Crypto Market Musings

I’m not ready to start singing “Happy Days Are Here Again” (the Annette Hanshaw version, NOT the inferior Carole King or Barbra Streisand versions). But I am starting to hum Bobby McFerrin’s “Don’t Worry Be Happy.”

The Federal Reserve raised its target interest rate by 25 basis points Wednesday. That’s the smallest rate hike since a similar 25 basis point increase last March. And it’s the first sign we’ve seen that the Fed believes inflation is headed in the right direction.

The modest rate hike came, as I had predicted, with hawkish talk about how the Fed would be willing to take more aggressive action again if inflation doesn’t slow down quickly enough. That’s a smart move. Data needs to dictate the Fed’s decisions. And if inflation looks like it’s becoming problematic again, it needs the flexibility to raise rates more aggressively.

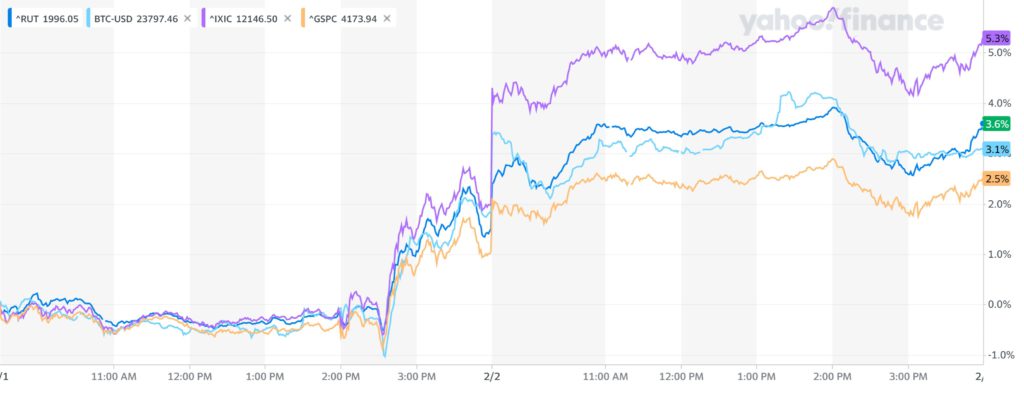

But investors and traders ignored the warning and acted as if the Fed would be more interested in jump-starting the economy than keeping inflation in check. Since Wednesday, the S&P 500 is up 2.5%, the Nasdaq Composite is up 5.3%, the Russell 2000 is up 3.6%, and bitcoin is up 3.1%.

As long as inflation continues to trend downward, the markets will gradually rebound. But if the Fed gets any signals or data that inflation is on the rise — or could be on the rise — it will raise rates. That will slow down the economy. And the markets will go down as well.

Bitcoin (and crypto) will likely move up or down based on the inflation data. So as long as inflation continues to fall, investors should be in decent shape.

What Vin Is Thinking About

Inflation is a lot like COVID. It’s a persistent enemy. Just when you think you’ve got it under control, it comes back with a vengeance and knocks you down again. The U.S. learned this lesson the hard way in the late ‘70s and early ‘80s.

Inflation was out of control back then. It was so bad that more than 50% of the country said inflation was the biggest problem in the country according to a Gallup poll. By comparison, only 15% of people in January told Gallup that inflation was the biggest problem facing the country.

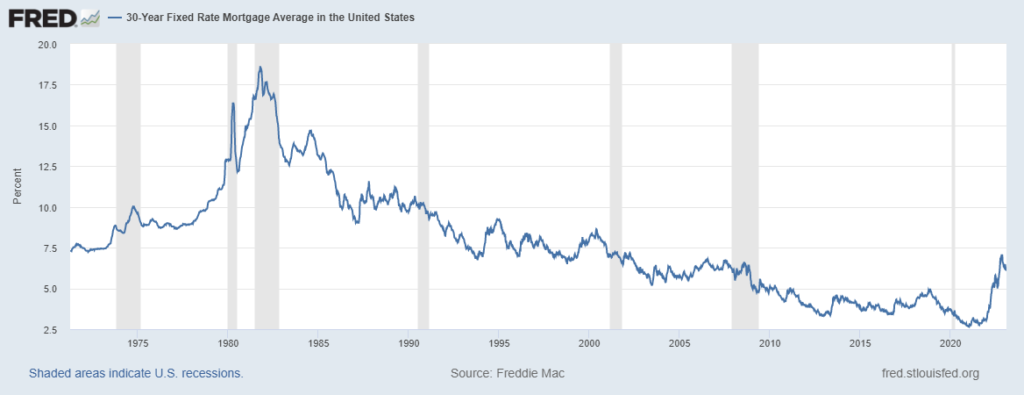

This was the second time in a decade that Americans faced double-digit inflation rates. So the Fed declared war on inflation. A recession hit. Mortgage rates topped 16%. (You can see the spike in the chart below.) Unemployment topped 7%. And when it looked like things were under control, the Fed began easing rates.

But despite the Fed’s strong action, inflation proved to be stubborn. The New York Times‘ outline on the events is illustrative.

The effective Fed funds rate reached 19.39 percent in April 1980, only to fall to 11 percent in May and 9 percent in July. The Fed had to reverse course in September. By January 1981, with inflation surging, the Fed funds rate was again above 19 percent.

The Fed’s rate hikes had devastating consequences. Another recession began. Unemployment rates soared to 10% and mortgage rates climbed to 19%.

Eventually, the Fed’s rate hikes worked. Inflation fell, leading to one of the longest periods of growth in American history. There have been some hiccups along the way, but it can be argued that roots of the incredibly strong economy we’ve seen for almost 40 years now can be traced back to the Fed’s rate hikes in the early ‘80s.

Right now, the Fed funds rate ranges from 4.5% to 4.75%. But the last thing the Fed wants to do is lower rates too quickly and see inflation return like it did in 1980. If the Fed has to choose between preventing a recession or curbing inflation, it will opt to fight inflation.

That’s why inflation holds the key to how the economy and markets will perform this year. If inflation is under control, investor confidence will return. If inflation surges again, the Fed will raise rates again, the markets will likely tumble — and a recession becomes a near certainty.

And Finally…

People can play Doom on the bitcoin blockchain now. You won’t find me doing it. I played Doom in college when it first came out, before most people had even heard of it. The game has a special place in my heart. And I don’t want to ruin it. But if you’re interested in playing Doom on the bitcoin network, have at it. And let me know how it goes on Twitter (@vinistic).