New Recommendation: Lendsnap

Get In on the Amazon of Home Lending

This year, mortgage lenders, banks and brokers will be handing out $1.5 trillion worth of home mortgages.

That’s a hunk of change in anybody’s book.

Here’s the thing. Only a fractional portion of these loans will be done online.

Anybody who’s taken out a home loan knows how long and trying the process is. Home lenders and brokers – along with their often overwhelmed customers – continue to drown in a sea of paperwork. To apply for a home loan, they are forced to find, collect and Xerox multiple copies of dozens of documents.

It now takes about 30 documents to complete a home mortgage loan application. While retailers were discovering the convenience, speed and profit that comes with conducting business online, the mortgage industry was frozen in its tracks.

You’d think this would be one of the first markets to take advantage of new software and cloud-related technology to make loans quicker and easier.

In fact, the mortgage industry will be one of the last to adopt. (Even though elsewhere in the financial sector, customers are embracing new technology to ease the burden of managing their own finances – think Mint, Acorns and Betterment.)

It’s not that these financial players are hopelessly hidebound. The onslaught of regulations that followed the housing crisis basically put innovation on hold.

Lendsnap, the company I’m introducing to you today, hopes to change that. It has developed a standalone web and mobile application that helps you quickly collect from the cloud all the financial information required to complete a mortgage application. Its user-friendly online technology is exactly what the market needs to make up for lost time and lost profitability.

In Search of the Amazon of Home Lending

Everybody has their dream company. Mine is an Amazon-like company disrupting the massive home lending industry.

Why not? Amazon has 304 million customers worldwide. And the home mortgage sector is one of the few trillion-dollar markets yet to be disrupted.

I was looking for this very company for the last five years or so. I had a very good idea of what I was looking for. I wanted a company that…

- Was small, independent and tech-savvy, not an offshoot of a big bank or big mortgage lender whose shares aren’t cheap

- Had a critical insight or edge that no other company had

- Had the ability to create a user experience completely unlike the existing one

- Had founders who understood how tech-savvy customers value time and convenience

- Was capable of marrying vision andexecution to create a large and powerful financial company.

Lendsnap has a shot. If that sounds cautious, let me say it has a better shot than any other startup I’ve come across. But at such an early stage, it would be foolish of me to be anything other than “cautiously optimistic.”

The Y Combinator alum checks off all the boxes except the last one. The jury is still out on its execution chops.

Don’t get me wrong. The founding team, consisting of Orion Parrott and Mike Romano, has done a good job so far.

I’ve had several hours-long conversations with Orion… and have asked him dozens of tough questions. He has a very good idea of what it will take for his company to become the go-to resource for brokers and lenders looking to take advantage of the increasing availability of online financial information.

Solving a Huge Problem Head-On

Lendsnap found that one-third of a broker’s or lender’s time is spent asking people for documents and data. What a big waste of time and money!

How much money? We’re talking $15 billion every year in human labor. And get this… That does NOT include the time the potential borrower puts in.

In what world does this make sense? Certainly not the one we live in, where most of this information is available in the cloud.

Lendsnap has developed a mobile and web-based app that links to consumer accounts to gather pay stubs, W-2s, tax returns, bank statements and other documents.

It also delivers transactional data like biweekly salary deposits. No other company does both. A couple provide financial data sets, but not original documents.

Orion’s critical insight is that this is a great online business model… for five years into the future. But for now…?

Orion says that at least $100 billion in mortgage loans every year require original documents – electronic or the old-fashioned hard copy kind. The amount could be as high as $150 billion.

Plenty of Room for Growth

Only Fannie Mae has made the transition from original documents to transactional data sets. Freddie Mac? It’s lagging one full year behind.

The VA, FHA and subprime loan servicers are trailing even further behind. It’s going to take them about five years – perhaps more – to make this transition.

Now, admittedly, Fannie Mae backs the vast majority of loans. But, let me repeat, all those other loans amount to more than $100 billion… every year.

Most brokers and lenders would prefer a service that covers the entire spectrum of loans, not just Fannie Mae loans. Makes sense, right?

This is especially important to the 16,000-plus smaller brokers and lenders who like to keep things simple. They can’t afford – and don’t want to spend the time to figure out – expensive integrated solutions.

They need original electronic documents to serve a significant portion of their clientele. Which means that Lendsnap’s handful of wannabe competitors doesn’t cut it.

A Unique Value Proposition

Only Lendsnap is bridging the present and the future by delivering original electronic documents AND data sets.

It’s the only company offering a streamlined service allowing brokers and lenders to sign themselves up online and start in a single day.

No other company delivers actual electronic statements straight from source institutions like Bank of America, TurboTax, Chase and many others – more than 600 institutions in all.

And the cybersecurity – as it absolutely has to be – is state of the art. Lendsnap has securely encrypted its data when it’s “at rest” (with 256-bit AES) and “in transfer” (using SSL and TLS).

Lendsnap offers a turnkey solution that can be used right away. All lenders need is a web browser to access the web app to be up and running within the first 24 hours of signing on.

Editor’s Note: Other companies claim to offer similar services. But I’ve done my research, and they actually don’t. Two of them did a live demo of their services last December, but it turns out it was simulated, not really live. A couple of others claim to access original documents, but, again, they actually don’t. There are sure to be more pretenders as Lendsnap forges ahead with its proven technology.

Our Investment Criteria

So let’s go through the investing criteria we always use and then we’ll discuss the deal terms.

Market. Lendsnap is targeting some 998,000 mortgage origination workers. If the company charges them $15 per loan application, and if it does about 24 loan applications per month, that comes to an annual addressable market of $4.3 billion.

Lendsnap is aiming to serve 2% to 4% of these brokers and originators within five years, which would allow it to generate annual revenue of around $70 million. Very doable.

By the way, there is a lot of room for expansion into other services. Taking one thing at a time, this market alone is more than big enough to sustain an extended period of rapid revenue growth.

Need. There’s a $15 billion labor problem. Brokers spend a third of their time chasing down documents. And four out of five people stop after doing only one application when seeking a home loan. A big reason? The time and effort involved in providing documentation.

Solution. Lendsnap’s service shaves off 90% of the time it takes to document loans. Its product will also improve with future iterations. So far, it has no dropouts among users.

Our conclusion? Lendsnap has achieved early market fit. One customer says, “Lendsnap has

improved our signed application conversion almost overnight.”

Another satisfied client says, “Lendsnap has been a great tool… providing a secure, convenient and simple interface for consumers to provide sensitive information quickly.”

Monetization. The company has been experimenting with different fee structures to figure out which one works best. For some clients, it’s been charging a flat fee of $100 per loan officer per month. For other clients, it’s been charging $15 for every new application completed on its platform.

The experimentation will continue. As Lendsnap brings on bigger lenders, I expect this fee structure to evolve and include several options for customers to choose from.

Competition. Other companies are playing catch-up. Lendsnap leads the pack with a lightweight service tailored for the majority – some 80% – of loans handled by mortgage brokers and lenders. The company has a sizable lead, one that represents an attractive competitive edge to investors.

Traction. The company is just starting to make money. It handled 217 applications in April and projects 250 for May.

Capital efficiency. Lendsnap has a reasonable burn rate of $25,000 a month. That will increase as the company goes from being pre-traction to growing revenues and hiring more people. New hires alone will increase personnel expenses to about $120,000 a month within five months after the company’s current raise ends.

That said, a SaaS (Software as a Service) business model is relatively light on expenses, and that should be the case here.

Scalability. This is the beauty of SaaS. As customers and revenues scale, expenses grow much more slowly. Lendsnap’s customers – mortgage brokers, lenders and banks – have become increasingly competitive with each other as margins have shrunk and costs have risen. Those customers will be placing a premium on lower costs. All the ingredients are present for scalability to take place.

Price. With Lendsnap’s $6 million cap, you’re buying future shares at a fair price. Think of it this way: If the next round is $12 million, with a $6 million cap you’re getting a discount of 50%. And if it’s lower than $6 million, you get an automatic 15% discount.

Leadership. Orion, Lendsnap’s founder and CEO, has real estate flowing in his veins. At the dinner table while growing up, young Orion was most excited to hear his father talking about his latest property coup. His father owned more than 180 rental properties, and Orion simply wanted to follow in his footsteps.

As a teenager, Orion bought mobile homes. Wanting more diverse business experience, he grew sales of an electronics maker to $25 million before returning to his first “love” and launching Lendsnap in 2014.

His co-founder, Mike Romano, has 14 years of experience as an asset manager and loan officer with Wells Fargo, including a stint as mortgage banking leader at Wells Fargo Home Mortgage.

As I mentioned before, I’ve had several conversations with Orion. He impressed me with his knowledge of the mortgage lending sector and his strongly held views of how it’s adapting (and failing to adapt) to technological advances. I believe that Mike and Orion make an exceptionally strong founding team.

An Opportunity Whose Time Has Come

Just a few years ago, Lendsnap would have had no market, no demand, no reason for being.

That’s not my view. It’s Orion’s. It took Rocket Mortgage (built on technology recently licensed by Quicken Loans) to change the way lenders think about their customers.

Though they used to say “our customers won’t like doing this,” lenders are now viewing online lending as a growing and unstoppable trend among homebuyers.

And not just for millennials. While 43% of the first-time buyers that used Rocket Mortgage were 35 or younger, 57% were over the age of 35.

By the way, Rocket Mortgage is not a competitor. It provides its online service directly to consumers. It ignores the thousands of brokers and lenders who could also use – and would be very willing to pay for – similar enabling technology.

Quicken Loans serves about 4% of the mortgage market. Lendsnap wants to take care of the remaining 96% by acquiring these lenders and brokers as customers.

We believe that its timing is spot-on, taking into account both sides of the market… For lenders, the cost to originate a loan has skyrocketed thanks to increased regulation and, yes, the need for more borrower documentation.

On the consumer side, consumers are less willing than ever to put up with anything that leads to frustration and pain. Mortgage loans certainly qualify.

At long last, the mortgage industry can look toward the future and finally take advantage of the technology its customers really want.

Ranked as one of the top 25 startups transforming the mortgage industry by CB Insights, Lendsnap is leading the charge to bring account-linking technology to mortgage lending. It’s a huge opportunity – for the company, certainly, but also for you.

How to Invest

Lendsnap is raising up to $2 million on the SeedInvest website. Here’s how to invest.

If you’ve already registered with SeedInvest…

- Go directly to the Lendsnap listing seed, then click on the blue box labeled “Invest.”

- You will then be asked a series of quick and easy questions to execute your investment.

- The first one is “how much do you wish to invest?” Lendsnap has set the minimum investment at $500. You can invest more, but you can’t invest less.

If you’re not registered with SeedInvest…

- Go to www.seedinvest.com and click“Sign up.”

- Once registered, search for “Lendsnap.”

By the way, you’ll be making a loan to Lendsnap through SeedInvest’s Crowd Note. For information on how it works, here’s a quote from Lendsnap’s documents…

If there is a qualified equity financing (and only a financing using preferred shares will count for this purpose), the conversion price will be set for conversion into non-voting shares of a to-be-determined class of preferred stock. Only major investors will have their notes converted at this time, notes held by non-major investors will only convert at the sole discretion of the company or in the event of subsequent corporate transaction.

SeedInvest has told us this means that for major investors, the company is required to convert shares into equity at the next round of equity financing. For crowdfunders, it’s optional. Why?

Shares can’t be cashed out until a liquidity event occurs anyway. So a Crowd Note simply merges equity conversion and a liquidity event. The shares are worth the same amount as if they were converted earlier. Or, put another way, the price of the shares is exactly the same for major investors and non-major investors alike. Besides not getting share voting and some other rights, which is not a big deal, I see no downside to doing it this way.

If they are converted at less than a $6 million valuation, you get an automatic 15% discount, meaning you get a 15% lower price than later investors.

Finally, the 3% interest you earn is paid when your note is converted into equity (and not on a quarterly basis).

If you encounter difficulty at any point in the process, all you have to do is click on the “Chat with Us” link on the SeedInvest site. It’s on every page as you go through the application process.

How You Can Help

If you can introduce Lendsnap to retail mortgage lenders, including brokers and credit unions, please contact CEO Orion Parrott at orion@lendsnap.com.

If you can introduce Lendsnap to accredited investors you think would be interested, please do so using the same email.

We always try to add value to our portfolio companies. Of course, this step is optional.

Risks

Like all early-stage companies, there is a risk that the business won’t succeed. It could run out of money or fail to attract enough customers. While we’re confident in the company’s ability to execute, we don’t want you to invest any money (in this or any other startup) you can’t afford to lose or will need in the near future.

Deal Summary

Valuation: $6 million cap

Security: Crowd Note

Maximum amount to be raised: $1,000,000

Currently raised: $626,000

Minimum investment: $500

Discount: 15%

Interest: 3%

Fundraise period: Ends June 26, 2017

Playbook

Equity Crowdfunding Playbook Part 6

When Valuations Matter (And When They Don’t)

Editor’s Note: This is Part 6 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them here.

What price do you put on a young company that has not yet begun selling its product?

It’s a tough question. There’s so little to go on at such an early stage of development.

As an early investor, you don’t have to determine price. But you do have to decide whether the price or valuation you’re getting is fair.

If it’s fair, you can take one concern off the table.

If it’s high, you’ve got a problem, especially if you really like everything else about the company.

Before I dive into determining valuation, I need to dispel three common myths about valuation…

- Founders decide what price their companies are worth. It’s not up to founders. When they raise funds from professional venture capitalists and angel investors, they enter into negotiations with them to determine a valuation. Unless their startup is really hot, they’re usually not the dominant voice.

- Founders seek the highest possible valuations for their companies. Some do, but the smart ones know it’s better not to overshoot. High valuations create high expectations. If not met, the next round could turn into a “down round.” Down rounds go for less than the previous round, which is every founder’s nightmare. A founder wants their valuation to increase from round to round, reflecting the progress the startup has made.

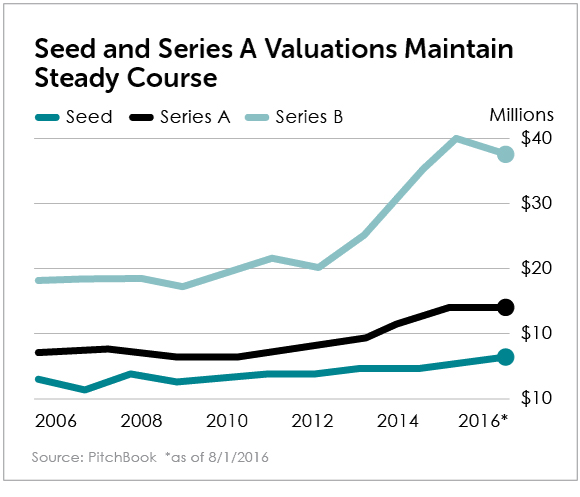

- Startup valuations go up and down with the public stock market. Not really. For example, the Nasdaq rose more than 40% in 2016. Seed companies? Their valuations rose 10%. And Series A companies’ valuations were flat.

Take a look at this chart…

Now look at 2007.

Remember that horrible year? The Nasdaq plunged 55%. But seed companies actually rose in valuation. And Series B companies’ valuations were flat.

At best, we can say a bull stock market encourages optimism in equity investments, which eventually seeps into the private startup market.

A bear stock market can dampen sentiment of early investors at some point, putting a lower ceiling on prices.

But startup valuations do NOT move in lockstep with public stocks. (By the way, that’s a good thing. A startup portfolio injects some much-needed diversification into your equity investments.)

Now, let’s address the two critical questions about valuation…

How is valuation determined? And how do you assess what is fair or reasonable?

Determining the Valuations of Young Startups

Investors have come up with several ways to determine valuation. Some are better than others. Here are the main ones…

Cost Approach. How much would it cost to build or recreate the company? Sounds good in theory, right? But how do you put a price on experience, technical expertise and the networks the company nurtured? Estimates from this approach tend to undervalue a company’s worth.

Income Approach. Also sometimes called the “Earnings Approach,” this is based on what an investor would pay now (present value) for the cash flow they expect the company will generate in the future. Analysts usually perform a discounted cash flow for this approach. (The calculations can be complex. For a detailed explanation of how the math works, go to Investopedia.com and search for “Discounted Cash Flow [DCF].”)

The problem with this approach?

You need to accurately forecast future income or earnings. For early-stage companies, this ranges from difficult to nearly impossible. I’ve been given plenty of projected revenue forecasts from early-stage companies, and I’ve taken every one with a grain of salt. They’re a window into what a founder hopes to achieve and nothing more.

Assets Approach. This is also called “Liquidation Value Approach.” The best thing about this approach is its simplicity: Assets minus liabilities. If it’s a fire sale, then the amount for which the assets of the company can be sold goes down precipitously.

A company should be worth more than the sum of its assets. So, as with the cost approach but even more so, estimates from this approach can undervalue a company’s worth.

Market Approach. This is the best of the bunch. Your valuation is whatever a buyer would pay for the company.

And what a buyer would pay depends on the “comparables” (or comps) they find. Anybody who has bought or sold a house knows what I mean. Your realtor determines the value of your house by finding similar houses nearby.

Investors do the same thing.

They search for similar public companies, because the shares of these companies are traded every day and the prices of their shares are visible to everybody.

Connected investors can also identify similar startups when they’re privy to their latest valuations (even when they’re not publicly disclosed).

If you’re not connected? Things are getting much better, especially for crowd investors. Companies that crowdfund make their current valuations or valuation caps public on the portals where they’re listed.

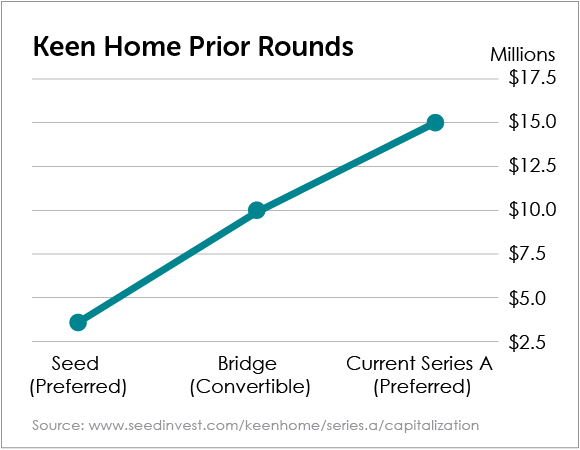

Some portals, like SeedInvest, go a step further, encouraging their listed companies to provide a history. Here’s one from Keen Home, a company we’ve recommended previously…

But even this approach is not without its flaws.

For example, if the comp has sales and the startup you’re valuating is pre-sales, you’re forced to make assumptions about future revenue, or you need to know what the comp’s valuation was at a similar pre-revenue stage.

But between public and private companies, investors can get a pretty good idea of what a startup’s valuation should be.

And the more valuations you come across on these sites, the better sense you’ll develop of what’s fair and reasonable.

How Much Value to Attach to Valuation

Clearly, valuation is tough to nail down.

It’s not a guessing game. But it’s not exactly a science either.

In which case, how much should it really matter, especially for a startup you really like?

More to the point, should a high valuation be a deal breaker?

Interestingly, some of the smartest investors say valuation doesn’t matter.

Paul Graham, uber-successful venture capitalist and co-founder of Y Combinator, says, “High returns don’t come from investing at low valuations. They come from investing in the companies that do really well.”

Warren Buffett chimes in with a similar sentiment: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Even Fred Wilson, founder of Union Square Ventures, has noted on his blog that “valuations can be fixed.”

Not So Fast…

But I say valuations do matter. Graham is technically right. If you’ve invested in a company that’s doing really well, the price you paid really doesn’t matter. For a billion-dollar Unicorn, what does it matter if the company’s valuation was $5 million or $25 million when you invested?

At either valuation, you still make out.

But what if it grew into only a $100 million company? At the higher valuation, you’ve made 4X. At the lower valuation, you’ve made 20X. Quite a difference. (To keep the math as simple as possible, I’m setting aside dilution effects.)

It’s by orders of magnitude more likely that your startup will reach a $100 million valuation than a $1 billion valuation.

And it’s by orders of magnitude more likely that your startup will reach its peak valuation far under $1 billion than far over it.

Harvesting 20X gains from your “smaller” winners is far more preferable than getting 4X returns.

There’s no reason why startup investors can’t get the best of both worlds. What I try to do is invest in wonderful companies at fair valuations.

If I think a valuation is excessive?

I definitely stop and think twice. Most of the time, I won’t invest. But every now and then, I’ll make an exception. It’s rare, but it happens.

Valuations do matter… at least, most of the time.

The ONLY Thing You Need to Know for Triple-Digit Gains

Don’t let the talking heads on TV fool you. You don’t need to look at those complicated charts… analyze price action… or even strain your eyes to examine an earnings report.

All you need to know is this fundamental law of economics to predict whether a stock is about

to soar.

To discover the single most powerful force in the markets, click here or call 844.201.1980 or 443.541.4636 and mention priority code GMTDT500.

Crowdfunding News

Marijuana Startups Tap Equity Crowdfunding

The recent influx of marijuana startups using equity crowdfunding came as a bit of a surprise to me.

None are directly selling cannabis, but they’re certainly “in” the industry.

I recently reviewed two of these startups in an article titled “Two Marijuana Startups Raising Money Now.”

This is exciting, because it hopefully means more cannabis deals are on the way… and it possibly means the banking industry is starting to loosen up “Operation Choke Point” enforcement.

Since cannabis is an industry of major interest to many subscribers of First Stage Investor, I wanted to let you know my thinking on these specific deals.

In short, a few of these deals are interesting, but I don’t like the valuations.

Interesting but Overpriced

Let’s take a quick look at HelloMD, a cannabis startup currently raising money on SeedInvest.

It’s built a nice business in California connecting patients with doctors who prescribe marijuana.

The problem is recreational marijuana is going to be legal in California next year. There will be no need for a prescription card any longer.

So the “telemedicine” part of its business is going to either change radically or go away altogether.

Due to these upcoming changes, HelloMD is “pivoting” its business. Its new mission is to become the “Amazon of cannabis.”

That’s all well and good, but the deal is priced as if its existing business isn’t going away. HelloMD is raising money at a $15 million pre-money valuation.

I hope that helps explain why I’m not recommending this deal.

Now let’s look at another cannabis startup using equity crowdfunding. (It’s one I didn’t include in the recent write-up I mentioned above, as I was still researching it at the time.)

The name of the company is Green Leaf Investment Fund. It’s raising up to $5 million on Crowdvest.co.

I’ve spoken with management and believe it has a solid business plan. The company will acquire real estate (greenhouses) and rent it to cannabis growers.

Real estate is, obviously, a big piece of the

cannabis sector. The rent money that can be generated by zoning property for cannabis far exceeds the rent that can be generated by most other uses of the space.

Green Leaf has assembled an experienced team of real estate professionals, led by CEO Douglas DiSanti, to execute the plan. And I think they’ve got a decent chance of succeeding.

However, the pre-money valuation on this deal is $6,240,000. And the company hasn’t bought a single property yet.

So while I like the concept here, the price is too high (no pun intended).

Add in the banking complications associated with the marijuana industry and uncertainty over Trump’s marijuana policy, and you can see why we decided against recommending this one.

Overall, I’m pleasantly surprised to see cannabis deals popping up. But that doesn’t mean we’re going to jump into the first ones that come along.

Successful early investing is often a patience game. So for now, we’ll stay on the sidelines and watch for a better entry point.

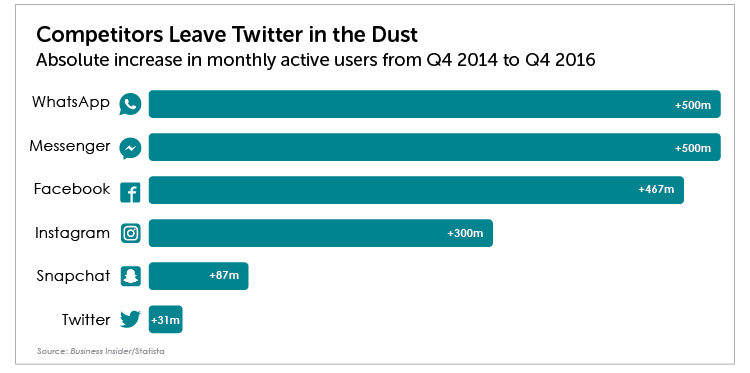

Chart of the Month

Even @realDonaldTrump Can’t Save Twitter

Watch any major news network and chances are they’re showing one of President Trump’s tweets about something.

You don’t have to have a Twitter account to see how often he tweets.

Let’s face it: At the very least, he’s helped make Twitter part of the news cycle.

Unfortunately for Twitter, even President Trump’s propensity to say something in 140 characters or less hasn’t helped the company’s growth… at least not compared to other social media titans.

According to Statista, after gaining hundreds of millions of users in its first few years, Twitter has added only 31 million monthly active users over the past two years.

As you can see in the chart below, this is way behind Facebook, Instagram and even the recently IPO’d Snapchat.

Yes, Facebook has a much larger suite of services than Twitter, and Twitter does serve a much smaller niche than Facebook.

But, according to Business Insider, the company appears to be in a prolonged rut.

In its early days, Twitter’s “140 characters or less” model was so unique and so different, companies like Facebook worked fast to develop more services to stay one step ahead.

Twitter hasn’t strayed from its model, and it’s now paying the price. When investing in early-stage companies, it’s important to seek out companies that have the ability to evolve to stay ahead of the competition.

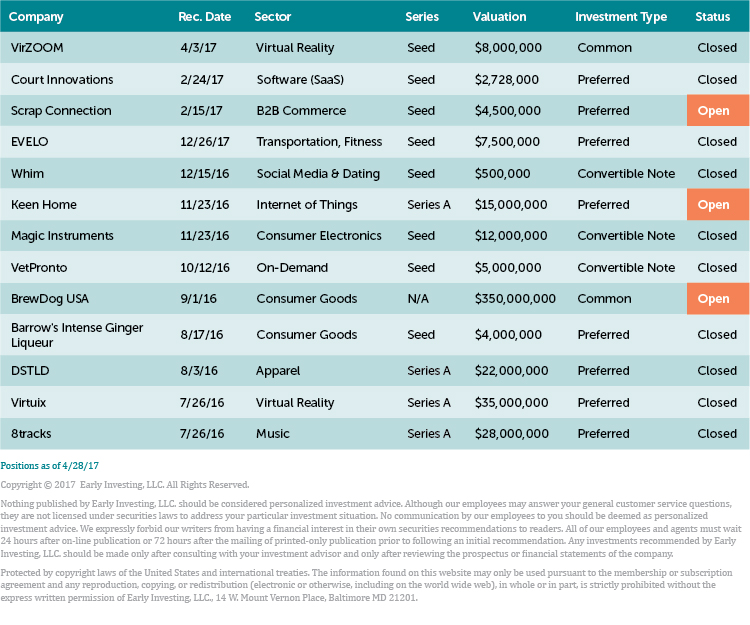

Portfolio Review

May Portfolio Review

There have been developments in two of our portfolio companies this month, from increased revenue to voice-activated integration.

As a reminder, you can see the entire First Stage Investor portfolio here.

Let’s take a look.

VetPronto

Our favorite on-demand pet care company had revenue of $83,084 in March. In fact, overall revenue is up 32% since last December (when we last checked in on VetPronto).

But VetPronto’s March revenue was down slightly from February.

Founder and CEO Joe Waltman told us…

This was due to spring break (as in, people don’t need the vet when they are out of town) as well as some significant cuts (about $10K) that were made to paid acquisition channels.

While the cuts hurt a little bit in the short term, they will allow us to decrease our acquisition costs significantly.

We have started focusing on proven customer acquisition methods in existing and new markets.

We continue to be encouraged by VetPronto’s overall growth and expansion.

Keen Home

When we last checked in on Keen Home back in February, its team described 2016 as “a year of major milestones.”

These milestones included shipping 30,000 units, appearing on Shark Tank for an update and announcing its Smart Filter.

So far in 2017, Keen Home has continued that trajectory by accelerating its pre-order fulfillment and previewing new features to look forward to.

In an email to us, the company stated…

We have shipped out the first third of pre-orders to customers who ordered between June 21 and August 8, 2016. That’s a whole lot of happy people who now have Smart Vents in their homes.

Our next wave of shipments will cover orders placed between August 9 and mid-October, and we expect to have these units all shipped out in the next three to four weeks. The remaining 2016 pre-orders will ship by May.

We will start fulfilling orders placed after January 1 in May and will fulfill all pre-orders by this July.

The company also told us that it continues to get a lot of questions about what its next projects will be.

The company’s biggest initiative is to integrate its products with Amazon’s Alexa (on schedule for this summer). It’s also rolling out Keen SenseTM to compliment ecobee (Honeywell’s Lyric platform).

Since starting work on our integration with ecobee, we have been exploring the possibility of integrating remote sensors into our platform. Ecobee’s wireless room sensors communicating with Smart Vents results in true autonomous room-by-room thermostat functionality and benefits from our new Temperature Limits™ feature.

We want every Smart Vent user to benefit from truly autonomous airflow control, no matter what thermostat they have, so our team has been working on new hardware and the software architecture to support such functionality system-wide.

PRIVATE WEALTH SEMINARS 2017

Four Seasons Resort Rancho Encantado | Santa Fe, New Mexico | September 25-26

Our friends at The Oxford Club are holding a special seminar this September, and our very own Adam Sharp has been invited to speak! He and a superb team of experts and analysts will tackle what four years under President Trump likely means for the markets.

They’ll reveal the sectors that stand to benefit the most, and they’ll give details on the companies they expect to skyrocket in 2017.

This year, you’ll also hear from a number of Oxford Club experts, including Chief Investment Strategist Alexander Green, Chief Income Strategist Marc Lichtenfeld, Bond Strategist Steve McDonald, Energy and Infrastructure Strategist Dave Fessler and others!

Please join us for an incredible experience that will enrich your mind and strengthen your portfolio. Click here to get the details – and to save an additional $300 on registration.