Editor’s Note: This recommendation was co-authored by KingsCrowd Investment Research Manager Francis Vu.

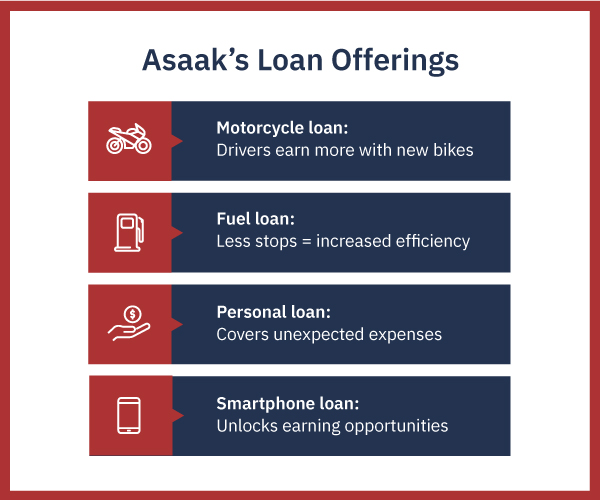

Asaak — the company I’m introducing to you today — immediately intrigued me. As a Uganda-based fintech company, it’s very different from other startups I’ve shared with you. Asaak provides asset financing and other financial services for budding entrepreneurs in Africa. More specifically, it currently provides boda boda (bicycle or motorcycle taxi) loans, fuel loans, and smartphone loans to unbanked entrepreneurs, with more types of loans planned for the future. Its loans are small, averaging $1,500. Asaak charges around 30% interest, which is normal for Africa.

So why does Asaak grab my attention?

For one thing, I like fintech. The financial industry has resisted change for a long time. It’s easy pickings for companies with innovative technologies and more customer-centric business models.

Companies focused on developing countries also appeal to me. They have the opportunity to engage in basic infrastructure building — financial and otherwise — that happened decades ago in the West. There’s simply more to do in these countries. The opportunities are bigger, and the potential upside that comes with success is also much greater.

Helping smaller companies and small business owners is classic startup territory in the U.S. and Europe. But it’s become increasingly picked over and competitive. It’s a different story in developing countries, though. The markets there are wide open. The problems they face are more urgent because they’ve been neglected for so long. And entrepreneurship is finally gaining a much wider foothold in Africa, fueling rapid growth of the middle class. The market for both business and personal financial services is on the upswing. And it’s just the early phase of what should be a multi-decade trend.

Off-the-Charts Traction

Asaak has significantly grown its loan count, team, and revenue since its last campaign ended in April 2021. Asaak saw a more than 550% boost in the amount of loans disbursed (from 1,328 to 8,722). Its employee count increased by more than 380% (from 23 to 112). And revenue shot up by more than 1,320% (from $201,207 to $2.9 million).

The company also boasts a lifetime value (LTV) to customer acquisition cost (CAC) ratio of 120. An LTV to CAC of three is normally considered good (but feel free to take four as an acceptable minimum, as I do). So 120 is off the charts. I don’t think I’ve ever seen this metric at anything approaching this level before.

Lastly, Asaak’s traction is only scratching the surface. In Francis’ conversations with Kaivan Sattar, the founder and CEO of Asaak, Kaivan indicated that Asaak plans to expand beyond Uganda to Kenya — one of Africa’s largest markets.

Asaak’s presence in Uganda (and most likely Kenya in the coming months) is coming during a time in which fintech startups comprise nearly half of all tech startups in Africa. The explosion of startups in Africa — and fintech startups in particular — is driven by a market that’s poised to capitalize on Africa’s rapidly growing middle class.

While Asaak isn’t the first fintech startup to provide asset financing, it does asset financing and other financial services much better than its closest competitors, Tugende and Watu Africa. Asaak has an industry-leading 95% repayment rate on its loans, and those loans are repaid daily. Daily repayments are pretty much what they sound like — loan payments that are made on a daily basis, generally with higher interest rates than long-term loans. Smaller daily payments are generally more manageable for borrowers, which reduces risk for Asaak. And since Asaak receives payments on a frequent basis, the company has more evenly distributed cash flow it can use to fund more short-term loans for future borrowers.

Additionally, Asaak is way more efficient than its competitors. It’s disbursing millions in loan volume on an eighth of the manpower. Asaak is setting a good precedent for itself — high productivity with minimal overhead cost is ideal. If the company manages to keep this up as it expands, investors can expect Asaak’s impressive traction to continue. It could very well become an industry leader, especially since this isn’t a winner-take-all market.

Serving the Underserved

Asaak is attacking a market that is not only underserved but also growing rapidly. During the past three decades, Africa’s middle class has tripled to 313 million people. Reports indicate that 57% of Sub-Saharan Africans are unbanked.

Africa also boasts the world’s top entrepreneurship rate — 22% of the working-age population. Putting the three together, it’s clear that Asaak’s target customer base makes up a good chunk of the African population — and it’s likely to keep growing.

With Africa’s expanding middle class, increasing presence on the international stage, and large unbanked population, Africa’s growth path reminds me of China’s more than 20 years ago, India’s more than 10 years ago, or parts of Southeast Asia’s today. While each of those geographies still represents large opportunities, Africa has far greater untapped potential today. And as a company catering to that underserved and ballooning market brimming with possibilities, Asaak’s potential is just as great.

Quick Math

The math on Asaak is quite simple. While a $50 million valuation cap seems rich, the company has a revenue run rate of about $3.7 million, resulting in a 13.5x valuation multiple.

Fintech multiples are some of the highest out there due to how popular fintech companies are. The median multiple of publicly traded fintech companies is 12.2x. Considering Asaak is an early stage fintech company that has already disbursed more than 8,700 loans, it’s remarkable that its multiple on the current round is only slightly higher.

Lessons From Africa

Doing business in Africa can’t be easy. Apart from having some of my employees do a couple of road reconstruction demos in Africa a long time ago (when I founded and ran a company based in Indonesia with tentacles reaching beyond Asia), I can’t claim meaningful experience running a business in Africa.

But I do have lots of hard-earned experience doing business in developing countries. And let me tell you, it’s tough — mainly because it’s not intuitive in so many respects. What often works in the U.S. doesn’t necessarily work in emerging countries (and, for what it’s worth, vice versa).

Here’s a startup corollary to that rule: Founders who have the instincts and skills to succeed in the U.S. won’t necessarily succeed in developing countries.

And that brings us to Kaivan Sattar and Asaak Chief Business Officer Dylan Terrill. Asaak is the realization of Kaivan’s lifelong interest in the unbanked. While in college, he conducted field research in Africa and the subcontinent on how the poor save and borrow money without access to banks. He served as a data scientist at LendingHome and a quantitative specialist at the Federal Reserve. I didn’t get to talk to Kaivan, which is fine with me. It probably would have been way over my head.

But I did talk to Dylan, who was an early employee at TikTok, DoorDash, and LendingHome. We talked about the challenges of running an Africa-based business. He told me how he and Kaivan went about mitigating risk in Africa. Here’s one way: Become a high-volume lender of very small loans.

He also explained how they will maintain upside by extending their financial services from the business side to the personal and consumer side (in addition to expanding into other countries).

The team has done a nice job of steadily expanding its financing services in Uganda. But the achievement that significantly bolstered my confidence in the company is its partnership with the Standard Bank Group. With $172.9 billion in assets as of June 2022, Standard Bank Group is the largest bank in Africa.

Early in 2022, Asaak entered into an exclusive partnership with Standard Bank Group to finance and provide insurance for a portfolio of Asaak’s motorcycle loans.

Critically, Standard Bank Group, along with another financing company, provides Asaak with more than $20 million in revolving credit. Beyond financing, Asaak and Standard Bank Group work together to create products and services — including digital banking services and financing — for a customer base that Standard Bank Group hasn’t targeted before: the middle class. (Before, its lineup of financial services did not even come close to addressing the needs of Africa’s poorer and burgeoning middle-class customers.)

It’s highly unusual — especially for such an early stage startup — to work hand-in-glove with a powerful legacy company. In this case, it works for both parties. Standard Bank Group reaches a customer segment outside of its traditional universe of customers. Asaak gets instant credibility and — just as important — access to capital. Financial risk is lowered. And it gives Asaak a wide range of choices in how it will integrate its own financial offerings in savings, insurance, and investment products with Standard Bank Group’s.

Startups usually try to disrupt their legacy counterparts with great relish. But this is one of those cases where it makes sense for both parties to join forces rather than compete against each other. Asaak’s competitors don’t enjoy the benefits of a powerful partner. Nor do they have the operational advantages Asaak has through the use of its technology and ever-growing customer database.

On top of Standard Bank Group, Asaak has also partnered with three of the four largest mobility companies in Africa to provide their drivers with financial services: Bolt, Jumia, and SafeBoda. While not as rare, these relationships are definitely reassuring. They help secure Asaak’s access to a steady stream of business — and, by extension, revenue.

A Unicorn on the Horizon

Asaak has put itself in an enviable position to expand and prosper across Africa in a fairly wide-open market. It needs only about 200,000 active borrowers to generate roughly $100 million in revenue (at the company’s historical rate of making $500 per loan).

For a company that’s aiming to eventually become a Pan-African company, that shouldn’t be that hard to do. Roughly 200,000 borrowers is far less than 0.1% of Africa’s middle class population. Asaak is aiming for a much higher penetration rate than that.

But it does mean that the company doesn’t have to be in every single country in Africa to flourish. And it also gives its valuation a little cushion. Asaak doesn’t have to maintain the publicly traded average fintech revenue multiple of 12.2x or its own current 13.5x revenue multiple to reach unicorn status. At $100 million in revenue, its multiple can dip down as low as 10x and still reach $1 billion. Even taking dilution into account, current investors would get at least a 10x return.

While this is back-of-the-envelope math, at the very least it suggests an achievable path to unicorn status, especially when you take into account that Asaak has already done much to pull ahead of Africa’s fintech pack. As such, Asaak presents us with an unusually appealing investment opportunity.

Deal Details

Startup: Asaak

Security type: Crowd SAFE

Valuation cap: $50 million

Minimum investment: $150

Where to invest: Republic

Deadline: January 28, 2023

How to Invest

Asaak is raising capital on Republic. If you don’t already have an account with Republic, you can sign up here.

Once you’re logged in, visit the Asaak raise page. Be sure to review the Asaak deal page and offering documents thoroughly before making an investment. When you’re ready, click the blue “Invest in Asaak” button. Enter in the amount you want to invest, starting as low as $150, and then move through the required steps. Make sure that your investment is confirmed, and then you’re good to go.

Risk

Startup investing is inherently risky, and startup investors should expect to hold their investments without liquidity for five to 10 years. Never invest more money than you can afford to lose.