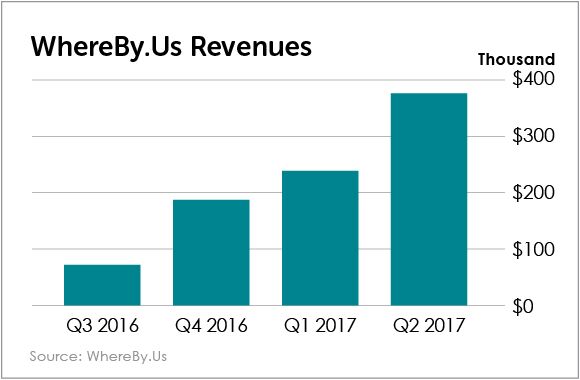

This Tiny Company Is Making Local Advertising Easy… and Raking in Millions

New Recommendation: WhereBy.Us

I like my investing opportunities served on an oversized silver platter.

Big problems. Big markets. Big solutions. And startups with ambitions to match.

With that in mind… what could be bigger than a startup going after the demographic with the most money to spend?

Move over, baby boomers. Your time (well, my time too) is done. Make way for the millennials.

An Unprecedented Wave of Urban Spenders

Millennials are raising families, moving into their first and second homes, and growing their disposable income.

Even better, they’re willing to spend it.

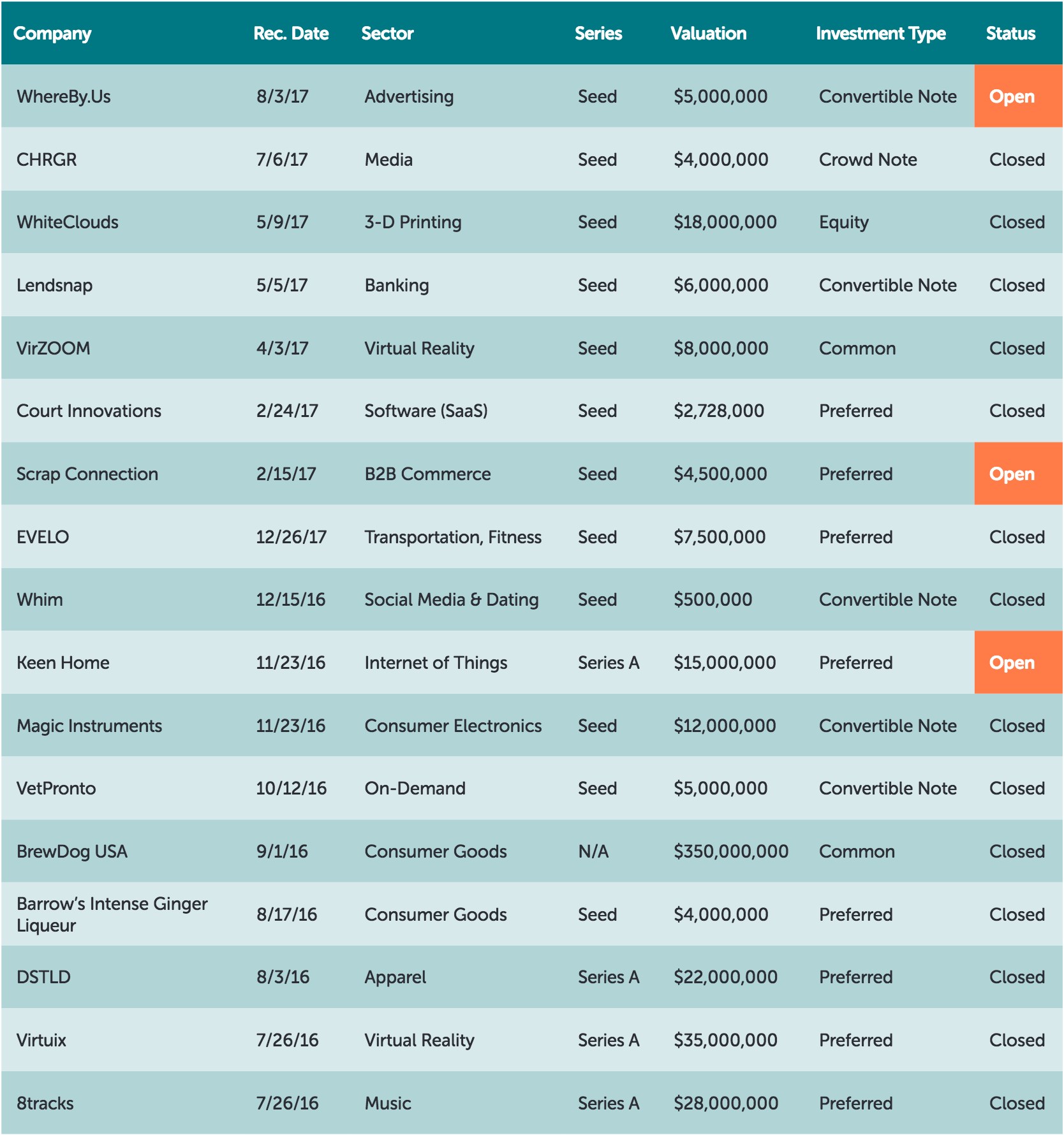

They’re also moving to emerging cities more than any generation in history. According to The Brookings Institution, millennials are flocking to “nontraditional” markets like Charlotte, North Carolina; Austin, Texas; and Minneapolis, Minnesota… and they’re leaving places like New York City.

They’re a huge market, and they’re getting bigger with each passing month.

It’s not that baby boomers aren’t spending their disposable income, it’s just that millennials are spending more of it. And, amazingly, they’re largely untapped at the local level.

These are the spenders big and small companies alike need to understand and connect to most.

The question is… how?

Traditional Media Advertising Is Broken

Traditional Media Advertising Is Broken

It’s not as easy as it used to be. Things have changed.

Newspapers? I have two kids in their 30s. Both highly educated and well-read.

Nick, my son, lives in Washington, D.C. Rachie, my daughter, lives in Atlanta. Neither subscribes to a newspaper.

How about digital? Display and social ads are an inexact science at best and not the most reliable way to get the word out locally.

They certainly don’t engender a sense of deep engagement. The traditional ways of advertising simply don’t work very well for local engagement, which leaves a gigantic void.

As an early investor, I LOVE gigantic voids. They usually attract a swarm of companies.

I’m left to figure out which ones, if any, can solve the problem. That’s not the case here.

A Visionary’s Solution

I’m pretty sure it’s because the solution isn’t obvious or easy. It’s not about creating an app… or throwing artificial intelligence technology at it. (AI is all the rage right now.)

It took a visionary founder to not only recognize the scale and depth of the problem, but understand how helpless traditional media is to address it.

And that wasn’t even the hard part. The hard part was coming up with a solution. And then building a growing company around it.

That’s exactly what the co-founder of WhereBy.Us – Chris Sopher – has done.

A New Company That Defies the Old Categories

It wasn’t easy. He had to move beyond traditional categories.

WhereBy.Us is not a media company (not in the traditional sense).

Nor is it strictly an advertising company. Nor is it a social event planner/organizer.

But it has elements of all three and much more.

The company’s strategy emanates from its unique platform, which lets it develop a deep understanding of its users, build loyal communities and create meaningful engagement for its customers.

The first thing WhereBy.Us does when it moves into a city? It creates communities of local influencers.

The company calls them “curious locals” or “leading locals.” They have hundreds of followers. They go to city events. They explore new local venues.

When influencers adopt WhereBy.Us, they become readers of the company’s daily e-letter and social content and share their new resource with their friends.

That’s how the company’s communities grow organically… by word of mouth.

Around 3% of readers become members. WhereBy.Us knows this from its experience in building communities in the two cities it’s currently located in: Miami and Seattle.

It has more than 30,000 subscribers from these two cities.

Members pay $60 a year for access to special content, giveaways and events. They’ll be contributing 15% of the company’s revenue this year.

Lyft: One of Many True Believers

So this is where the WhereBy.Us business model really shines…

The company’s biggest revenue streams do not come from engaging its local communities, but from leveraging that engagement with its corporate, government and nonprofit clients.

Brilliant, yes?

These communities are targeted and segmented in multiple ways for the company’s bigger clients.

WhereBy.Us uses research, custom content and creative activations to help clients build local engagement.

Here’s just one example. It organized a community event for Lyft that was so successful, Lyft increased its contract from an initial $6,000 to $108,000.

Did Lyft get its money’s worth?

WhereBy.Us delivered more than 500,000 digital engagements for Lyft every month, along with local engagement through social events.

Lyft is a true believer.

About 85% of WhereBy.Us’ revenue comes from these multimarket campaigns for large clients.

With the company’s plans to increasingly serve these clients across its targeted cities, these revenues should grow rapidly.

Large clients will continue to be the company’s biggest revenue producer. As a percentage of total revenue, they will eventually fall to 50%.

New Technology Unleashes Do-It-Yourself Ad Campaigns

That’s because the fastest-rising revenue generator will be the company’s automated, self-serve email newsletter advertising.

Customers buy ad campaigns in the company’s local newsletters and load all the creative content themselves.

WhereBy.Us confirms and manages the orders at the back end. This currently accounts for 10% of the company’s revenue and should grow to 30% by the end of 2017.

The company also works with local leaders and influencers, marketing their content, merchandise and events through its local sites.

So you see, WhereBy.Us covers the entire spectrum of users: large companies like Lyft, smaller companies that buy do-it-yourself advertising, and local individuals who buy memberships, event tickets and merchandise.

There’s a lot to like about how these pieces work together.

WhereBy.Us has cost-efficient expansion. New cities are “launched” at a cost of just $150K. And they hit profitability in less than a year.

WhereBy.Us launches with a single editor, backed by its headquarters team, who provides business development, creative direction and back office support.

It then adds another person within a few months.

And that’s it. It’s now making revenue at a $1 million-per-year clip in Miami and is fast approaching that level in Seattle.

Three new cities will be added this year.

And 25 cities will be added by year five.

At $1 million minimum per city, revenue should reach at least $25 million in five years.

But I think it’ll do much better than that.

For one, WhereBy.Us will be able to attract bigger clients – those with multimarket agendas – as it expands into more cities.

It’ll develop larger networks with regional reach. And it won’t have to constantly reinvent the wheel.

For example, in introducing a new brand into an urban area, it’ll be able to use the same “template” for multiple cities.

About 85% of its clients are already national companies conducting local marketing campaigns.

As a new company, WhereBy.Us will simply get better at what it does.

It’ll develop better tech tools to drive conversion and user engagement. And it’ll develop a deeper understanding of the cities it’s in.

The company has no competition. Who does what WhereBy.Us does?

Not the newspapers. Not the legacy companies that have more of a national perspective.

For example, a Miami vocational institute does a lot of Facebook campaigns.

But it turned to WhereBy.Us to help it understand how to connect with young people in Miami.

WhereBy.Us works with the newspapers and other local media. It works alongside Facebook ads and Google AdWords and traditional media buys.

Many of its customers do all of the above.

Competition? What competition?

The company has recurring revenue. This is the best kind of revenue, in my opinion.

Not only are membership fees recurring, but so are the company’s revenues from its creative clients – with fees ranging from $5,000 per month to $10,000 per month for the bigger projects.

Our Investment Criteria

Here’s our thinking on the main investment variables (out of the few dozen we look at) and why we like WhereBy.Us.

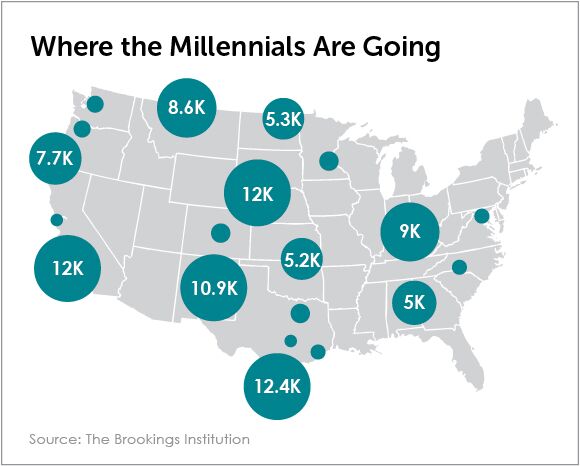

Market. Ad spending is flatlining.

Promotional spending is surging. Maybe traditional media didn’t get the memo.

More likely, it’s simply unable to take advantage of this opportunity.

WhereBy.Us is jumping into the breach by taking advantage of the fact that companies are spending much more on promotional spending than on traditional advertising.

Capital efficiency. This is one of the company’s biggest advantages.

But can it sustain its lean local operations strategy as it moves into more cities?

It’ll have to make good local hires. Chris explained to me how the company’s “expansion team” is deployed. Just another thing that is impressively thought out.

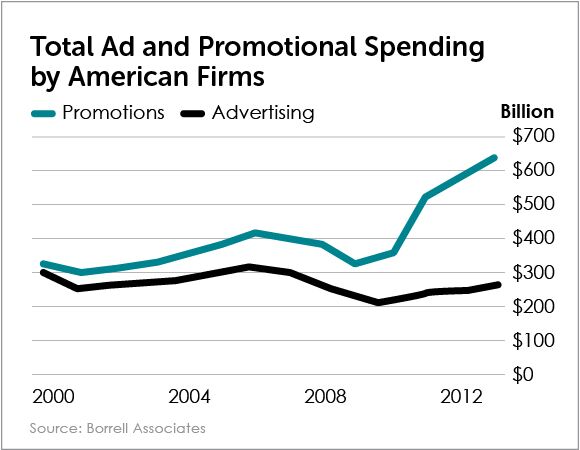

And get this: The company pulled in almost $400,000 in revenue in the second quarter this year – an average of more than $130,000 a month. Its current burn rate? Just $90,000 per month.

Though the company will be spending more after its raise, its lean model has already proven profitable. Amazing.

Need. Display and social ads don’t generate deep engagement. National brands work through disjointed networks with questionable results.

The need is clear.

Traction. As you can see, revenue is taking off. Of course, that’s what should happen when you go from one city to two.

But give the company credit. It started in Miami and expanded into Seattle.

Could two American cities be any more different?

Didn’t matter. The company made it work.

Monetization. Its monetization channels seem to be working. It’s early, though. And the company’s strategy will evolve. I expect its upper end will double from $10,000 per month to $20,000, and its lower end will be cut in half from $60 per year to $30. Just a gut feeling.

Scalability. The company’s growth is not purely scalable the way that SaaS (Software as a Service) is, for example, when done right. Headquarters will have to get bigger as WhereBy.Us enters more cities. And large clients may require more man-hours to fine-tune their multimarket campaigns than the company anticipates.

But WhereBy.Us’ business model, along with an improving platform that should make tasks quicker and quicker, will give the company the ability to pop up in cities at decreasing costs and increasing speed.

Leadership. Chris managed a portfolio of grants and investments for the Knight Foundation. He had a front-row seat to a lot of great urban and media projects making an impact – projects that he helped fund.

Inspired, he and his co-founders started organizing civic events around Miami and were able to engage hundreds of like-minded locals.

He felt empowered but also frustrated, asking himself how he could take this to the next level.

The answer? WhereBy.Us. Connecting people to people. Connecting people to a city’s new events and venues. Connecting the shakers and movers to more followers and those followers to the things they care about… as well as to companies and their products.

In other words, the vision in action. In doing so, he’s putting a tiny innovative company on the path to hypergrowth – a journey that you can invest in.

I strongly suggest you do just that… so that you may reap the profits that come when visionary founders fill a gigantic void with the superb planning and execution that Chris has shown.

How to Invest

WhereBy.Us is raising up to $750,000 on the SeedInvest website.

Here’s how to invest. If you’re already registered with SeedInvest…

- Go directly to the WhereBy.Us listing at

www.seedinvest.com/wherebyus/seed, then click on the blue box labeled

“Invest.” - You will then be asked a series of quick and easy questions to execute your investment.

- The first one is “How much do you wish to invest?” WhereBy.Us has set the minimum investment at $500. You can invest more, but you can’t invest less.

- Follow the instructions and choose your preferred payment method. Complete the process and, if you run into any problems, email SeedInvest at contactus@seedinvest.com.

If you’re not registered with SeedInvest…

- Go to www.seedinvest.com and click “Sign up.”

- Once registered, search for “WhereBy.Us.”

Editor’s Note: If you’re new to First Stage Investor, or if you just need a refresher on how to invest in startups through portals like SeedInvest, check out our video tutorial “Investing in Startups Through Online Portals” at http://earlyinvesting.com/reports/investing-startups-online-portals/.

By the way, you’ll be making a loan to WhereBy.Us through SeedInvest’s Crowd Note. For information on how it works, here’s a quote from the company’s documents…

“Upon the occurrence of a Qualified Equity Financing, the Company will convert the Crowd Note into Conversion Shares prior to the closing of the Qualified Equity Financing.”

Qualified Equity Financing is the company’s first sale of its preferred stock of $1 million or more. If the notes are converted at a $5 million valuation or less, you get an automatic 20% discount, meaning you get a 20% lower price than investors in a future round.

Finally, the 7% interest you earn is paid (in shares, not cash) when your note is converted into equity. If you encounter difficulty at any point in the process, all you have to do is click on the “Chat with Us” link on the SeedInvest site. It’s on every page as you go through the application process.

How You Can Help

Let WhereBy.Us know what new developments and trends you’re most excited about in your city. It has a data model that helps it choose which cities it should launch next, but understanding conditions on the ground would help it prioritize its future cities!

Drop the company a line at chris@whereby.us. We always try to add value to our portfolio companies. Of course, this step is optional.

Risks

As with all early-stage investments, there is significant risk the company could fail. It could fail to secure further funding, lose

important revenue streams or have any

number of other things go wrong.

This is the nature of early-stage investments.You should not invest any money you can’t afford to lose. ■

Deal Summary

Company: WhereBy.Us

Valuation: $5 million (conversion cap)

Platform: SeedInvest

Minimum investment: $500

Raising up to: $750,000

Discount: 20%

Interest: 7%

Offering ends: August 28, 2017

Playbook

Equity Crowdfunding Playbook Part 9

The Five Types of Securities You Need to Understand

Editor’s Note: This is Part 9 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them here: www.earlyinvesting.com/playbook/.

So you want to invest in a startup. You think you know everything there is to know about the company? Good.

But you’re not done…

Not until you also know what type of security the company is giving you in exchange for your money.

It will be one of five types:

- Convertible note

- Safe (Simple Agreement for Future Equity)

- Preferred shares

- Common stock

- Revenue sharing loan.

Each represents a different set of risks and rewards – apart from the company itself you’re investing in.

Let’s take them one at a time…

Convertible Note (or Debt)

This is a loan that turns (or “converts”) into equity upon a triggering event – usually the next equity round.

Companies are obliged to spell out the triggering event in the deal terms. The details matter.

Does the future equity round have to raise a minimum amount (such as $1 million)?

Is it optional or required?

If it doesn’t happen by a certain time, does the company provide another pathway to conversion?

And this one: What happens if the company never raises an equity round? (You would usually lose all your money.)

Again, pay attention to the details.

Perhaps your loan gets converted into shares that end up being worth something – though most likely not much.

These kinds of loans (or “notes”) usually come with an interest rate, a discount and a cap.

The cap is the most important factor. So let’s begin there.

Let’s say the cap is $5 million and your loan is $100.

That means when the loan converts (at a future round), your shares will be priced at a max of $5 million divided by the number of shares issued.

Suppose the valuation of that round was $10 million. Current investors in that round would be buying shares for $10 million divided by the number of shares issued. But you?

Your shares would cost half that.

Now that’s the kind of scenario that convertible debt lenders dream of.

Other scenarios aren’t quite as beneficial.

Suppose the valuation is $5 million during the next equity round. You’re getting the same deal as current investors.

But you invested earlier, right? You took on more risk and should be getting a better deal.

This is where the discount comes in. Discounts usually range between 10% and 20%.

In this case, let’s say 20%. So you’re getting shares for $4 million (20% off $5 million) divided by the number of shares issued.

That’s a better deal than current investors get. And it rewards you for assuming additional risk.

These discounts also apply to valuations of less than $5 million. But it’s a mixed blessing.

On the one hand, your $100 buys more shares because the price is lower.

On the other hand, lower valuations mean the company isn’t progressing as much as expected.

The company may be reluctant to raise money at a significantly lowered valuation.

It means more dilution, since more shares will have to be issued to raise a given sum of money.

More worrisome, it’s not a positive signal. Institutional investors may not want to invest in a company making slower-than-expected progress.

This is part of the risk you take on. If the company never raises an equity round, you won’t be able to convert.

Lastly is interest. It’s nice. It helps. But it’s a minor consideration.

Interest ranges from 2% to 8% in most cases. It’s given to investors when the conversion takes place. And it’s not provided in cash, but in shares.

For every year your loan is active, you get a few extra dollars’ worth of shares.

Remember, a lot of these very early shares go for pennies on the dollar. So even a few dollars a year can bulk up your portfolio.

You’re probably thinking, “Why do startups have to make it so complicated?”

Founders have their reasons for not issuing shares right from the beginning.

For one, many times they’re not sure what valuation makes sense.

It’s very early, remember. Instead of running the risk of mispricing the company, they get enough funding to see them through another year or two.

At which point, they figure, the value of the company should be clearer.

The convertible debt route can be simple, fast and cheap. The contract is five to 10 pages (compared to 50 to 60 pages), and the company isn’t spending tens of thousands of dollars.

A big drawback? It’s a loan instrument.

It comes with a maturity date. If the company hasn’t converted your money into shares by then? In most cases, the company must either repay the loan or trigger conversion by completing a Series A round.

Both scenarios could be equally problematic for the company.

Which is why the “safe” was created.

Safe (Simple Agreement for Future Equity)

In 2013, Y Combinator introduced the safe (Simple Agreement for Future Equity).

Unlike a convertible note, a safe is not a loan. It does not have a maturity date. It does not accrue interest. And there is no legal obligation on the part of the company to pay investors back.

Like a convertible loan, it retains the right of investors to obtain equity at a future date – if the startup sells shares in a future financing round.

Let me repeat: if the startup sells shares in the future. If it doesn’t, you’ll likely lose your entire investment.

In this regard, a safe and a convertible note are no different. You should only invest using either one if you believe the startup can do an equity raise in the future.

A safe, however, gives startups more flexibility to choose when to do an equity round.

That benefits both the startup (whose hand isn’t forced) and the investor (who figures, “better late than never to get converted”).

Y Combinator developed the safe for accredited investors.

Most startups using a safe get funding from a dozen or so investors.

For crowdfunding purposes, some changes had to be made. Many portals have now designed their own versions of safes specifically for crowdfunders.

- Wefunder’s Crowdfunding SAFE: The Wefunder SAFE treats major investors

(typically defined as those investing between $10,000 and $25,000) much like the Y Combinator version, but it gives no voting rights for minor shareholders. - Republic’s Crowd Safe: When a Crowd Safe converts, investors will see the same financial outcome as shareholders, but without the voting or information rights. In the event of a subsequent equity financing, the company may elect to “roll over” Crowd Safe holders and continue the terms of the Crowd Safe. Or it may choose to convert the investment into preferred stock.

If there is a liquidity event during the term of the Crowd Safe, investors may have their cash returned to them. Or they may convert the Crowd Safe into company stock based on the purchase price and fair market value of the shares.

-

SeedInvest’s Crowd Note: The Crowd Note can remain outstanding until an exit occurs. It’s optional – up to the company – whether to convert the note to shares at the next round of equity financing. All of this means this note has more in common with a Crowdfunding SAFE – including its limits on share voting – than a conventional convertible note. It’s worth noting that the shares are worth the same at exit as they are if converted earlier.

Preferred Shares

These shares come with certain conditions, or preferential terms, hence the name.

This is not to be confused with publicly traded “preferreds,” which are shares that pay a fixed dividend.

The preferred shares I’m talking about are handed out to investors at all stages of fundraising, except perhaps friends and family (who, along with the founders and earliest employees,

typically get common shares).

In liquidation proceedings, preferred stockholders get paid before common stockholders, if there’s anything left to give back.

Other preferences, rights and privileges mostly apply to wealthy and/or institutional investors, including conversion into common stock, anti-

dilution options, voting rights and board seats.

But crowdfunders can be given senior

liquidation preferences, which means they receive their investment back not only before common share investors, but also before other holders of preferred shares.

Common Stock

Common stock is the basic form of equity (ownership interest) in a corporation. Founders, friends and family, and early employees are typically issued common shares.

A recent trend has been for startups to issue common stock to early investors.

Companies will sometimes divide common stock into classes with different rights: common A stock and common B stock, for example. Investors who buy class A common stock do not have voting rights, but class B stockholders do.

Since preferred stock comes with economic rights and protections, common stock typically gets a lower valuation for the purposes of stock option grants or share issuances to the employees of the company.

They can generally exercise their common stock options at a lower price than the price of the preferred stock.

Revenue Sharing Loan

Also called revenue participation, these are promissory notes that are paid back from a share of the revenues of the business.

They come in two flavors. Some are capped. When you get back your loan plus whatever amount was promised above that, the deal is done.

Some are uncapped. Your interest income keeps coming until revenues dry up.

Payments of the loan are made annually or quarterly, with quarterly payments being more common. Investors make from 1.5X to 3X (or more for uncapped deals).

You invest with two X factors: future revenue and amount of money raised. The less guessing you do with these two numbers, the more predictable your future returns will be.

Final Words

There’s no need to avoid any of these securities. This is true even for common shares.

Let’s face it, they’re simply a less advantageous version of preferred shares for investors.

With that said, it’s not a deal breaker. If you really like the startup, then invest. Common shares put you in the same position as the founding team. Not a terrible thing.

Regardless of what kind of security is offered, your paramount task is to invest in high-quality companies. Of course, we’re here to help you do just that.

Chart of the Month

Chart of the Month

Healthcare Startups Sidestep D.C. Legislation

Glance at any major news outlet these days and you’ll see a story about healthcare reform. While the focus remains on D.C. politicians’ attempts to bring some kind of unified reform to the table, healthcare startups are continuing to raise

money… lots of it.

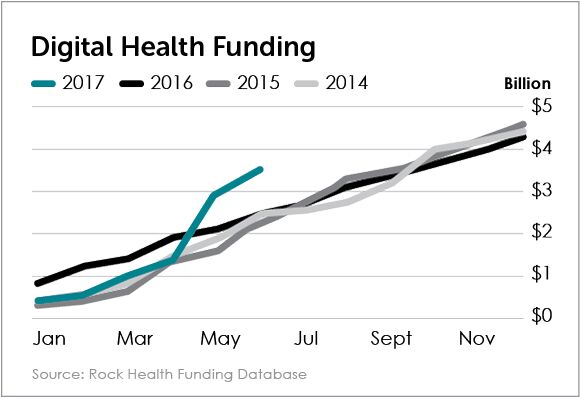

During the first half of 2017, digital health startups raised more money than ever, with 188 deals and $3.5 billion invested, according to a new report from Rock Health.

The chart to the right shows just how rapidly healthcare startups are raising money compared to in years past.

If financing continues at its current pace, 2017 will see $2.7 billion more in healthcare investments than 2016.

The digital health category that continues to generate the most funding is “consumer health information.” Think platforms and solutions that promote healthy behaviors.

“As provider reimbursement is increasingly based on outcomes, providers are more likely to invest in solutions that promote healthy patient behaviors in and outside the hospital,” said Megan Zweig, Rock Health’s director of research.

“Regardless of the outcome of the healthcare policy kerfuffle, we look forward to seeing how startups will continue to meet the urgent needs of patients and transform healthcare for the better,” Zweig concluded.

Major providers need to find ways to make healthcare more affordable, and startups are leading this charge.

The healthcare debate isn’t going away anytime soon. Thankfully, neither are the startups that will change the landscape of health and wellness.

Quote of the Month

A good [pitch] deck would earn an A or B grade. C or lower makes me worry about execution ability. A+ makes me worry about prioritization ability.”

– Leo Polovets, general partner, Susa Ventures

After working for Google and two early-stage startups as a software engineer, Leo Polovets co-founded Susa Ventures to focus on building successful businesses from the venture capital side.

According to his bio, he loves working with smart and passionate founders, helping them whenever possible.

His statement above certainly helps all founders.

When pitching to potential investors, founders need to stick to substance… not style.Keep this in mind when browsing potential startup investment opportunities.

Portfolio Review

August Portfolio Review

Two of our portfolio companies have made significant strides with their expansions, both financially and geographically.

Let’s take a look. As a reminder, you can see the entire First Stage Investor portfolio at www.earlyinvesting.com/fsi-companies/.

WhiteClouds

In early May of this year, we recommended a company called WhiteClouds. As a refresher, WhiteClouds is an industrial-scale 3-D printing operation that builds complex, multicolored products.

Major customers use WhiteClouds for medical modeling, prototyping, real estate, architecture, gaming and more.

WhiteClouds CEO Jerry Ropelato emailed us directly with some exciting results he wanted to share with First Stage Investor subscribers…

“We have been pleased with our Wefunder success. We have also been extremely busy. We have some big (game-changing) deals we’re still working on getting closed. Here are a few updates…

- 2017 YTD gross margins up 16% over 2016. We expect additional improvements.

- 2017 revenue increases:

- Q2 over Q1: +49%

- Q1 over Q4 2016: +6%

- We are finishing up a three-month first-of-its-kind veterinary surgery 3-D printing beta with one of the largest veterinary companies in the U.S. Results have gone extremely well and have surpassed expectations. We like our current situation for 2017.”

VetPronto

In October 2016, we recommended a pet care startup called VetPronto. VetPronto offers in-home, on-demand veterinary services. So instead of dragging your terrified animal to the vet’s office, a licensed pet doctor comes to you. And it costs about the same amount as a traditional visit.

VetPronto’s raise is currently closed (as the

company was successfully funded within a month of our original recommendation), but we’re happy to report that it has continued to grow and expand its operations.

At the time of its raise, VetPronto was live in two cities. It has now launched in 15 cities.

VetPronto co-founder and CEO Joe Waltman said, “We’ve launched in 15 cities. We’ve doubled our size of vets and nurses. We’ve significantly changed our marketing strategies. Previously we were trying to be super clever and tech-oriented. We’ve learned that the lower tech, offline stuff seem to be working better. So we’re doubling, tripling down on that.”

Are These 3 Stocks About to Take Off? (A $40,800 Gain)

According to Manward Press Founder Andy Snyder, there’s no time to waste. An expertly crafted market indicator just alerted him to three stocks set to soar. By his analysis, they could hand you $40,800 in pure profit.

Andy has compiled a special report on them. He thinks you’ll be very surprised by what sector they’re coming from. To find out, click here, or call 844.201.1980 or 443.541.4636 and mention priority code GMTDT803.