In bear markets, people tend to fixate on bitcoin and ethereum when it comes to crypto. And for good reason. If bitcoin and ethereum are falling, the crypto markets are likely following their lead.

But if you look beyond bitcoin and ethereum, it’s possible to find coins that are either holding their own or actually doing well.

Shocking, I know. But it’s true. The coin I’m recommending today, Quant (QNT), has had a stellar 90 days. It’s up 169% during that period of time.

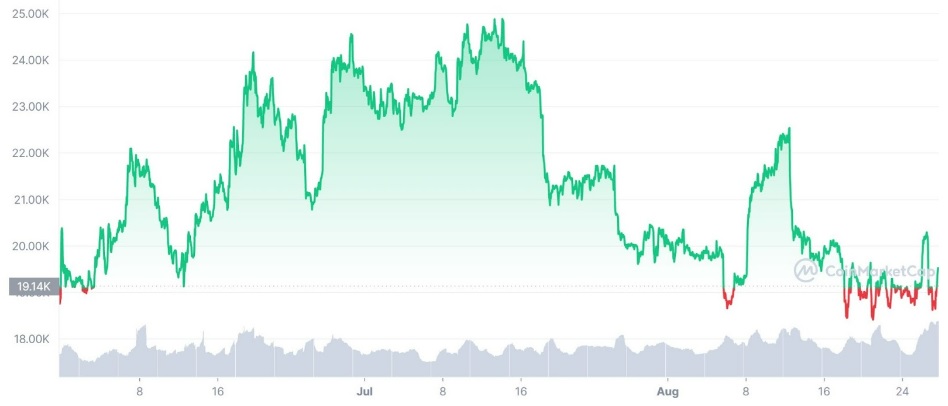

Bitcoin, by comparison, is up just 3% during the same time frame.

Do I wish I had recommended QNT three months ago? Sure. But I’m not worried about buying QNT in this spot. The bear market will catch up with it eventually, and the price will start dropping. That’s okay. Quant is a project that’s worth investing in for the long haul. And its performance over the last three months demonstrates that it has the resiliency to not only survive the bear market, but also take off when crypto’s next bull market arrives.

The Future of Decentralized Apps

Most interoperability plays allow data or assets to transfer from one chain to another. Polkadot — which I recommended earlier this year — works that way. And as I explained in my Polkadot recommendation, interoperability is a vital component of crypto’s future. Quant takes interoperability a step further with its Overledger technology.

Overledger operates by opening a series of interfaces that can “see” data from a variety of blockchains at once. Decentralized apps can then process this data without having to actually connect between chains. This dramatically speeds up the process. Apps can scale — both in terms of users and complexity of calculations — AND access data from almost any blockchain. It’s almost as if Quant is an operating system for multiple blockchains.

From decentralized apps to digital currencies, payments, supply chain management and more, there are a myriad of potential uses for Quant. It’s a powerful platform with a bright future.

Buying Strategy

If you’re going to invest in QNT, make sure you enter your position using dollar cost averaging (buying a small, fixed amount each week instead of investing everything at once). If QNT’s price starts to collapse, dollar cost averaging will allow you to enter your QNT position at a lower effective price. And if QNT keeps going up, you can pocket a tidy profit. QNT can be purchased on Coinbase.

Rules of the Road

Investing in a bear market is tricky. It is likely that the market will go down further from here. But it’s important to be opportunistic. So if you have capital to invest — and you’re psychologically and emotionally willing to enter what promises to be a highly volatile market — here are some guidelines to follow.

- Do not invest money you can’t afford to lose. The markets are in for a rough ride. And if you can’t afford to lose the money, don’t risk it.

- Focus on projects with strong use cases.

- Look for teams or communities that are active and committed to their projects.

- Always enter a position using dollar cost averaging. That means buying a small amount each week rather than buying your entire position at once. That way, if prices continue to fall, you lower your overall acquisition cost.

- Don’t try to time the market perfectly. Nobody can. And I believe this bear market will be around for several months. So if you want to wait, that’s perfectly okay. But when you do invest, make sure you utilize dollar cost averaging to buy into the market.

- Diversify your crypto portfolio. From a percentage standpoint, bitcoin and ethereum should be the biggest investments in your crypto portfolio. But you need exposure to a much broader and more diverse set of coins to take advantage of the full upside of the crypto markets. Bear markets are a good time to diversify your portfolio and increase exposure to different crypto sectors.

Remember, investing in crypto is risky. Investing in a crypto bear market carries even more risk. Less than 5% of your overall portfolio should be invested in crypto. That said, I believe Quant provides an attractive risk-reward ratio.