Clearing Up Cryptocurrency Wallets

In the cryptocurrency (or “crypto” for short) world, coins and tokens are held in wallets.

Think of a crypto wallet like a bank account for your digital assets. But, unlike a traditional bank account that holds traditional currency, a crypto wallet allows you to take full control of your own assets.

This means you don’t have to put your trust in a bank. It’s one of the features that makes crypto so disruptive.

So how do you get started?

There are hundreds of different crypto wallets available, but I’m going to cover the ones I’ve used personally and am most familiar with.

Wallet Basics

Each wallet has a unique address associated with it. Here’s what a public wallet address looks like:

1PUA99Fyco1hQRpwwmstfDP2xmvZMyAiK8

This is a public address, meaning you don’t have to keep it secret. Anyone can send coins to that address if you provide it to them.

What you do need to keep secret, however, is the private key to that wallet.

A private key is like a very long password that determines ownership of your crypto assets. It “unlocks” your coins. Whoever owns the private keys to a wallet controls any cryptocurrency contained within.

Even if you don’t own a lot of crypto today, you should take wallet security seriously, because your coins may be worth a lot more in the future.

There are many different kinds of wallets. Each is accessible in a different way. Here are the pros and cons of the most popular types.

No. 1: Exchange Wallets (Beginner)

With exchange wallets, you hold your coins on a crypto exchange, such as Coinbase.com or Bittrex.com.

If you choose this method, you’re putting your trust in the exchange. It holds your private keys.

The exchanges we recommended to First Stage Investor subscribers, Coinbase and Bittrex, both have top-notch security. They keep the majority of coins in what’s called “cold storage.”

Cold storage is when coins are kept on a hardware device, such as a secure USB memory stick, that’s not connected to the internet, is encrypted, and is geographically distributed in safes and vaults to minimize risk.

That means it’s nearly impossible to steal.

You can leave your coins on exchanges, but it’s important to realize that if you do, you don’t have full control of your assets.

You are trusting the exchange to secure your assets for you.

Keeping your coins in an exchange wallet may be the best option if you…

- Frequently get computer viruses

- Often lose things

- Cannot figure out the other options.

If you choose to store your coins on an exchange, I strongly recommend using two-factor authentication (2FA).

This means that when you log in to your account, you need to enter a password and a second code. This secondary code is either sent via text to your phone or pulled from an authentication app such as Google Authenticator or Authy. (Versions are available for both Android and Apple phones.)

You can run these apps on your phone and scan a code provided by the exchange when you enable 2FA. Every time you log in, you’ll be asked for a code, which the app will give you.

So even in the extremely rare instance that someone gets a hold of your password, they still need the second code to access your account.

Always use very long, completely random passwords. A password with 16-plus random characters and numbers is strong.

Write them down and store them in safe places. Make sure they’re unique passwords. Never reuse passwords associated with your email account, traditional banking accounts or other frequently visited sites.

No. 2: Hardware Wallets (Beginner)

The safest way to store your coins is offline in a hardware wallet.

In my opinion, this is the best option for most people. These are quick and easy to set up and offer excellent security.

A hardware wallet is a small specialized USB device. The primary benefit of using a hardware wallet is that these devices can be stored offline.

And once they’re not connected to the internet, even the most sophisticated hackers can’t get to them.

Here’s what the popular Ledger Nano wallet looks like.

Besides the Ledger Nano, the other top-rated hardware wallet is the Trezor.

Both have had extensive security testing and retail for around $100.

If you don’t have a hardware wallet, here are the official sites where you can buy the Ledger Nano and Trezor, respectively:

Both companies make it quick and easy to move your coins onto the unit. Simply follow the guide, then find a very secure place to store your new wallet.

Both wallets support the most popular crypto assets and are adding new coins every day.

If you own coins that aren’t supported by these hardware wallets, you may need to keep them on a coin-specific wallet (see below) or on an exchange.

If you have a large crypto portfolio, I recommend storing it across multiple hardware wallets in multiple locations.

No. 3: Online and Mobile Wallets (Intermediate)

Online wallets are another option for beginners.

They can offer advanced features not available on exchange wallets, such as the ability to invest in initial coin offerings (ICOs).

If that’s something you’re interested in, this section is for you.

The online wallet I’m most familiar and comfortable with is MyEtherWallet.com. I have used it to invest in multiple ICOs and was quite happy with this free service. MyEtherWallet is widely used and open source, which means its security is battle-tested.

The site takes a little getting used to, but the basic functionality is the same as an exchange like Coinbase. You can send and receive dozens of different cryptocurrencies securely.

In addition, you can invest in new crypto offerings using this service.

If you do decide to invest in ICOs, be sure to follow the instructions very carefully. Each ICO is unique and requires significant homework.

Mobile wallets are also quite popular, but I personally haven’t found a need for them yet and would rather not store my coins on the phone I carry with me everywhere.

I believe mobile wallets will eventually be a more attractive option, but for now I recommend avoiding them unless you have no other options.

No. 4: Coin-Specific Wallets (Advanced)

Note: Coin-specific wallets are only good options if you’re technically advanced.

All respectable coins have a dedicated wallet you can download and run on your computer and/or phone.

However, I do not recommend using this option unless you have a powerful computer and are very comfortable running complex programs.

Also, if you go this route, you will need a separate program for each coin, something that can be a pain in the neck.

Running a coin-specific wallet does have certain advantages. For example, with our recommendation New Economy Movement, in order to “harvest” (collect “dividends” on your coins), you need to run the official NEM wallet.

The other reason you might want to run a coin-specific wallet would be if some of your coins aren’t supported by hardware wallets.

In this case, I always try to run the light version of the wallet. (Most coins will have two primary options: full node or light. Choose light.)

Do not attempt to run a full crypto node unless you understand what this entails.

Remember, buying your coins on exchanges is the first step in building your crypto portfolio. Securing your portfolio on a wallet will set you up for long-term success. ■

Playbook

Equity Crowdfunding Playbook Part 10

CF vs. Reg. A+: Which Is the Better Investment Opportunity?

Editor’s Note: This is Part 10 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them here: www.earlyinvesting.com/playbook/.

We’ve made 20 startup recommendations for our First Stage Investor portfolio.

The majority of those raised funds under Regulation Crowdfunding rules. Five raised under Regulation A+ rules.

As a refresher, Reg. CF companies can raise up to $1 million. Reg. A+ companies can raise much more – up to $50 million – in slightly later rounds than Reg. CF startups.

Now, don’t be fooled by the breakdown in our First Stage Investor portfolio.

It doesn’t mean we prefer Reg. CF companies over Reg. A+ ones.

At the moment, there are simply more Reg. CF deals available.

But suppose the deal flow were split 50-50. Would we lean more toward Reg. CF startups or Reg. A+ ones?

This is the question I’m going to address today by asking…

What are the differences?

And is one a better investment opportunity than the other?

Small Cap vs. Large Cap

The difference between these two groups is somewhat similar to the difference between small cap and large cap stocks.

As you know, it’s not just the capitalizations (or, for startups, valuations) that distinguish these two groups.

It’s a number of factors ranging from growth to risk.

The same goes for startups.

For diversification purposes, I like having both in our startup portfolio.

But I do have a preference.

And I’ll tell you what it is… after we’ve gone over the main differences.

Series

Reg. CF companies are almost always seed.

Reg. A+ companies are almost always Series A. (That’s just a coincidence – there’s no relation between the A’s.)

Reg. A+ companies are older and further along than Reg. CF companies. So they have more of a track record and more information to help you evaluate their strengths and weaknesses.

You can also read a Reg. A+ company’s “offering circular.”

These documents range in length from 50 to 200 pages and break down revenue, costs, assets and growth numbers. Risks are spelled out and capital structure is detailed.

Lots of good information there.

With seed investing, information is scarcer.

You can read the Form C’s they’re required to file with the U.S. Securities and Exchange Commission.

These forms are somewhat bare bones, but they do provide some basics, including the number of employees, the type and number of shares offered, total assets, cash reserves, debt, cost of goods, and net income.

The bottom line here is that with Reg. CF companies, you’ll have to dig deeper for clues to future success, and those clues can be murky and faint.

The clues for Reg. A+ companies are usually clearer and stronger.

But remember this: Though Reg. A+ companies are a bit more mature than seed companies, they are still extremely young.

Predicting their future performance is a bit like examining an 8-year-old to determine what kind of adult they’ll turn into.

Evaluating a seed company is more like looking at a 5-year-old.

Psychologists will tell you lots of traits are established at age 5. But you have to know what to look for. It’s not obvious.

Track Record

Like Warren Buffett, you want to see a record of growing profits. The longer, the better.

But these are early-stage startups we’re talking about. We’re looking for revenue growth, not profits. (Profits are likely years away.)

Some early-stage investors insist on revenue growth – a reasonable demand for Series A companies.

(I make exceptions here and there, but I have to be very sure that the company is so outstanding in other ways that it deserves to be an exception.)

And seed companies?

Their ability to generate revenue very early is a welcome signal.

But their inability to generate revenue is NOT necessarily a negative signal.

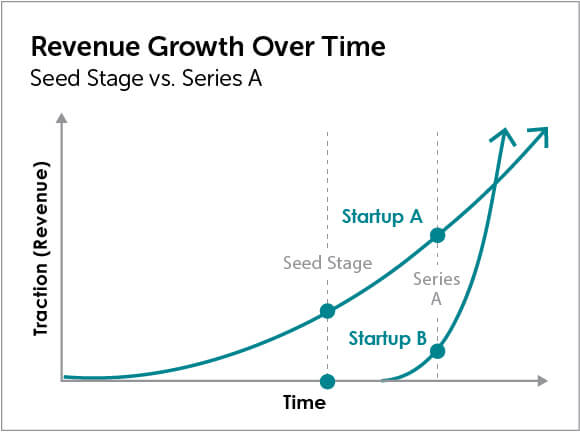

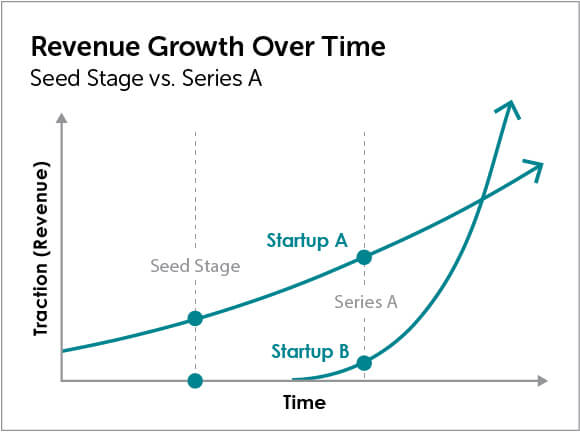

At the seed stage, if you’re looking at revenue, you would choose Startup A over Startup B.

That’s because Startup A has begun generating revenue, and Startup B shows no revenue.

At Series A, Startup A continues to have the better-looking revenue.

But when we extend the time horizon, the picture shows something quite different. Startup B has far more explosive revenue growth.

Lesson No. 1: Soft Metrics

As powerful a signal as revenue is, you should always look at more than just this one metric (or any single metric).

In the absence of hard numbers – which are often missing at the seed stage – there are plenty of “softer” metrics to clue you in…

Proof of concept… product/market fit… sales channels… and cost-effective customer acquisition strategy, just to name a few.

These softer metrics can provide important clues to a company’s growth potential.

Lesson No. 2: Certainty vs. Uncertainty

Let me remind you of something you already know: You’re never going to get 100% certainty with any kind of investing.

So here’s lesson No. 2…

In thinking about track record, you’re not comparing certainty (A+) and uncertainty (CF).

For Series A companies, for example, pivots could still happen. New companies could steal market share.

Leadership teams could prove better able to grow revenue from $500K to $1 million than from $50 million to $100 million.

Future revenue growth is still a tough call. And future profitability even more so.

With seed companies, you aren’t dealing with 100% uncertainty – though with the dearth of hard metrics, it may sometimes feel that way…

The team is untested. The product often unfinished. The marketing and growth strategies still in their formative stages.

What you’re really comparing is different levels and degrees of uncertainty.

At the Series A stage, more is known, and less research and expertise are required.

Investors can usually make better decisions with less work.

But for those very same reasons, you’re also more likely to invest in consensus choices that carry higher price tags.

The upside is less exciting compared to seed opportunities.

That’s the trade-off in a nutshell.

Runway to Liquidity

The less time you need to wait to cash out, the better, right?

As with many things “startup,” it’s not that simple.

Founders acquiescing to “early” buyouts can leave a lot of money on the table… for themselves and their investors.

What would Instagram be worth today as an independent startup? What about Cruise? Or Oculus Rift?

I expect to wait years when I invest this early. For me, it’s part of the package.

Big returns happen when your companies start small and grow very big… and that takes five to 10 years.

But I understand that some investors prefer cashing out sooner rather than later.

This is where the further-along Reg. A+ companies have an advantage over Reg. CF companies.

It’s now even possible for companies to go directly from fundraising under Reg. A+ to being listed on the Nasdaq and the New York Stock Exchange.

It’s a recent development and doesn’t happen frequently… yet. But in time, it will.

I’m really looking forward to more Reg. A+ companies choosing this pathway to near-instant liquidity.

Valuation

Reg. A+ companies are valuated from roughly $15 million to $40 million.

(First Stage Investor portfolio company BrewDog, at a $350 million valuation, was an exception… but well worth the price, in our opinion.)

Reg. CF companies have valuations ranging from $4 million to $20 million.

The key here is to figure out which group of companies does a better job of…

- Matching price with company accomplishments to date. (Series A companies must meet higher expectations and be more accomplished than lower-priced seed companies.)

- Setting themselves up for future success.

Risk

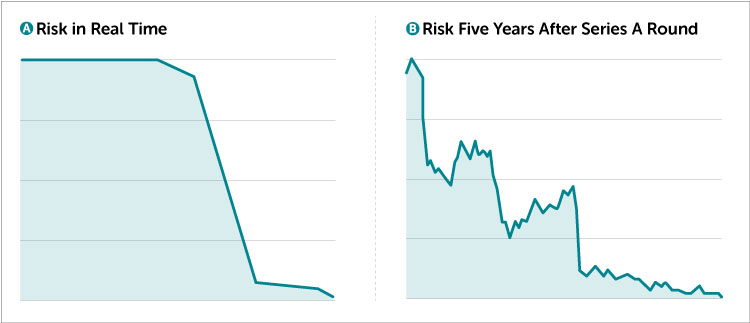

By definition, seed companies carry more risk than Series A companies.

Good founders will systematically reduce product, market and execution risk in the six months to two years it usually takes to go from seed to Series A.

In real time, risk reduction seems huge. Like section A of the chart below.

Five years after the Series A round, risk reduction looks like section B of the chart.

What looks like a huge reduction in risk from seed to Series A is really just the beginning.

It takes many years for a startup to shed a significant portion of its risk as it winds its way from Series A to B to C to D and so on.

So, time to ask the question again…

Which do I prefer, Reg. CF or Reg. A+ companies?

Honestly, I don’t have a strong preference.

But I will admit that seed rounds are more affordable (with minimums as low as $100) and play more to our strengths than Series A rounds, which require somewhat less research and expertise.

Hey, I like researching startups.

It’s a lot of fun. And Adam and I have developed a knack for it.

Then again, I love to see high-performing founders take risk off the table as they approach a Series A round – even if it’s not as much risk as it seems at the time.

Both seed and Series A rounds count as early-stage investing, and if you choose well, the upside can be amazing.

The lesson here? There’s no bad choice. ■

Chart of the Month

Chart of the Month

Startups Adapt While Retail Continues to Fade

Last August, our Co-Founder Andy Gordon noted the following…

Retail has changed forever. The retail landscape is littered with corpses. Traditional brick-and-mortar retailers have been forced to adapt or suffer the consequences. One venture capital investor puts it this way: “Everything bad that happened to media in the last decade is going to happen to retail.”

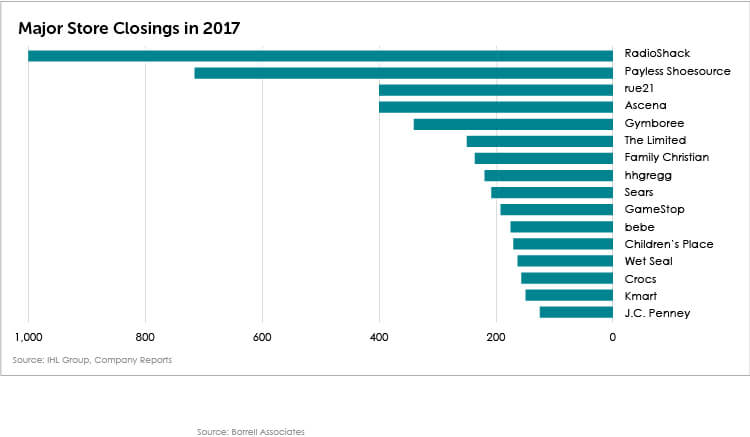

Andy was right. Nine retailers went bankrupt in 2016. This year, nine retailers declared bankruptcy by April. By the time August rolled around, many more had followed.

Just how bad is it?

There is a staggering number of retail stores planning to close hundreds of locations across the country… just in 2017!

They were once titans of the retail industry.

Now J.C. Penney is shutting down more than 130 stores… Kmart is closing more than 150… Sears is shuttering more than 200… and RadioShack is closing 1,000!

While physical retail locations continue to close, overall retail spending is on the rise. What gives?

Online retailers are rushing into the breach, scooping up all this online shopping demand… specifically in the apparel sector.

This is where startups have a huge advantage over established retailers.

They’re not weighed down by underperforming brick-and-mortar locations.

They can grow their businesses along with rapidly expanding online demand.

They can make immediate adjustments according to the ever-changing demand data they gather.

And – the killer advantage – they can charge much lower prices.

Take our recent startup recommendation DSTLD.

Its first product was what Andy called “‘three-in-one’ jeans: fashion, quality and affordability… all rolled into one extraordinary pair of jeans.”

By eliminating the middleman (retail stores), DSTLD has been able to pass considerable savings on to the consumer.

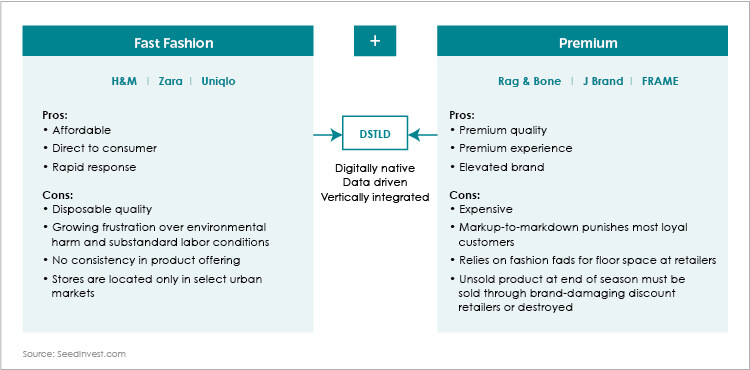

In DSTLD’s words… it combines “fast fashion affordability with premium quality and experience,” all delivered via a digital platform.

This, in addition to superb execution, has allowed DSTLD to significantly reduce risks to growth, business and profit margin in just a year’s time… increase its valuation… AND give early investors a second opportunity to scoop up equity.

Look for more and more startups to disrupt the retail space.

In DSTLD’s case, the global apparel market is $3 trillion (yes, I said TRILLION) – large enough to support several huge companies.

Like they did with DSTLD, Andy and Adam will continually seek out startups that can run lean, mean and green! ■

RETIREES: If You Own Gold, Read THIS

Gold is a great security measure for your portfolio. BUT if you’re retired and need regular income, it’s not much help.

That’s why Andy Snyder, founder of Manward Press, has developed a unique way to collect SUPERCHARGED retirement income – as much as $5,167 every month.

To see how, click here, or call 844.201.1980 or 443.541.4636 and mention priority code GMTDTA00.

Portfolio Review

October Portfolio Review

The bitcoin rally is back! And one of our startup recommendations is entertaining buyout offers.

Let’s take a look at some updates from our portfolio holdings.

As a reminder, you can see the entire First Stage Investor startup portfolio at www.earlyinvesting.com/fsi-companies/.

You can also see our cryptocurrency portfolio at www.earlyinvesting.com/fsi-cryptocurrencies/.

Bitcoin

In mid-September, the price of bitcoin dropped sharply after Chinese officials announced they would be closing most cryptocurrency exchanges.

Though bitcoin slipped to around $3,000, we told you this was no reason to panic… and definitely not a reason to sell. In fact, we called it a buying opportunity…

The last time the Chinese government banned bitcoin, it reversed the situation after only a few months. And remember, China is just a single market. Cryptocurrency is global.

It’s important that you keep the big picture in mind.

Following this correction, the cryptocurrency market will begin a new climb that will reach new highs.

The climb back up has already started.

As we suspected, investors left billions of dollars on the sidelines while patiently waiting for a major correction.

But as we also told you, more announcements from China – and elsewhere – in the next few days could very well trigger more selling.

That’s exactly what has happened.

While bitcoin is indeed rallying, some days have seen more selling than buying, pushing the price down.

Even with the overall upward trend intact, corrections will continue to occur in the cryptocurrency market.

Take advantage of them by adding to your portfolio on dips.

Napa Valley Distillery

We recommended Napa Valley Distillery (NVD) in July.

If you recall, it makes more than a dozen small-batch and limited-release spirits, including the award-winning Meyer Lemon Liqueur and Napa Vodka. It has more than 35 labels in all.

Founder and CEO Arthur Hartunian recently reached out to let us know that his expansion plans are well underway.

His food service consultants are reviewing and providing final feedback on his plans.

He’s also in the last stages of finalizing construction drawings before sending them off for government approval.

Construction should start in about three to four months.

He says, “All is going very well. We had a film crew at the distillery yesterday. Afar magazine is doing an article on ‘Makers of Napa Valley,’ so they were filming and interviewing us. It was a pretty cool experience.”

Arthur had already told me he expects the industry to consolidate.

Sure enough, he reports that a nearby brandy distillery was just sold to Gallo.

This is where the six degrees of separation come into play…

He said, “I’m not surprised. The person whose company offered to purchase a majority stake from us last year is married to a Gallo.”

Yes, you heard correctly. NVD has already turned down a big chunk of money from a buyer. The reason?

Arthur wants NVD to grow MUCH BIGGER before he entertains any buyout offers.

To accomplish that, Arthur says a big part of his budget will be going toward production and export growth.

“The future,” he says, “is going to bring many fantastic opportunities for us.” ■