A Simple Guide to Budgeting Your Startup Portfolio

Investing in startups can be downright thrilling. Young companies brimming with potential can have that effect.

However, it’s easy to get caught up in this uber-potential and invest too much in a single deal. That’s a mistake.

So, today we’re going to cover suggested guidelines to use when building your portfolio and budgeting your investments for the year.

Why is this important?

Because there’s nothing worse than having an excellent opportunity pop up and no dry powder to invest with.

We strongly recommend investing in 10 to 20 (or more) startups over time and investing no more than 5% to 10% of your portfolio in early-stage investments.

Minimum investments starting at less than $100 make it possible for every

investor to build a large and diverse portfolio of startups over time.

This was impossible to do even two years ago, so take advantage of it.

Using strategy will allow you to have a good chance at hitting a big winner… and avoid putting too much of your savings into these high-risk, high-reward assets.

Understanding Government-Imposed Limits

One aspect of equity crowdfunding that’s key to understand is how the U.S. government has imposed limits on the amount people can invest in these deals per year.

The rules are a little confusing, but that’s to be expected with government.

Here are the basics.

- Everyone can invest at least $2,200 per year in Regulation Crowdfunding deals (startups raising up to $1 million).

- If either your annual income or net worth is less than $100,000, you can invest 5% of the lesser per year.

- If your income and net worth is more than $100,000, you can invest up to 10% of whichever is lesser.

- You can combine your income and wealth with your spouse to calculate your investment limit.

- These limits don’t apply to accredited investors. (To be accredited, you need more than $200,000 in income for the last two years or a net worth of $1 million, excluding primary residence.)

- Income and wealth numbers for non-

accredited investors are “self-certified,”

meaning it’s an honor system – you don’t have to provide your private information.

If you have any questions about your personal limit, crowdfunding portals like Wefunder and SeedInvest will be able to help. Most of these sites will calculate the limit for you based on the income/wealth numbers you provide.

Even if we didn’t have these government-

imposed limitations, it would still be important to budget your startup investments.

Andy and I recommend investing approximately the same amount in every deal.

That means if your annual limit is $2,200, you should probably pass on deals where the minimum investment is $500 or $1,000.

This will be hard for some of you, but our belief is that investing $100 in 10 deals is always preferable to investing $1,000 in a single one.

Editor’s Note: For an extensive breakdown of the math and logic behind a startup portfolio, check out Part 1 of the First Stage Investor Equity Crowdfunding Playbook, “A Special Risk-Reward Equation.” You can find it here:

www.earlyinvesting.com/playbook/.

Occasionally, I will recommend investing more than your normal amount. This happened back in February with our Court Innovations recommendation.

I suggested investing two or three times your normal amount, because it was an extraordinarily good deal. (The deal has since closed.) I don’t expect this to happen often. It’s rare to see a deal as attractive as that one was.

With early-stage investing, it’s sometimes hard to tell which investments will be the outliers.

So our advice is to invest approximately the same amount in each deal, and only double up or triple up when it’s truly a rare opportunity.

Using this as a guide will significantly increase your chances of profiting handsomely from a portfolio of startup holdings.

In summary…

- Invest the same amount in most deals.

- Invest the minimum amount if your budget is small.

- Spread your investments out across at least 10 to 20 startups over time.

- Pass on high-minimum deals if making the investment would limit the number of startups you can invest in.

- Be aware of your investment budget and save some cash for extraordinary deals. (We’ll tell you when we think we’ve found one of these.)

149 companies… with an average return of 498.2%

Forget the Dow, S&P 500 and Russell 2000. Private companies are delivering record returns right now.

There are now 149-plus private companies that have achieved an exceptional $1 billion valuation. And the average gain on all of them is 498.2%…

That’s why we’ve put together a special “private placement” recommendation. It could be the most profitable opportunity we ever recommend.

To find out more, go to www.StartupInvestor7.com or call 800.683.0687 or 443.353.4254 and mention priority code GSUIT600.

Crowdfunding Update

Equity Crowdfunding Goes Mainstream

Last month I was fortunate enough to attend TechCrunch Disrupt in New York City. It’s one of the world’s premier startup conferences.

It was an illuminating event with dozens of high-quality tech startups pitching their hearts out. TechCrunch events always draw plenty of venture capitalists and angel investors, because they’re a great way to meet high-quality companies.

I’ve attended many tech conferences, but Disrupt definitely stood out.

Why? It showed me how far equity crowdfunding has come in the last year… and it validated the research Andy and I are knee-deep in each and every day.

Equity crowdfunding is no longer just a concept… it’s mainstream.

I talked with just about every startup founder at the conference, and I was surprised to learn that nine out of 10 knew about equity crowdfunding. Better yet, about half were considering using it to fund their companies.

A number of investment portals, including Netcapital.com and Republic.co, were also there doing business development. The few startups that didn’t know about equity crowdfunding certainly do now.

As I was talking with the portal representatives, one of them mentioned a few companies currently in their pipeline. I was floored. Unfortunately, I can’t share any of the companies yet, but suffice it to say it’s highly likely we’ll be seeing some excellent deals in the near future – venture capital quality opportunities.

I also managed to convince a few of my favorite startups from the conference to do an equity crowdfunding round. I expect at least a few of them will follow through, and you’ll be the first to know when they do. It felt good to see

founders’ eyes open up to a radically different way of raising capital. This is what we’ve been waiting for. Widespread adoption of investment crowdfunding is happening… and we’ve been ahead of the curve.

Last year, just before Regulation Crowdfunding launched, I wrote the following:

Starting May 16 (2016), we’ll all have the opportunity to invest as little as $100 in promising young companies.

If equity crowdfunding catches on like I believe it will, there will be a lasting and positive impact on the economy.

Capital will flow to businesses supported by the public. Jobs will be created. And diligent investors will be rewarded.

Equity crowdfunding could very well be the growth engine America needs.

Here we are just over a year later, and this has all been validated. (And Disrupt is just the tip of the iceberg.) At any given time, there are 50-plus companies raising money across more than a dozen portals.

Lawyers, startup founders and investors have all had time to get comfortable with the concept of investment crowdfunding. We’ve moved past the trailblazer stage and are moving into the early adopter phase.

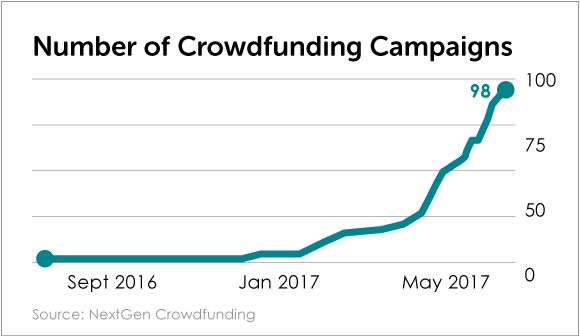

The numbers don’t lie. As of May 30 of this year, there are now 98 active crowdfunding campaigns.

This is going to be an exciting time.

More opportunities to choose from, more deals with venture capital co-investors and more free publicity for the companies raising money.

This is a dramatic change from just months ago.

Clearly, word is spreading within the startup ecosystem that there’s a new way to raise capital.

But in the grand scheme of things, we’re just getting started. We’re about to see this market take off. Stay tuned, as we have some very exciting deals coming soon.

Playbook

Equity Crowdfunding Playbook Part 7

The Portals: Where We Shop for Startups

Editor’s Note: This is Part 7 of a 12-part series called the First Stage Investor Equity Crowdfunding Playbook. If you missed the previous installments, you can find them here: www.earlyinvesting.com/playbook/.

When looking for startups, you’ll find there are dozens of online portals to choose from. Which one should you use?

Well, that’s up to you. We can only tell you what to expect from each of the ones we’ve used. We began the task back in “Part 2: Key Players in Your Startup Ecosystem.” We’ll finish it in this lesson, diving deeper into the portals’ inner workings and how well they serve the investor.

Let’s begin with what we think are two of the best online portals to use.

SeedInvest (https://www.seedinvest.com/)

- It has had more than 160 startups funded to date.

- Deal flow is highly curated.

- Its best innovation is the “crowd note,” which allows crowd investors to cash out under the same terms as larger angel investors.

SeedInvest continues to grow, innovate and offer an expanding array of diversified startup investment opportunities. Though undermanned at the moment, its staff does its best to accommodate both startups and investors. They usually succeed. One founder calls SeedInvest the “Goldman Sachs of startup portals.”

The site offers the full gamut of companies raising online: 506(b)s and 506(c)s (for accredited investors) to Regulation A+ and Regulation Crowdfunding companies (for everybody).

As a refresher, Reg. CF companies can raise up to $1 million. Reg. A+ companies can raise much more – up to $50 million in slightly later rounds than Reg. CF startups.

SeedInvest is one of the few portals to offer Reg. A+ companies. While it usually has more, at the moment SeedInvest lists only two companies raising under Reg. A+ and another two testing the waters.

As the primary portal for Reg. A+ offerings, it should be offering more. This is likely just a temporary lull. Fortunately, SeedInvest has many more Reg. CF companies raising. Right now, 16 are raising on its site (with one accepting reservations).

SeedInvest gets the investor user experience right. The company pages – where each startup describes what it does and the particulars of its raise – are nicely done.

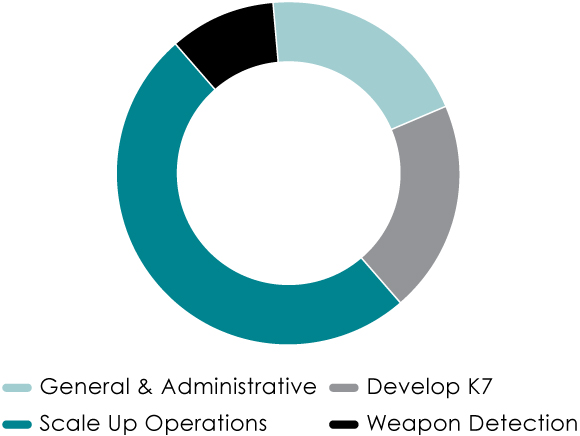

The FAQs cover everything they should, and SeedInvest keeps the explanations short and simple. “Use of proceeds” is shown with a simple circular chart, like this one taken from Knightscope’s SeedInvest page…

The pitch deck, overview video and basic terms of the raise (share price, valuation, and security type) are near the top – as they should be. As you scroll down, the company reveals itself more fully. The Q&A between interested investors and the founder is particularly robust. At the bottom is the offering circular, which you should delve into if you’re interested in the company.

We’re impressed with the overall job SeedInvest has done.

There is one concern, though – its fundraising success rate. Of the 16 Reg. CF companies raising on its site right now, five have managed to go over $500,000.

But 11 are stuck with totals less than $100,000, meaning that up to three-quarters of these companies are at risk of not reaching their minimum targets.

That’s not entirely SeedInvest’s fault. For the most part, they’re quality companies.

As the portal adds to its 120,000 active users, it will generate more investment dollars for the listed companies.

Our experience with SeedInvest has been quite positive and rewarding. When you’re looking for startups online, this portal should be one of the first you visit.

Wefunder (https://wefunder.com/)

- It’s the largest and most active startup portal.

- Its extensive connections and unparalleled fundraising abilities drive quality deal flow.

Wefunder is the premier portal for crowdfunders by most measures – dollars raised, success rate and number of successful offerings over $50,000.

It has 34 listed companies now raising under Reg. CF.

The big difference between Wefunder and SeedInvest? Wefunder does not curate. It says it’s against the rules.

In practice, that means that some of the companies it lists aren’t appealing. 10 of its currently listed startups have raised less than $18,000.

(I should add that not all startups unable to raise substantial amounts make for lousy investments. And not all startups that do well with their raises develop into good investments. I see some big miscalculations at both ends of the spectrum.)

According to Wefunder’s own statistical compilations, it has an 83% success rate of companies reaching their minimum raise targets.

Quite remarkable. Even taking into account that of those 85 successful offerings, 25 had targets of $50,000 (or less).

Thankfully, Wefunder also lists more than its fair share of top-notch startups. Six have raised more than $1 million. It also lists two companies that have raised more than $500,000, including one member of our portfolio, Scrap Connection.

Wefunder’s success in attracting high-caliber startups begins with its deep roots in the startup community. Wefunder is a graduate of the top-rated Y Combinator accelerator. Its track record as a proven fundraiser also helps.

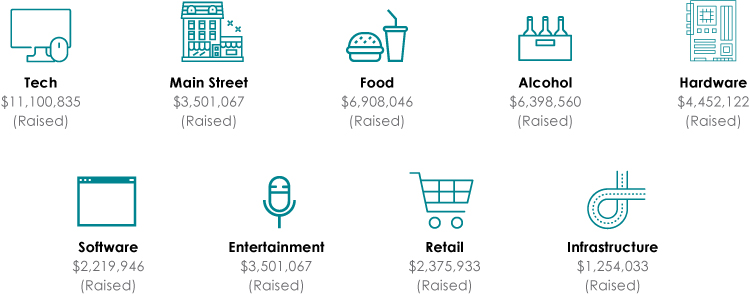

If you’re looking for diversification, Wefunder has it. It attracts companies from a multitude of sectors…

Like SeedInvest, Wefunder packs a lot of information in an easy-to-digest format on its company pages.

It enjoys a great reputation among both founders and investors – not an easy thing to do. Adam and I have worked closely with Wefunder for several years now.

Not surprisingly, a third of our recommendations come from its site.

The Rest of the Best

Netcapital (https://netcapital.com/)

Netcapital is about half a year old. And you can tell.

Since we’ve never talked about this portal before, let’s cover the basics.

Right now, it lists only seven companies. The website is nicely designed but not quite finished. Work still needs to be done.

Yet it was a no-brainer to list Netcapital among the top up-and-coming startup portals.

Two of our recommendations have listed on its site. And both (Court Innovations and VirZOOM, the latter of which is still open to investors) are outstanding opportunities we were extremely happy to add to our portfolio.

The company collects a 4.8% “success” fee from the companies it lists and no fees from investors. And you buy common shares, the same as founders.

The companies’ home pages feel friendly and informal. They provide more detail on the startups than the other portals’ company pages generally do.

Some companies that are raising $100,000 on Netcapital have target minimum amounts as low as $10K. I’m not entirely comfortable with that. In the startup world, $10,000 is essentially beer money, even in this day and age of low data storage and software costs.

Jason Frishman founded Netcapital. He’s a smart guy. He graduated summa cum laude with a degree in neuroscience from the University of Miami.

MicroVentures (https://app.microventures.com/crowdfunding)

One of the oldest startup angel investing portals, MicroVentures recently partnered with Indiegogo to offer crowdfunding investment opportunities. The joint venture is too new for me to come to any firm conclusions about it. But it’s off to a promising start.

It has listed 12 Reg. CF companies to date, and 11 have successfully fundraised. The other has just begun its fundraise.

Although it’s a small sample size, it has a 100% fundraising success rate so far.

And the sums it has raised aren’t small. Three of the raises were more than $500,000, and only one was less than $140,000.

MicroVentures’ Reg. CF home page is fine, but it’s the companies’ listed pages that really shine. The content is outstanding.

You can really dig into the market and performance. They provide a plethora of charts: quarterly revenue, annual revenue, net income, cost of goods and operating expenses.

And you don’t have to click on a link to access them. They’re right there, in full view, on the site.

If you’re like me and like going through a couple dozen startups a day, this is very welcoming.

MicroVentures prides itself on its vetting chops. The same expertise it has used in the past to invest in the secondary shares of Yelp and Twitter is now focused on early-stage companies raising under Reg. CF rules.

And these expert evaluators will have some of the most successful Indiegogo companies to choose from. It should make a powerful combination.

Republic (https://republic.co/)

Like MicroVentures, which will be getting a substantial portion of its deal flow from companies that graduate from reward-funding site Indiegogo, Republic hopes to get a big piece of its deal flow from AngelList.

AngelList is a leading portal for professional angel investors and accredited investors.

Republic hopes that some of AngelList’s startups will “top off” on its site.

This relatively new portal has successfully funded nine companies so far.

Most raised between $100,000 and $200,000. Two raised more than $200,000 and three raised less than $100,000.

It has two open fundraising companies listed at the moment. To attract a critical mass of crowd investors, it will have to increase that number.

The home page is nicely set up. You see a basic FAQ as you scroll down.

No need to click on anything. The company pages are also well put together.

My only quibble is that the companies’ Form C links get a bit lost among the ample research and information presented on the pages. (It’s on the far right halfway down the page.)

A nice benefit is the letter to investors from the founder. It’s a more brief and informal version of the letter from the CEO that sets the tone and expectations of a public company’s annual report.

There are, of course, many startup portals not covered here. In fact, we’re discovering new startup portals almost every week. Some will grow in importance. Some will fade.

But the ones we’ve shown you in our lesson today are ones you can visit NOW and use TODAY. These portals were set up to offer their services to everyday investors just like you.

We encourage you to visit the sites we’ve covered in this lesson and hopefully discover your own favorite portal.

When we provide a new startup recommendation, we will always provide details about the portal it’s listed on.

PRIVATE WEALTH SEMINARS 2017

Four Seasons Resort Rancho Encantado | Santa Fe, New Mexico | September 25-26

Our friends at The Oxford Club are holding a special seminar this September, and our very own Adam Sharp has been invited to speak! He and a superb team of experts and analysts will tackle what four years under President Trump likely means for the markets.

They’ll reveal the sectors that stand to benefit the most, and they’ll give details on the companies they expect to skyrocket in 2017.

This year, you’ll also hear from a number of Oxford Club experts, including Chief Investment Strategist Alexander Green, Chief Income Strategist Marc Lichtenfeld, Bond Strategist Steve McDonald, Energy and Infrastructure Strategist Dave Fessler and others!

Please join us for an incredible experience that will enrich your mind and strengthen your portfolio. Click here to get the details – and to save an additional $300 on registration.

Q & A With Keen Home

Innovation Making a Difference in

People’s Lives

An Interview With Keen Home Co-Founder Nayeem Hussain

We first recommended Keen Home – the exciting young startup behind a popular line of “Smart Vents” – back in October 2016.

Since then, the founders have done a great job of keeping me up to speed via email.

But it had been a while since I spoke to them directly.

So it was great to hear from Co-Founder Nayeem Hussain when he called last week. He caught me up on several topics.

As always, it was very informative. Here’s an excerpt from that conversation.

Andy: How’s your fundraise on SeedInvest going so far?

Nayeem: We’ve been very pleased with investors’ appetite for owning a piece of Keen Home.

That said, our goal is to raise at least $2 million to $3 million more, so we will be shifting our primary focus from smaller investors to larger investors and institutional funds in the coming months.

Andy: Any big surprises worth mentioning?

Nayeem: No real surprises, but we’re consistently impressed by the sophistication displayed by our investor base.

There is a steady stream of great questions and a high participation rate in company webinars and other investor events.

Andy: You’ve been fundraising for a while now. What has been your biggest lesson?

Nayeem: Communication is key. Having a steady stream of positive product-related updates builds investor confidence and also creates a buzz about the undeniable strength of your company. Every time we send a product-related email (like the one announcing our recent integration with ecobee) to prospective investors, we see a nice investment surge.

Andy: What’s keeping you busy these days?

Nayeem: Well, with the funds we’ve already raised, we brought in a new vice president of sales to help us ramp up pro channel sales.

We’ve also ordered new inventory to fill demand.

Andy: How about in the near future? What are your next steps for growing the company?

Nayeem: Post-fundraising, we’re very excited about expanding distribution to professional sales channels like utility companies, homebuilders and HVAC pros.

We’ll also be expanding our sales and engineering teams while continuing to develop new and innovative products that really enhance a home’s core functions.

Our next generation of products will feature voice integration with services like Amazon’s Alexa and Google Home.

And we’ll be launching Keen Sense™, a distributed sensor and control system that will give homeowners more control over their homes.

It doesn’t hurt that it also gives our partners better data about HVAC system performance and energy usage.

Andy: Do you have an update on when you’re closing your Regulation A+ round on SeedInvest?

Nayeem: Hard to give an exact date, but we’ll most likely keep the round open through the end of June.

After our phone conversation, Nayeem emailed me directly with some more feedback and insights.

I’ve included a snippet of his email below.

It’s a real thrill to be at the forefront of the smart home movement.

Raising money from the very people who have supported us as friends, customers, business partners and members of the tech community has only increased our resolve to drive innovation and, ultimately, help people live better lives in their homes.

Throughout this journey, we have built partnerships with billion-dollar companies like Samsung and Google, as well as billionaire investors like Robert Herjavec.

We’ve been fortunate enough to ship tens of thousands of units and receive dozens of requests and questions on a daily basis from all over the world regarding our products.

I’ll leave you with these unsolicited customer testimonials. Reading about how we’re making a difference in peoples’ lives really makes coming into work every day such a joy and privilege.

“We use Smart Vents to target cooling and heating to specific rooms instead of conditioning our whole house at once, helping cut our energy bills by almost 15%.”

– John C., York, South Carolina

“Our daughter’s room was always too cold in summer and too hot in winter. Adding Keen Home Smart Vents let us set the room to a comfortable temperature for her no matter the season.”

– Devesh B., Pennington, New Jersey

“I close vents in my dining room and living room and partially close vents in two bedrooms while leaving my bedroom wide open. I can stay comfortable at night without conditioning the whole house. I love it!”

– Richard T., Clearwater, Florida

“The ecobee integration is absolutely phenomenal. Well done!”

– Chad A., Charlotte, North Carolina

Keen Home is still an open recommendation in our portfolio.

Be sure to check out the entire First Stage Investor portfolio at www.earlyinvesting.com/fsi-companies.

Chart of the Month

Startup Community Making Hackers “WannaCry”

It’s a terrifying trend… but it could be a big positive for investors.

According to The New York Times, the massive cyberattack “WannaCry” infected more than 200,000 computers in 150 countries – all in just a matter of days.

The attack was no insignificant event.

It affected major corporations like FedEx, as well as public groups like Britain’s National Health Service.

Like the attacks on Target and Yahoo in 2015, WannaCry highlights the need for companies to integrate sophisticated cybersecurity into their business operations… or, at the very least, re-

evaluate their existing cybersecurity measures.

Folks on both sides of the aisle nodded in approval as President Trump signed the “Strengthening the Cybersecurity of Federal Networks and Critical Infrastructure” executive order on May 11.

But it’s what’s happening at the startup level that has us most excited…

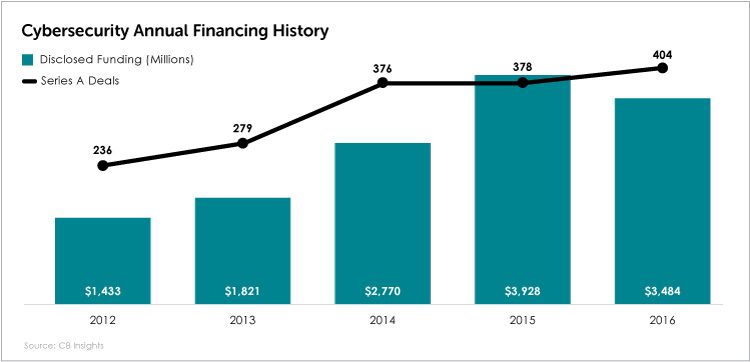

According to CB Insights, there were a record 404 funding deals for cybersecurity companies in 2016.

From 2012 to today, the number of deals secured by private cybersecurity companies has risen 71%.

This rapid increase in deal activity indicates that cybersecurity will continue to be a high-priority item for businesses and governments. And, from our vantage point, it’s proof that there’s a big opportunity for those investing in early-stage cybersecurity companies.

Hackers will continue to find ways around existing cybersecurity measures.

It’s a troubling fact, but it should ensure the landscape remains positive for cybersecurity investors.

You can expect even more private opportunities to come to the forefront in the year ahead.

Portfolio Review

June Portfolio Review

There have been new developments in some of our portfolio companies this month, including a big step forward with one of the nation’s leading mortgage loan companies.

As a reminder, you can see the entire First Stage Investor portfolio at www.earlyinvesting.com/fsi-companies/. Let’s take a look.

Lendsnap

Last month we outlined one of our newest recommendations, Lendsnap. They are developing a standalone web and mobile application that helps financial institutions quickly collect from the cloud all the financial information required to complete a mortgage application.

Lendsnap recently started working with Fannie Mae, one of the biggest mortgage buyers in the country.

According to founders Orion Parrot and Mike Romano, Lendsnap has started the process of getting approved for Fannie Mae “Day 1 Certainty.” Per Fannie Mae’s website, Day 1 Certainty™ gives lenders freedom from representations and warranties, as well as greater speed and simplicity, and enables an improved borrower experience.

They expect to start piloting with a Fannie Mae mortgage lender soon. Stay tuned for more updates.

Scrap Connection

Scrap Connection is a global platform providing B2B software solutions to companies that buy, sell or broker recyclable materials. It connects scrap professionals to facilitate trade in this $250 billion market.

We continue to be encouraged by Scrap Connection’s overall growth and expansion. It’s well on its way to hitting its $750,000 raise goal. But there’s still time to invest if you haven’t already.

Scrap Connection CEO and Founder Chris Yerbey noted that the funds the company has raised to date will be used to create new product and build its team. He also noted that its current raise will continue to remain open.

For details on the deal and how to invest, check out our original recommendation: https://earlyinvesting.com/new-recommendation-scrap-connection/.

Whim

Last December we recommended Whim, a dating app that focuses on facilitating actual dates and eliminating the back-and-forth messaging process that usually goes with online dating apps.

Whim CEO Eve Peters told us it raised $250,000 this past January, and its team has been “heads-down working on a new app called ‘Tonight.’”

According to Peters…

Tonight maintains the fundamental philosophy of getting people out to meet in real life quickly and directly, but the execution is significantly different. Based on over a year’s worth of data and feedback from Whim users, we’ve changed everything – onboarding, profile viewing and liking, the matching algorithm, the engagement notifications, incentives for date follow-through, the revenue model, the UX flow, the look and feel, the way we moderate and cohort the users, the messaging and, most importantly, the basic process of getting a date. Quite simply, Tonight eliminates the concept of planning for the week ahead and is all about meeting up with someone tonight.

Read more about Whim’s new branding on www.republic.co.

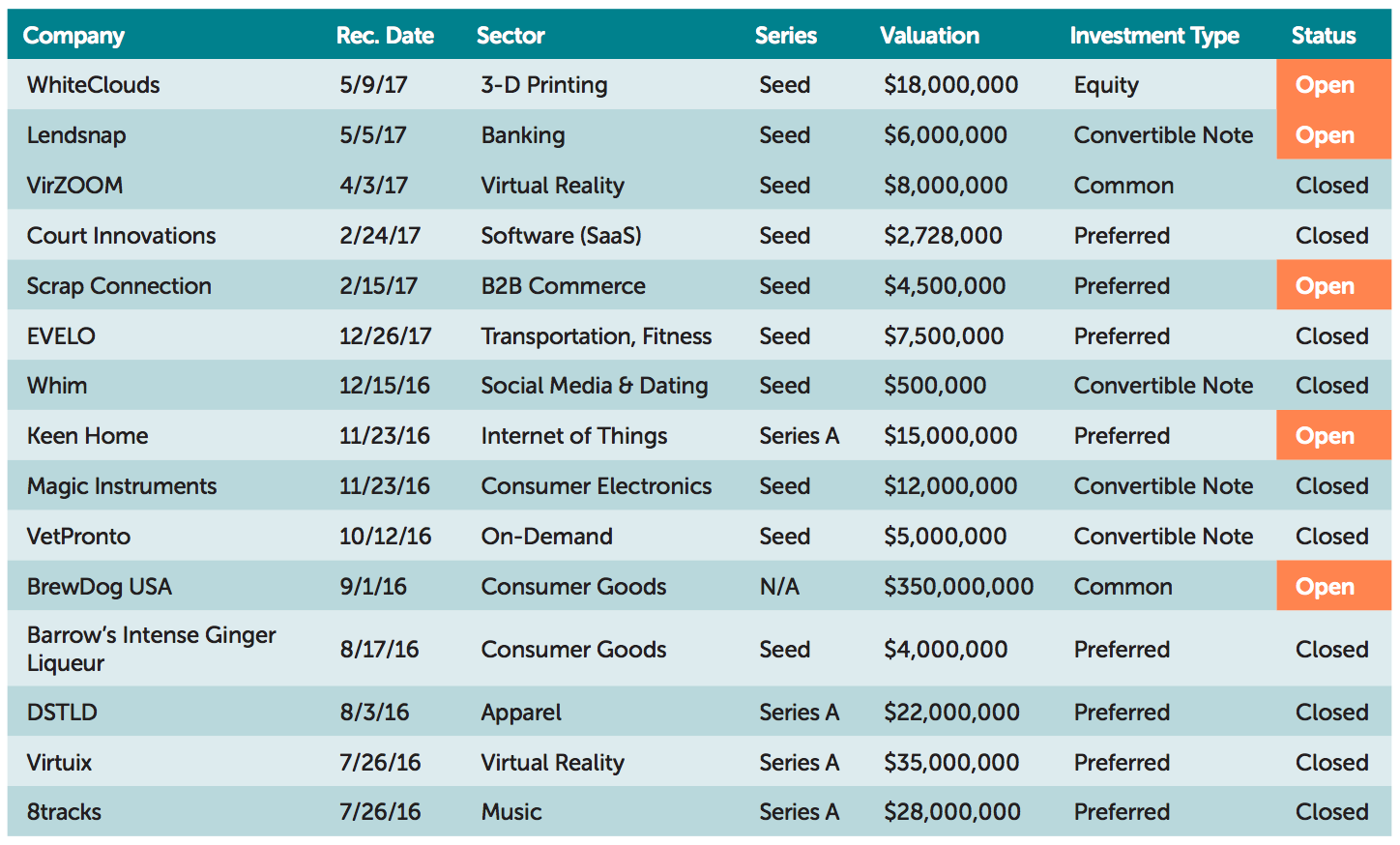

June Portfolio

Positions as of 5/31/17

Copyright © 2017 Early Investing, LLC. All Rights Reserved.

Nothing published by Early Investing, LLC. should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in their own securities recommendations to readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Early Investing, LLC. should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Protected by copyright laws of the United States and international treaties. The information found on this website may only be used pursuant to the membership or subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Early Investing, LLC., 14 W. Mount Vernon Place, Baltimore MD 21201.