As regular readers know, I’ve been watching the Federal Reserve closely for many years.

After all, we’re in an unprecedented period in financial history. Never before have interest rates been held so low for so long in such a global fashion. It affects everything.

Here’s my primary takeaway from all my Fed-watching: The Fed has the power to juice markets higher at the press of a button (using lower interest rates and bond buying), and it has become intoxicated by that power.

Whenever the stock market declines, the Fed lowers interest rates, or even buys bonds to dramatically increase liquidity and keep rates low.

One of my favorite financial analysts, Sven Henrich, recently made the case incredibly well:

In March 2009, markets bottomed on the expansion of QE1, which was introduced following the initial QE1 announcement in November 2008. Every major correction since then has been met with major central bank intervention. QE2, Twist, QE3 and so on.

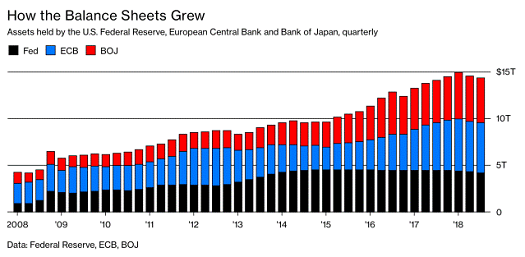

When [the] market tumbled in 2015 and 2016, global central banks embarked on the largest combined intervention effort in history to the tune of over $5 trillion between 2016 and 2017, giving us a grand total of over $15 trillion in central bank balance sheets, courtesy [of the] Federal Open Market Committee, European Central Bank and Bank of Japan:

When did global central bank balance sheets peak? Early 2018. When did global markets peak? January 2018.

Well said. The only point I would add is that the Fed also fueled the housing bubble in the early 2000s. Shockingly, The New York Times economist Paul Krugman said as much in 2002, explaining:

To fight this recession the Fed needs… soaring household spending to offset moribund business investment. [So] Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

This is why people say the Fed is too powerful. A small circle of bankers, academics and politicians can essentially choose the market’s direction. And generally speaking, they like markets to go up. So interest rates trend lower and lower.

The Fed Should Keep Raising Interest Rates, but Will It?

Fed Chairman Jerome Powell has taken a no-nonsense approach since he joined the Fed. The Fed has hiked rates steadily under his leadership and is even starting to reduce the massive $4.5 trillion of assets it has on its balance sheet (Treasury and mortgage bonds).

He knows that the Fed needs to “take away the punch bowl” and end the party. But nobody wants the party to end. Pressure is building on Powell and the Fed to pause rate hikes and quantitative tightening (selling bonds into the market). It’s coming from President Trump, Jim Cramer on CNBC and thousands of other financial talking heads.

If the Fed keeps hiking interest rates, it’s going to wreck this debt-laden market. Stocks, bonds and housing are especially vulnerable. And when stocks and home prices go down, people feel poorer. Many Americans would likely see their mortgages go underwater (again). In this type of environment, people slash personal spending, pay off debt and boost savings.

This is what everyone’s afraid of. Unfortunately, it’s the only thing that can fix this market. It’s “taking our medicine.” The market needs to be allowed to do its work, but it can’t with artificially low rates.

The Fed has two choices as I see it. It can stay the course, raising rates steadily despite the negative effect on markets. Or it can try to extend the credit bubble by keeping rates low and stop quantitative tightening indefinitely.

I believe it will choose the latter. More tightening means near-term pain, which would be extremely unpopular politically.

The Fed has proven that it will do almost anything to prevent a major correction from happening. And each time it has stepped in, it’s required even more stimulus and lower rates.

During this last cycle, the Fed kept rates near zero for an entire decade. Things are more expensive: stocks, houses, college tuition, etc. Companies that should have died are able to borrow money and shuffle on like zombies.

We’re stuck in an economic rut. It seems likely that we’re entering a recession after an amazingly long Fed-fueled bubble, and interest rates are already near rock-bottom.

Normally, the Fed would just lower rates or even initiate quantitative easing (buying bonds to increase money supply). But we’re supposed to be doing the opposite, and this current credit bubble has been going on for 10 years already.

I expect this trend to continue. That means we’re headed for negative interest rates here in the U.S. in the not-too-distant future. This path avoids short-term pain, but it guarantees greater long-term pain in the form of inflation and malinvestment.

All of this makes a solid case for cryptocurrency. We need an alternative to this insane fiat monetary system. For now, the leading contender is bitcoin.

It’s the beginning of decentralized money, and bitcoin’s true believers are dedicated to making it happen. Even if bitcoin fails somehow, others will come along until a few of them catch on.

There’s a good reason why major financial players like Fidelity are getting into crypto, along with individual investors. Many of us are convinced it’s the future of money.