Crypto Market Musings

- It’s been a relatively calm week for crypto. Bitcoin is up 1.73% over the last seven days as of this writing. Ethereum is up 3.54% over the same period. Monero is down 1.93%.

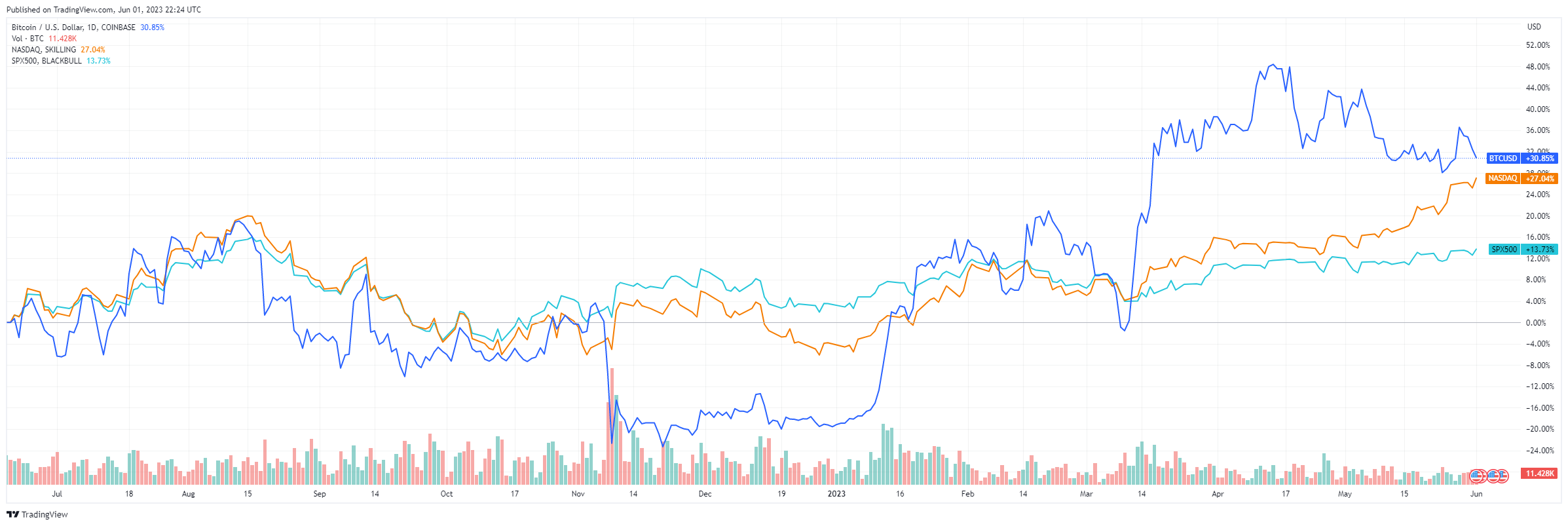

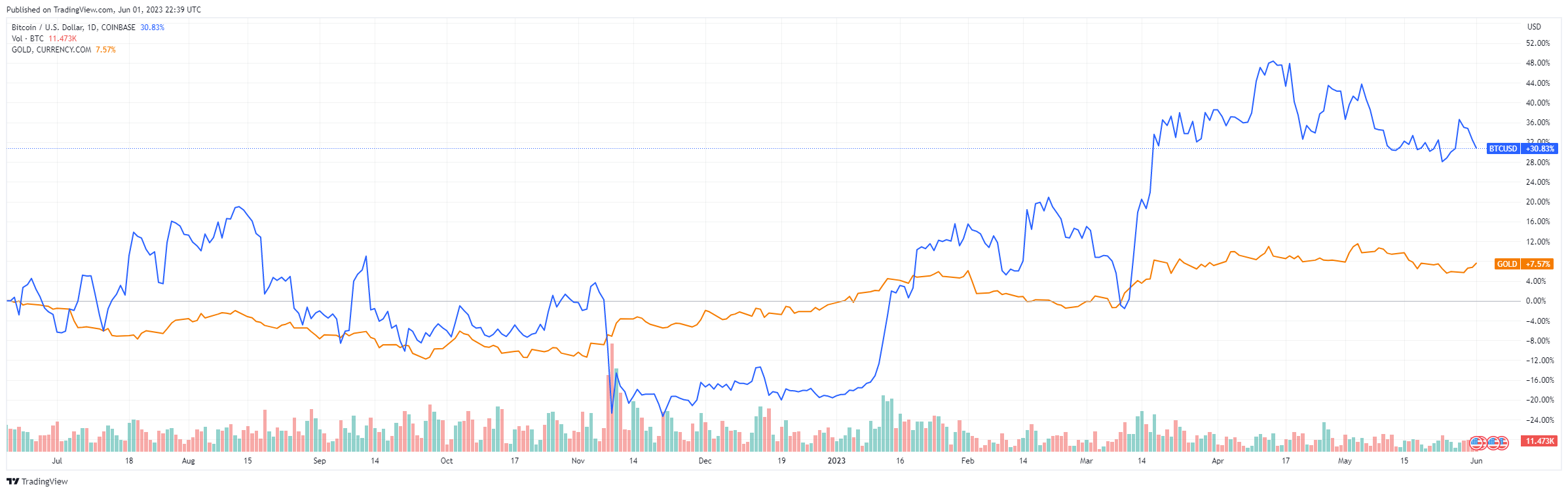

- Crypto has largely decoupled from the Nasdaq and the S&P 500 and become more correlated with gold. The charts below show bitcoin (dark blue line) moving out of sync with the stock markets and more in sync with gold.

BTC Decouples From Stock Markets

BTC and Gold

- I believe that what happens with interest rates for the rest of the year will determine what happens next for crypto and when the next crypto bull market begins. Right now, the Federal Reserve is signaling it might skip an interest rate hike in June even if we get bad inflation news. Just remember that skipping is different from pausing. Skipping means the Fed maintains the option to resume interest rate hikes as soon as July if inflation is still going up. Pausing means the Fed will stop raising rates for at least a couple of months. If the Fed gets inflation under control and begins cutting rates (and that’s a big if) later in the year, it should increase liquidity. And I believe that’s the most likely trigger for the next crypto bull run.

What Vin Is Thinking About

There are two ways to look at bitcoin decoupling from stocks and tracking more closely with gold.

- Bitcoin has resumed its role as a flight to safety. And as investors consider the possibility that inflation will remain a problem for some time and/or that we’ll see a recession in the coming months, they’re moving their money into bitcoin because it’s an alternative store of value.

- AI has juiced the broader equity markets. But without a similar catalyst, the crypto markets are largely stuck in place right now.

I’m more inclined to buy the AI argument right now. Last month, Société Générale S.A. strategist Manish Kabra noted that “without the AI-popular stocks, S&P 500 would be down 2% this year.”

Instead, the S&P 500 is up more than 10% for the year. The AI bubble is real. And that means that the macro conditions crypto is struggling with are still affecting the equities markets.

And Finally…

Keep an eye on Litecoin. It’s up more than 8% over the last seven days and has a halving event in August that could send its price even higher.