.

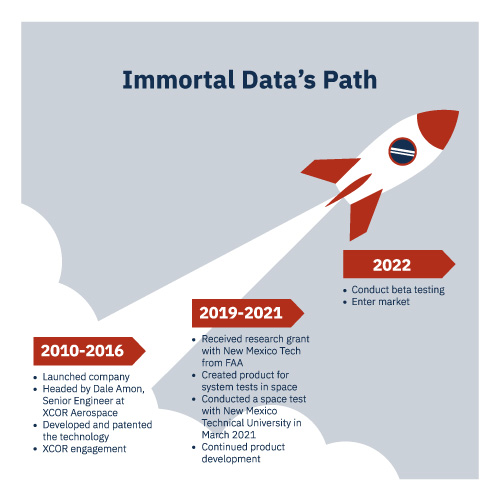

Immortal Data is not only plugged in, but in important respects it’s leading the charge. Its CEO, Dale Amon, has been working on this technology since 2010. He foresaw the needs of “new space” before practically anyone else. Immortal Data’s chief regulatory officer, James Bennett, is a Space Fellow at the Economic Policy Centre in London. He helped write modern aerospace regulations. And it looks like he’ll be doing it again.

This time around, he’ll be wielding his considerable influence to make sure that the new regulations take advantage of Immortal Data’s technological strengths.

Immortal Data has been awarded FAA grants in the past, thanks to the government’s high regard for its technology. Dale and James fully expect more grants to be forthcoming. The next one is already in the bag. It’s to help fund Immortal Data’s suborbital flight test later this year.

Immortal Data will continue to prod the government toward adopting badly needed black box regulations. And it will continue to test its black box products. The two timelines are roughly in sync. New regulations are still a few years away, as is a fully tested and certified space fight black box.

In the meantime, the company will begin selling its products this summer. There will be plenty of consulting opportunities and non-space flight use cases for its products, such as ground-testing and pre-launch development testing.

As an investor, this is what you need to know…

When (and NOT “if”) these new regulations are issued, it’s highly likely that Immortal Data will be the only company with patent-protected products that fully comply with them.

Worst case scenario, somehow another company has also developed a compliant new black box. In a market that is not winner-take-all, that’s okay. Immortal Data would still be on track for a huge payday.

And that’s our regulation play in a nutshell.

Deal Details

Startup: Immortal Data

Security type: Common stock

Round size: Up to $1.07 million

Share price: $4.00

Valuation: $10,004,000

Minimum investment: $100

Investment portal: Netcapital

Deadline: April 1, 2022

How to Invest

Go to the Immortal Data investment page on Netcapital.com. If you don’t have an account on Netcapital, you’ll be prompted to create one. Then follow the steps and fill out the required information. It shouldn’t take more than a few minutes. Then click on the yellow “Invest” button.

Now choose the payment method that works best for you to transfer the funds. Your money will be held by an escrow agent until the deal closes, when it will be transferred to Immortal Data, and you will officially own a piece of this exciting, innovative space technology company.

Risks

This opportunity, like all early-stage investments, is risky. Early-stage investments often fail. Immortal Data might need to raise another round of funding in a year or two, if not sooner.

If it executes well, this shouldn’t be a problem. But that’s a risk worth considering when investing in early-stage companies. The investment you’re making is NOT liquid. However, Netcapital does allow secondary trading on its portal after a holding period of one year for retail investors. It might be less for accredited investors. Expect to hold your position for five to 10 years. An earlier exit is always possible but should not be expected.

All that said, I believe Immortal Data offers an attractive risk-reward ratio.