Dear First Stage Investor Member,

Welcome to issue No. 4 of First Stage Investor.

We’d like to start this month’s letter by addressing some feedback from members.

We got quite a few emails this month, so let’s tackle those first.

Question No. 1: “How do I make money from investments like these?”

Investing in seed-stage private companies is quite different from making a stock market buy.

Your shares may not become “liquid” for years, meaning you shouldn’t expect to have an opportunity to sell anytime soon.

Here are the most common “exit scenarios” to expect from early stage investments.

- IPO: This is usually the best outcome, but it takes five-plus years to get there.

- Acquisition: The company is acquired. (Outcomes vary, but usually it’s a shorter wait and can be excellent.)

- Fail: The company liquidates, returning some or none of the capital to investors.

- Small but profitable: In some cases, a company may return capital in the form of dividends.

Coming Soon: “Secondary Market” Exchanges

In the near future, it is almost certain that “secondary market” exchanges will develop.

These new markets will allow investors to buy and sell startup shares (subject to holding period requirements).

In fact, we’ve talked with equity crowdfunding portals that are currently building their own exchanges. Mike Norman, co-founder of Wefunder.com, recently told me that the Wefunder exchange probably won’t launch until the end of 2017 or early 2018.

So for now, selling equity crowdfunding shares is not an option.

And even when it is, think carefully before you sell. A 3X gain, for example, may seem like a reasonable profit to take.

However, that’s not how successful venture capital firms and angels do things. They hold on to investments for the long run and double down on the winners.

Furthermore, most people are not good market timers. So trying to time buys and sells (for most people) is counterproductive.

Almost everyone would be better off if they simply held on to their portfolio holdings.

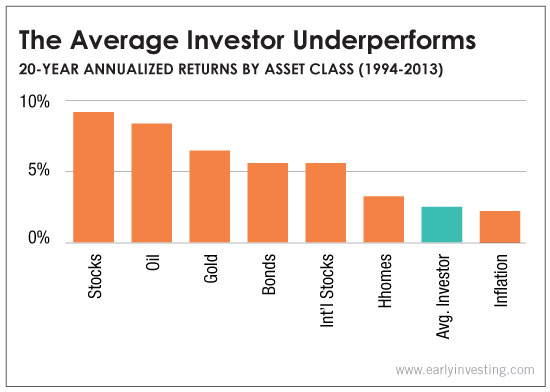

This can be seen clearly in a major study conducted by financial giant BlackRock. The study found that the average investor made only 2.5% per year on average (from 1994 to 2013). The reason for that disappointing number is people tend to buy high and sell low.

The same is true in startup investing. So before you get too excited about cashing out some early gains, consider that your best course of action may be to simply hold your shares.

We cover this important issue in more detail here.

Question No. 2: What’s the deal with “preferred shares”?

When you buy preferred shares in a startup, first and foremost, you’re getting equity upside in the company. Your ownership stake in the company is proportional to the amount you invest.

Preferred startup shares have the same upside potential as common shares. But they have what is known as “liquidation preference” over common shares. That means if the company is forced to liquidate, preferred share owners get paid back before common share owners do.

In the vast majority of startup deals, investors get preferred shares. Founders and employees get common shares. Since the latter has only invested time, not cash, they’re last to share in the proceeds from a negative outcome.

However, in a positive outcome, such as an IPO, the return for preferred and common shares (assuming the same price) will be the same in the vast majority of cases.

New Recommendation: Magic Instruments

Rock Star Status in a Matter of Minutes

By Adam Sharp co-Founder, First Stage Investor

I’m excited to announce our newest recommendation: Magic Instruments (MI).

MI is a hardware startup based in Silicon Valley.

The company’s first product is the MI Guitar, an instrument designed to make learning to play the guitar a breeze.

The product had a successful pre-order campaign on Indiegogo, gaining $415,000 in revenue from 1,200 guitars.

I highly recommend watching MI’s brief explainer video on YouTube, which shows how the product works. You can watch as non-guitar players learn to strum along in minutes.

The MI Guitar comes with a companion app that runs on Android and iPhone. The app will help users start playing in minutes and will have thousands of popular songs available when the guitars come to market.

I’ve spoken with two trusted contacts who have used the MI Guitar. Both raved about the experience. Unfortunately, we weren’t able to get our hands on one of the guitars, but the sources I checked are solid.

MI has garnered positive press from major publications, including…

Backers and Investors

The MI team has attracted a number of high-profile investors, including Ammunition Group, a California firm that designed the best-selling “Beats By Dr. Dre” headphones. Beats was eventually purchased by Apple for $3 billion.

Ammunition Group not only designed the MI Guitar, but also invested in the company.

MI advisors include Charles Huang, the co-inventor of Guitar Hero. Guitar Hero is a video game that comes with a digital “guitar” and has generated more than $2 billion in revenue.

Magic Instruments also graduated from two top-tier “startup accelerator” programs.

The first is Highway1, which is designed exclusively for hardware startups. This accelerator program specializes in helping startups manufacture overseas. I’m familiar with Highway1. It has an excellent reputation. I invested in one of its most well-known graduates, Navdy. I’ve seen the value Highway1 brings to the companies it works with.

The second accelerator is Y Combinator, arguably the most prestigious accelerator program in the world. Fellow YC companies include Dropbox, Reddit, Instacart and hundreds more. MI is a recent graduate of YC’s Winter 2016 class.

MI has also secured an investment from Matthew Bellamy, lead singer of rock band Muse. Here’s what Mr. Bellamy has to say about the MI Guitar:

MI has also secured an investment from Matthew Bellamy, lead singer of rock band Muse. Here’s what Mr. Bellamy has to say about the MI Guitar:

“For people who don’t have the time to learn the guitar, Magic Instruments is the ultimate shortcut – you’ll be strumming your favorite songs in minutes. For singers and non-guitar-playing musicians, it’s also a great tool for songwriting.”

Leadership

Magic Instruments founder Brian Fan is a graduate of both Juilliard and the Wharton Business School. He started MI after struggling to learn guitar himself. Fan realized that if he, a highly trained musician, was having trouble learning to play guitar, the average person didn’t stand a chance.

So he created the MI Guitar, which he calls a “shortcut” to learning the instrument.

Brian Fan has a rare combination of talents: music, technology, programming and marketing.

During our call, Brian continually impressed us with his enthusiasm, intelligence and marketing savvy.

Bottom Line

Magic Instruments is aiming to create an entirely new class of musical instruments. One designed for today’s digital world.

The MI Guitar is just the first in a planned line of products. And this is not a simple toy like the Guitar Hero line of products, which requires users to only press buttons at the right time.

The MI Guitar teaches real transferrable musical skill. And it allows beginners to start seeing progress much quicker than they would using traditional guitars.

Risks

As with all hardware startups, manufacturing is capital-intensive. The company will likely require further funding to get its product to market. This is an early-stage startup, and thus faces risks that all early-stage investments do.

How to Invest

- Create an account on Wefunder.com if you haven’t yet.

- After you’ve signed up and logged in, click here to go to Magic Instruments’ investment page.

- Go to the green “Invest” button on the right side of the screen. Enter the amount you want to invest ($100 minimum) and click “Invest.” You will then be guided through the funds transfer process.

Note: There are limits on the amount that individuals can invest per year. (Full details on that here.) So, if you’re new to this, consider investing the minimum amount. There will be many more opportunities to come. Remember, it is ideal to spread your investments across 20-plus startups.

Valuation: $12 Million Cap

This month’s special guest is Patrick Little, a contributing editor and researcher for First Stage Investor. Patrick works closely with Andy and Adam and shares a passion for equity crowdfunding.

The Next Frontier in Startup Investing:

Where a Lack of Structure Means

a Wealth of Opportunity

By Patrick Little

Despite the attention Silicon Valley gets, it’s far from the only place in the world where innovation is happening. In fact, some places have a surplus of innovators and entrepreneurs (but are lacking in investors).

Savvy and serious entrepreneurs with breakthrough ideas in emerging markets… waiting for the capital to get their innovations to take off.

Latin America is one such place.

There are many hubs of innovation throughout the region – São Paulo, Mexico City, Santiago and Lima are a few that come to mind. These places often lack local investors to get game-changing ideas off the ground.

Entrepreneurs in Latin America often rely on attracting capital from the U.S., where investors are more likely to be comfortable investing in the startup space.

The challenge for entrepreneurs then becomes selling not just the company to these types of investors, but also the country. For a U.S.-based investor, this means opportunities to not only diversify their startup portfolio, but also their lifestyle.

A Promising Market: Colombia

From an economic standpoint, Colombia is a standout in the region. According to the World Bank, GDP has grown on average by 4.2% each year since 2001. It continually ranks in the top five in foreign investment among emerging markets. Tourism is up 235% since 2002. And property values in major cities like Bogotá and Cartagena have gone up 10-fold over the last 10 years.

These impressive growth figures are easy to understand. With livable and cosmopolitan cities, diverse geography, outstanding cuisine and beautiful weather, Colombia has a lot to offer. It’s not hard to see why people want to travel and invest here.

And when it comes to startups, Colombia is just as appealing. It boasts not one, but two cities of innovation: Bogotá and Medellín. (Medellín, in fact, was named the world’s most innovative city in 2013.) Companies like Google, Facebook and Citibank have set up major offices in both of these cities to be a part of the action.

To get a closer look at the startup scene in Colombia, I spoke with a founder making a splash in Bogotá.

Not an Uber Competitor

Andres Blumer has been around tech startups all his life. Born in Boston, he moved to Seattle as a child when his father’s tech company was bought by Microsoft. Rather than work in Silicon Valley or New York right out of college, he decided to bring his interests in entrepreneurship and Latin American culture together.

He did so by opening an office for Humantelligence, a human resource analytics company, in Bogotá, where his mother is from.

Before long, Andres was investing in and sitting on the board of several startups in Bogotá, including Mi Águila, a business-to-business transportation service started by Fernán and Bruno Ocampo.

Eventually, the Ocampo brothers asked Andres to come on board with them full time as a founder. Andres accepted, realizing how huge an opportunity this could be.

“We found out that Grupo Arcos (one of the world’s largest concrete companies, based in Colombia) was spending between $5 million and $8 million a year on moving its employees around,” Andres told me. They crunched the numbers and realized that business-to-business transportation in Colombia is a $1.2 billion annual market.

Mi Águila hopes to eventually claim about 10% of that market share, and it seems to be well on its way. Andres cited 350% growth in 2016, signaling a strong proof of concept.

The company uses a mobile platform to securely move its clients’ employees to work sites. With around 70 employees and 2,000 drivers working in Colombia’s five biggest cities, Mi Águila doesn’t consider itself an Uber competitor.

Uber is illegal (though still operating) in Colombia. Uber is too much of a threat to taxicabs, which are government-regulated and union-protected… and serve as the foundation of the country’s transportation infrastructure. Andres estimates there are 60,000 taxi cabs in Bogotá – nearly five times as many as there are in New York City.

Mi Águila, on the other hand, operates as a black car service, which by law means that it operates only as a business-to-business service and is not for individual consumers. Therefore, the company is technically not competing with cabs and is entirely legal.

The average U.S. investor, lacking interest in the nuances of transportation infrastructure in Colombia, would likely miss an opportunity like this.

Mi Águila, meanwhile, has taken advantage of the situation and is thriving because of it.

Thanks to Andres growing up in and around the startup investing scene in Seattle, Silicon Valley and beyond, Mi Águila has benefited from U.S. investors’ funding, an advantage many companies in Bogotá could certainly use. The founders have also had access to prominent Colombian business and political leaders. That has enabled the company to better understand transportation problems in the country’s major cities. Just last year, Andres met with Colombia’s president, Juan Manuel Santos.

The company is currently raising money in a “bridge round” to take it to Series A funding. It is about halfway to a $1.28 million target, which it aims to hit by the end of 2016.

Opportunity Where Funding Doesn’t Exist

As I learned from talking with Andres, the startup space is not quite as ready-made in Colombia as it is in the U.S. That can make it a challenge to navigate. On the flip side, in most sectors the same level of regulation doesn’t exist, which can create enormous opportunities for investors and founders alike.

And while some familiar startup portals are available for accredited investors (like AngelList, for example), fundraising in Latin America by and large happens through entrepreneurial networks. Endeavor and Ruta N are two such networks Andres mentioned that have been instrumental in enabling the company’s access to capital and clients.

These networks are strengthening, as the number and quality of local startup investors are on the rise, especially in Medellín and Bogotá.

Despite the emergence of homegrown investors, Andres explained that many entrepreneurs – in Bogotá and throughout Latin America – are eager to attract U.S.-based investors that fit a certain profile, such as those who are well-traveled and recognize the benefits of investing outside the U.S. dollar.

Think you might be such an investor? Start by browsing through offerings on AngelList and perhaps by getting familiar with the entrepreneurial networks Ruta N and Endeavor.

Just like startups in the U.S., they certainly aren’t all going to be winners. But it’s another way to think about diversifying your startup portfolio.

Introducing the First Stage Investor

Equity Crowdfunding Playbook

By Andy Gordon, co-Founder, First Stage Investor

Crowdfunding is many things to many people.

To founders, it’s a way to avoid the sometimes suffocating bear hug of venture capitalists. To economic policymakers, it’s a new way to inject capital into small companies – the ones that drive employment gains.

But what does crowdfunding mean to you, the everyday investor?

I could say it’s a new asset class, which is technically true.

But it’s much more than that.

It’s an entirely new way to approach equity investing.

Almost everything about it is different from public stock investing.

It would take a thick book to explain it to you.

But crowdfunding is so new – having launched in May of this year – that no books have been written yet.

So we’re going to do the next best thing.

We’re going to explain crowdfunding to you over the next 12 issues – equivalent to a one-year subscription to First Stage Investor.

Each issue will address a different subject in depth. While the subjects will stand on their own, each article will build on what you learned in the previous month. And the terms and concepts we use in earlier articles won’t be continually explained in later issues every time we use them.

Next month’s issue will initiate Lesson 1.

Now, if you’re just interested in getting our recommendations and backing them with an investment, be our guest. That’s up to you.

But that’s not our preference, and it really shouldn’t be yours. For example, once you invest, then what? How do you track your investments? What would be reasonable expectations in terms of timeline and profitability? For that matter, do you have any idea how much to invest in each startup?

These kinds of questions are just the tip of the iceberg.

We won’t answer all of your questions in this 12-part series. But we hope to answer many of them – most importantly, the key ones.

At the end of the day, these lessons will make you a better early-stage investor… and, we hope, a happier one who appreciates the challenges startups face in growing into something of value to their customers and investors alike.

Think of startup investing as a journey. I’m driving the car. So is Adam. And we’d like you to eventually be able to drive yourselves. In the meantime, it’s important that you learn the rules of the road and appreciate the ever-changing scenery.

So fasten your seatbelts.

Here’s an overview of the 12 lessons.

- What unique benefits do you get from investing early? Beyond exposure to bigger profits, we’ll explore the risk/reward equation and how it’s different from public stock investing, as well as a few key ways to mitigate risk and build a highly profitable portfolio.

- Getting to know the players. Let’s put the startups at the center of our universe – our sun, so to speak. You’re an orbiting planet, along with the larger VC Planet and the Angel Investor Planet. The startup portals? Well, they’re moons on your planet. We’ll tell you how this universe works, your place in it and who’s hogging most of the sunshine.

- Mapping the portals. Startup investing is online investing. The portals are your brokers/startup-listers/fundraising hosts/research tools and where you go to actually make your investments in the startups of your choosing. You need to become familiar with a half-dozen of these websites, including a couple that have distinguished themselves with deal flow that is a cut above the rest. Learn what the major portals do well and not so well.

- Building, tracking and cashing out a profitable portfolio of startups. You probably know about the importance of diversification. But when applied to a startup portfolio, it takes on an entirely new and bigger dimension. And since private shares aren’t bought and sold on a daily basis, tracking their value presents a very different set of challenges to an early-stage investor. Don’t worry. It’s not hard. All you need is a few guidelines and lots of patience.

- In startup investing, there’s early and then there’s very early. Startups go through stages where they raise funds. And each stage presents a different set of risks and rewards. In general, as a startup graduates from stage to stage, its shares get more expensive as its risk become smaller. So what’s the best stage to invest? We have a strong opinion about this. In fact, we think it’s by far the most profitable stage during which to invest. Once you hear us, we think you’ll agree.

- Tips on picking the best startups. The bad news is there’s no shortcut here. No magic metric to follow. No one characteristic that guarantees success. The good news? We’ll share some of the unconventional techniques we’ve picked up over the past three years. They’re very personal. You won’t find them anywhere else. But they work great for us. We think they’ll work for you too.

- The private securities you’ll be owning. There are common shares, which founders own, but increasingly early investors do too. And then there are preferred shares, which come with certain conditions (or preferential terms, hence the name). Or you could very well end up owning convertible notes that convert to equity later on. Does it really matter? Yup. For example, I’ve seen cases where investors pay more money for shares when the preferential terms are ratcheted up (called the “full ratchet,” once but no longer a rare occurrence).

- Back to the portals. We’ll take a more in-depth look at the ones we use the most. You see, it’s not just about how they add high-caliber startups to their sites. It’s about how they encourage interaction with the founders; how easy it is to go on the site and make an investment; how well they align their ability to make money with yours. In this lesson, we let the portals speak for themselves in a Q&A format with one of the top executives of each portal.

- How startups get valuated. A clue: It’s not the market. Remember, their shares are pretty much illiquid. Another clue: Nor is it (most of the time) the founders. Then who is it? And how do they put a value on young startups, when there’s so little to go on? These are all good questions, and we’ve got the answers.

- The perfect founder. Not that there is such a thing, but if there were, we’d have a pretty good idea of what they would look like. Age. Experience. Personality. Determination. Knowledge. They’re all ingredients in our recipe. We’ll also examine how many founders make the perfect founding team. Founders come in all shapes and sizes and from anywhere in the world. Heck, two of my siblings have become founders! Boiling the idea of perfection down to a few characteristics may be a bit presumptuous. But we’re not overly rigid. When we see great founders, we know it. And they usually have at least three to four (if not all) of the five features we’ll be highlighting in this article.

- The magnificent power of the “Power Law.” The power of one sounds more like a description of the movie The Matrix than a key principal of how one big winner can make a huge difference in a startup portfolio. The truth is that startup portfolios are ugly – full of struggling companies or, worse, failing ones. But here’s the thing. Research has shown the uglier the portfolio, the more profitable it is. Are we talking in circles? It may seem that way until you read our explanation. Then it will all make sense.

- 50 shades of early investing. Crowdfunding now operates under two regulatory loopholes known as Regulation A+ and Title III. What we can count on: More change is on the way as the government continues to loosen up the rules. What we don’t know is specifically what the changes will be. But we’re willing to make some bold and not-so-bold (already coming true) predictions on what you can expect in the next few years.

Taken collectively, our 12 lessons make for a pretty effective First Stage Investor Equity Crowdfunding Playbook. Of course, reading our recommendations is another good way to pick up knowledge on how to target your startup investments.

The best teacher? You. By doing it. By actually investing. The more times you invest, the more you learn, and the better investor you’ll become.

Exactly what we’re aiming for.

FSI November Portfolio Review

There have been several developments in the companies in our portfolio this month, from successful fundraise closes to prestigious marketing awards. Let’s take a look at a few…

Virtuix Is the Hottest Ticket in Town

Virtuix’s Omni continues to draw crowds at trade shows.

(As a reminder, the Omni lets users walk, run and jump while simultaneously experiencing the same movements in virtual reality, or VR.)

Reload Studios showcased the Omni at two shows last month – one in Seattle and the other in San Diego.

Folks lined up to experience the thrills of chasing and shooting their quarries in Reload’s popular World War Toons. Founder Jan Goetgeluk says World War Toons provides one of the most fun gaming experiences with the Omni.

Below is a picture of the Omni in action Seattle’s PAX West show.

A third show was in Guangzhou, China. The Omni was used to play Hero Entertainment’s Crisis Action game.

By the way, this game has 400 million players in China alone!

The numbers speak for themselves. If just 10% of those users buy the Omni at $999 to get the full VR first-person shooter experience, that’s 40 million Omnis – or nearly $40 billion worth of Omnis. Even if just 1% of Crisis Action players buy the Omni, it would generate $4 billion worth of revenues. Oh boy.

Virtuix’s potential in China is sky high. It’s shaping up to be a huge win, which means…

Virtuix will have to transition from a batch pre-order model to a much larger manufacturing run of build-to-stock distribution.

It’s a key execution point for Virtuix. Can it manufacture and ship on a large scale on schedule, avoiding costly delays and glitches?

A lot rides on Jan and his team being able to execute. They’re primed to hit the big time. It’s what they’ve worked for all these years.

Part of our investment thesis is an appraisal of a team’s ability to meet future challenges such as these… and execute.

Virtuix’s co-founder, David Allan, set up a Chinese manufacturing subsidiary that employed more than 200 workers for an American electronics firm before joining Virtuix. He’s a big reason why we like Virtuix. He’s done this before.

It’s a critical time: Win big or go home. I’m excited.

Keen Home Gets a Smartie

Keen Home is a company we still have our eye on. We gave you a “sneak” preview of it in our last issue. We’re continuing to track Keen’s progress. And we’re waiting to see if and when it initiates a fundraise on SeedInvest.

The silver Smarties award it received last week is just another piece of evidence that our keen (get it!) interest in the company isn’t misplaced. The award came from the Mobile Marketing Association’s annual Smarties competition, in the “Internet of Things” category.

Congratulations to founders Ryan and Nayeem.

8tracks Reaches the End of a Successful Fundraise

The company closed out its fundraising campaign on SeedInvest on October 21. It got investments from 4,500 investors for a total of $2.2 million – a successful campaign, I’d say.

While its raise has ended, our relationship with 8tracks is just beginning. We’ll continue to stay in touch and monitor its progress.

Founder and CEO David Porter hosted a webinar exclusively for First Stage Investor members last month. David did a great job explaining the company’s new growth strategy. If you missed it, here is the recording of the private video webinar.

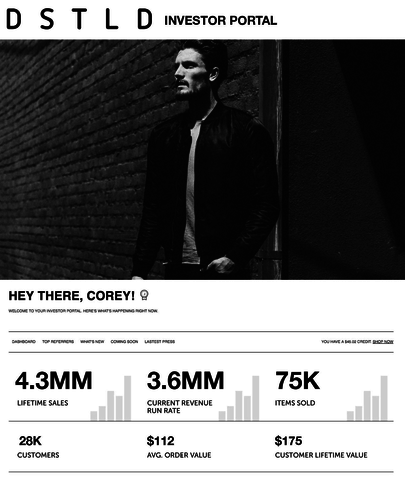

DSTLD Launches a New Investor Portal

DSTLD has recently launched a new portal for its investors. The portal outlines current sales figures and the latest news about the company.

If you’ve invested in DSTLD, go to its site and you’ll find a badge in the right-hand corner of your screen. Click the badge for instant access to the portal.

Here’s what it looked like a couple weeks ago…

VetPronto Expands

Our friend Joe Waltman, CEO and Founder of VetPronto, wrote to let us know that he has expanded to Atlanta, Baltimore, Chicago, Washington, D.C., Tampa Bay and New Orleans. If you know any pet owners in those cities, please let them know about VetPronto.com.

VetPronto’s round closed last week. The company raised almost $300,000. This capital will power its ambitious new plan to expand into multiple cities simultaneously and onboard new vet partners as they come in.

Barrow’s Intense Ginger Liqueur Becomes a Permanent Fixture

Just a quick update on Barrow’s. Founder Josh Morton tells me that his unique ginger liqueur has been added to the permanent menu at national restaurant chain Benihana. The exposure and revenue from this deal are meaningful for a small craft distiller and should help accelerate growth.

First Stage Investor Portfolio

| Company | Date Recommended | Sector | Series | Valuation | Investment Type | Round Status |

|---|---|---|---|---|---|---|

| Magic Instruments |

11/17/2016

|

Consumer Electronics |

Seed

|

$12,000,000 | Convertible Note | Open |

| VetPronto |

10/12/2016

|

On-Demand |

Seed

|

$5,000,000 | Convertible Note | Closed |

| BrewDog USA |

09/01/2016

|

Consumer | $350,000,000 | Common | Open | |

| Barrow’s Intense Ginger Liqueur |

08/17/2016

|

Consumer Goods |

Seed

|

$4,000,000 | Preferred | Closed |

| DSTLD |

08/03/2016

|

Apparel |

Series A

|

$22,000,000 | Preferred | Open |

| Virtuix |

07/26/2016

|

Virtual Reality |

Series A

|

$35,000,000 | Preferred | Closed |

| 8Tracks |

07/26/2016

|

Music |

Series A

|

$28,000,000 | Preferred | Open |