Deloitte has been busy feeding the negative blockchain news cycle.

It recently published the results of a survey of more than 1,000 “blockchain savvy” managers. The survey found 40% of them were “wary” of blockchain’s efficacy. In the U.S., 44% were skeptical.

Two years ago, only 34% expressed skepticism.

It gets worse. In the U.S., 30% said they still lacked a “compelling application” to justify implementation [of a proposed blockchain project, presumably].

On the face of it, this is not good news for blockchain enthusiasts. (Let’s put cryptocurrency to the side. This is about the future of the underlying technology.)

It doesn’t make much sense to me.

In the past two years, blockchain technology has made huge strides. There are more blockchain use cases being tested than ever before. Companies have the choice of joining consortia like R3 and Hyperledger that are making significant progress in developing and testing blockchain technology.

From TradeLens, the IBM-Maersk blockchain venture, cutting global shipping times by 40% and having 94 partners to the World Bank issuing a blockchain-only bond (“bond-i”), there are dozens of examples of live use cases.

The list goes on and on. Stock markets are being put on the blockchain. Property, produce and invoices are too.

Skepticism should be shrinking, not growing.

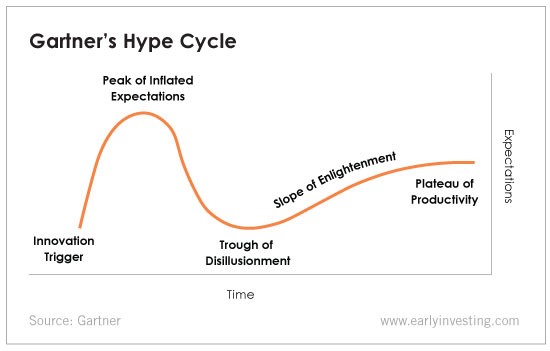

It doesn’t make sense, unless you consider Gartner’s “Hype Cycle.”

Then it makes perfect sense.

So what is the Hype Cycle and how does it work?

It has five different stages…

- Innovation Trigger: A potentially transformative technology generates strong media interest and proof-of-concept stories. But most viable products are years away. Tech-savvy individuals and true believers understand this. Practically everybody else doesn’t.

- Peak of Inflated Expectations: Reports of a few success stories push expectations higher. Patience begins to run thin. Failures are common but less publicized.

- Trough of Disillusionment: A more sober reality sets in. Beta tests either fail outright or fail to generate mass adoption. Weaker companies fail. Investment continues at a slower pace and is contingent on meeting more stringent standards.

- Slope of Enlightenment: The technology enters the mainstream and its benefits are more widely understood. Better second- and third-generation products are developed. Funding for pilot projects is easier to obtain, but many companies remain cautious.

- Plateau of Productivity: Mainstream adoption arrives. Criteria for assessing use cases are clearer. The technology’s applicability and relevance becomes self-evident.

This is how the five stages are visualized…

So where is blockchain technology on this chart?

It’s not quite halfway down the decline from the Peak of Inflated Expectations to the Trough of Disillusionment.

Gartner says blockchain technology is still five to 10 years away from reaching mainstream adoption.

That sounds about right. But if you’re willing to invest early, there are big returns out there.

Here are some other things you should consider…

- I’ve said it before and I’ll say it again: Early investing typically requires a two- to 10-year wait before you see returns. If this sounds like a lot of time, it’s because it is a lot of time! But keep in mind that this is how you reap huge financial rewards.

- Early investing also requires taking on more risk. Sentiment in the “Trough of Disillusionment” is bearish and negative, as its name would suggest. So technology risk – while real – seems bigger than it is.

- As an early investor, you will have more losers than winners. But taking a deep dive into the technology and use cases at this early point will reduce your number of losers.

You can always wait for a blockchain technology to mature and deliver more tangible value. But the price for those blockchain technologies will be much higher than it is now.

The choice is yours, of course. Gartner’s Hype Cycle gives you a useful context to make smarter choices and better understand the interplay of risk and reward.

With that said, Adam and I are big believers in investing ahead of the crowd… before the Slope of Enlightenment attracts investors looking more for safety than an edge.